- United States

- /

- Diversified Financial

- /

- NYSE:TOST

Toast (TOST): Evaluating Valuation After Strong Earnings and Major Client Wins

Reviewed by Simply Wall St

Toast (TOST) grabbed investor attention after reporting quarterly earnings, with both revenue and profit rising sharply from a year earlier. The company also announced client wins with brands like TGI Fridays and everbowl. These updates highlight Toast’s expanding presence among top restaurant chains.

See our latest analysis for Toast.

After the recent earnings beat and new partnerships with brands like TGI Fridays and everbowl, Toast's share price has pulled back, with a 1-year total shareholder return of -11.6%. Still, its momentum over the past three years, with a 97% total return, shows the long-term growth trend remains well intact.

If Toast’s ability to win big-name clients has you watching for the next breakout in the restaurant tech space, consider exploring fast growing stocks with high insider ownership

With the stock trading below analyst price targets even after strong client wins and earnings growth, investors may wonder if Toast is positioned for a rebound or if the market has already factored in its next phase of expansion.

Most Popular Narrative: 25.8% Undervalued

With Toast’s fair value estimate set at $48.38 by the most widely followed narrative and the last close price at $35.9, there is a sizable gap that is turning heads. Investors are recalibrating their views as strong growth expectations are weighed against recent shifts in analyst forecasts and sector guidance.

Key wins with large enterprise clients signal Toast's competitive edge in the space. These wins have contributed to bullish revisions in price targets by some research firms.

Are you curious about the bold assumptions powering this valuation? The real story lies in future profitability projections and the pace of revenue growth this narrative expects. Want to see the specific targets and financial leaps believed to support this gap? Unpack the full narrative for the projections that could drive Toast's next move.

Result: Fair Value of $48.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising competition in the restaurant tech sector and persistent margin pressures could challenge Toast's ability to sustain its current growth trajectory.

Find out about the key risks to this Toast narrative.

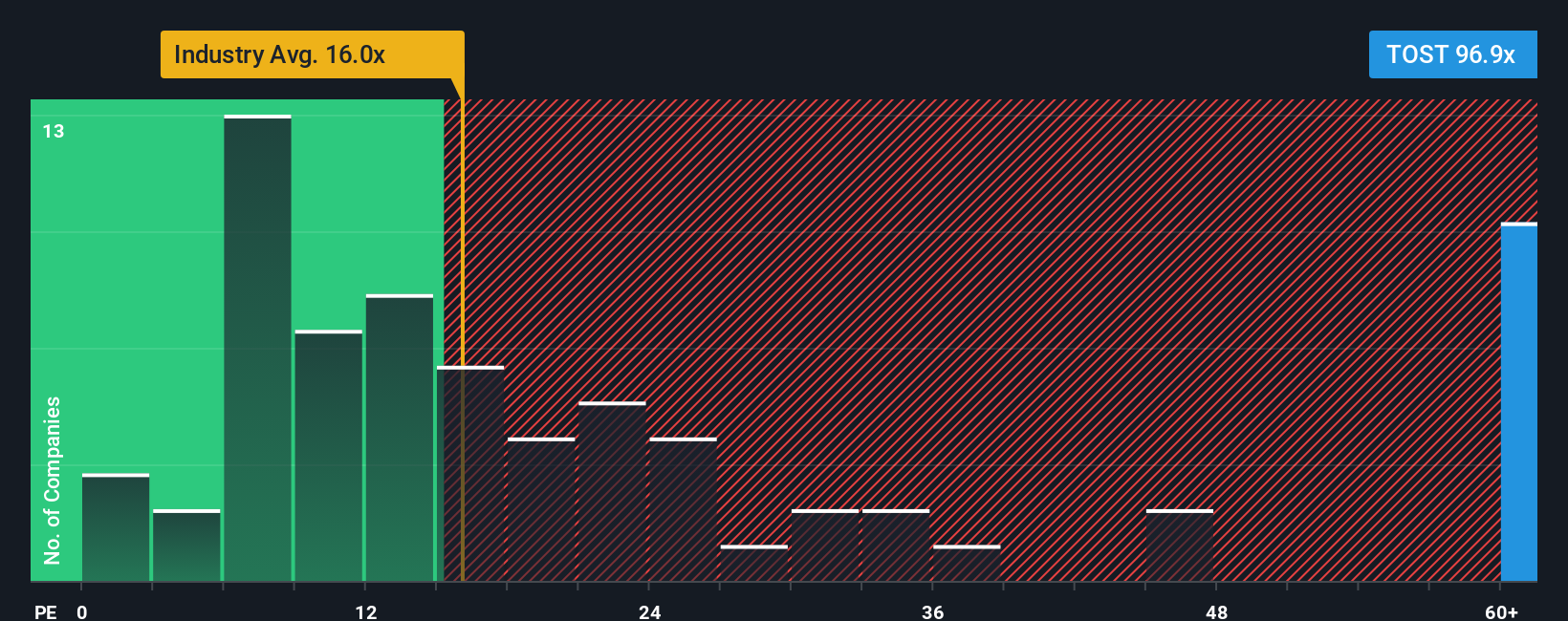

Another View: High Ratios Raise Questions

Looking at valuation from a different angle, Toast’s price-to-earnings ratio stands at 77.3x, which is much higher than both its peer average of 35.2x and the US industry’s 13.2x. This is also well above the fair ratio of 22.9x. These figures suggest investors are currently paying a premium. Does this imply a higher risk or a sign of future growth yet to be realized?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Toast Narrative

If you see things differently or want to dig into the numbers firsthand, you can easily shape your own story for Toast in just minutes. So why not Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Toast.

Looking for More Investment Ideas?

Smart investors know it pays to look beyond a single stock. Broaden your portfolio with unique opportunities you won’t want to miss right now.

- Boost your income potential with high-yield picks by checking out these 16 dividend stocks with yields > 3% offering yields above 3%.

- Capture the momentum of healthcare's digital revolution by browsing these 32 healthcare AI stocks as they transform patient care through groundbreaking AI solutions.

- Tap into the next wave of innovation and spot tomorrow’s tech leaders among these 25 AI penny stocks who are already reshaping major industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toast might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TOST

Toast

Operates a cloud-based digital technology platform for the restaurant industry in the United States, Ireland, India, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives