Visa (V): Evaluating Valuation After Landmark Interchange Fee Settlement with U.S. Merchants

Reviewed by Simply Wall St

Visa is making headlines as it approaches a settlement with U.S. merchants to reduce interchange fees and ease card acceptance rules. This move addresses a dispute that has influenced industry dynamics for years.

See our latest analysis for Visa.

This push toward settling the fee dispute comes at a time of innovation and partnerships for Visa. Over the past few months, they have launched embedded finance solutions for the freight industry with Transcard and taken the spotlight at major fintech conferences. Despite some volatility, the share price has climbed 7.8% so far this year, with a one-year total shareholder return of 10.3% suggesting steady long-term growth rather than a short-term surge.

If you're interested in exploring what else is shaking up the market, why not broaden your perspective and discover fast growing stocks with high insider ownership

With the fee settlement on the horizon and a record of solid growth, the big question now is whether Visa’s current share price reflects its full potential or if there is still a genuine opportunity for investors to buy in before the market fully prices in future gains.

Most Popular Narrative: 13.4% Undervalued

With Visa finishing last session at $338.92, the most widely followed narrative suggests the share price remains well below what future growth could justify. The narrative's fair value estimate of $391.46 highlights a significant gap that centers on transformative shifts in digital payments.

Rapidly accelerating adoption of value-added services (VAS), with VAS revenue up 26% year-over-year and expanding into areas such as AI, risk solutions, and open banking, is increasing Visa's mix of higher-margin business lines. This is expected to lift net margins and improve overall earnings quality.

What assumptions are behind this bold upside? The foundation is a bet on higher-margin transformation, aggressive service expansion, and a future profit profile that defies sector averages. Want to see which numbers turn these ambitions into a sky-high fair value? Dive into the full narrative for the factors the market might be missing.

Result: Fair Value of $391.46 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rapid advances in real-time payment systems and increased regulatory pressure on fees could pose challenges to Visa’s ability to sustain current growth projections.

Find out about the key risks to this Visa narrative.

Another View: Market Comparisons Cloud the Picture

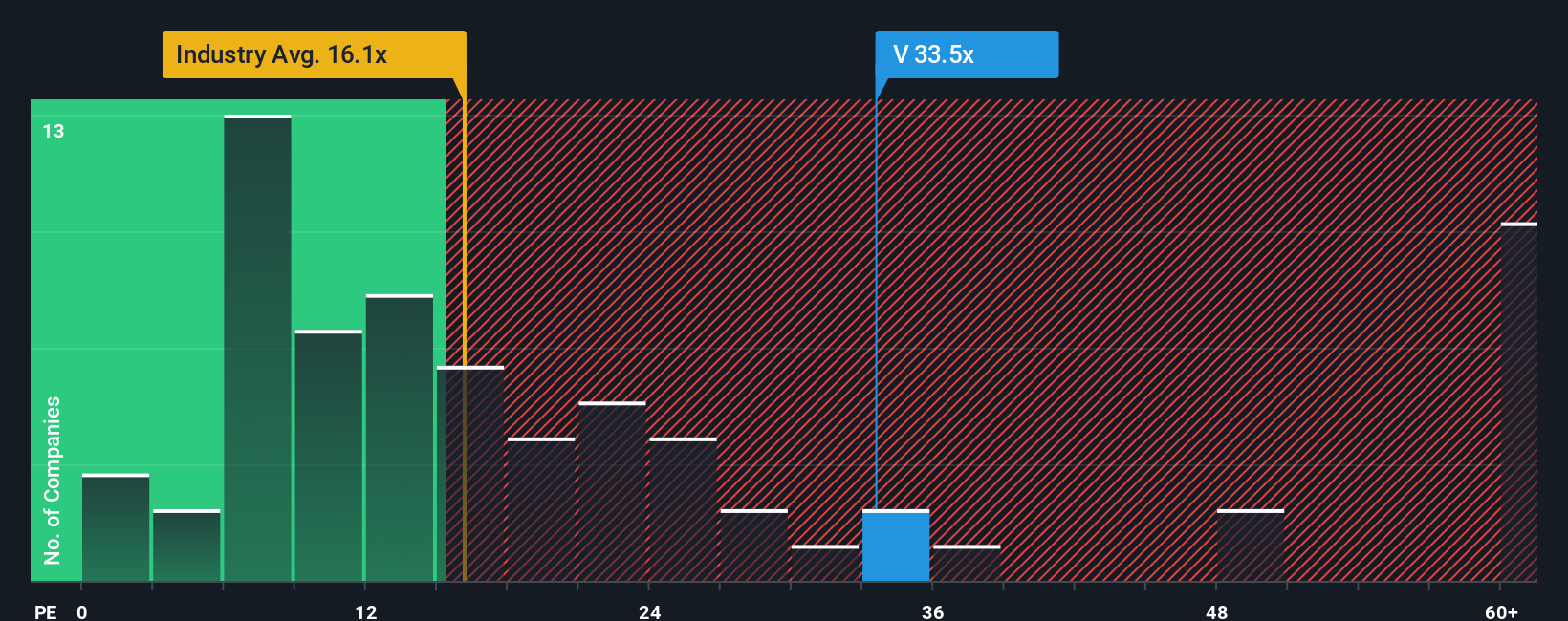

While analyst models point to Visa being undervalued based on expected growth, a look at its price-to-earnings multiple tells a different story. Visa trades at 32.7 times earnings, which is much higher than both the industry average of 13.5 and a fair ratio of 20.9. This premium suggests the market sees Visa as lower risk or positioned for superior growth. However, it also leaves less room for upside if results disappoint. Could this valuation gap signal opportunity or risk for anyone buying in now?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Visa Narrative

If you think you see the story differently or want to test your own insights against the numbers, it only takes minutes to build your own perspective, so why not Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Visa.

Looking for More Investment Ideas?

Don’t let your next opportunity slip by. Use the Simply Wall Street Screener to uncover exciting stocks and market themes tailored to smart investors like you.

- Unlock high yield potential and see which companies stand out for stable, generous payouts by checking out these 15 dividend stocks with yields > 3% now.

- Capitalize on the transformative rise of healthcare technology by targeting innovation leaders with these 32 healthcare AI stocks.

- Position yourself ahead of the curve and spot tomorrow’s leaders efficiently by searching for undervalued gems using these 872 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:V

Visa

Operates as a payment technology company in the United States and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives