- United States

- /

- Capital Markets

- /

- NYSE:SCHW

Should You Rethink Schwab After Latest Rate Policy Shifts and a 27% Rally in 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with Charles Schwab stock? You’re definitely not alone. With the shares closing at $93.79, and a year-to-date gain of 27.0% (not to mention a staggering 170.0% return over the last five years), a lot of investors are asking themselves if the ride can keep going or if recent gains mean it’s time to take a step back. In just the past week alone, Charles Schwab rose another 1.7%, reflecting renewed optimism across financial stocks as markets digest interest rate policy shifts and adjust risk appetite. Yet over the past month, Schwab has barely budged, up only 0.4%, hinting that short-term excitement might be leveling off while bigger-picture factors dominate.

For those watching, these price moves haven’t existed in a vacuum. Many investors are reacting to ongoing market developments, from persistent changes in rate expectations to shifting competitive pressures among brokers and asset managers. Against this backdrop, it’s only natural to wonder: Is Schwab still undervalued, or have the stock’s gains already priced in most of the upside?

That is where valuation checks come in. Out of six possible tests for undervaluation, Schwab currently scores a 2, meaning it’s undervalued by two measures. However, digging deeper reveals a lot more nuance than any single number can provide. Stick around as we break down each valuation approach and reveal which one might offer the clearest insight of all.

Charles Schwab scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Charles Schwab Excess Returns Analysis

The Excess Returns valuation model evaluates whether a company is generating returns above its cost of equity. For Charles Schwab, this method places emphasis on return on equity and the growth of book value over time as primary indicators of shareholder value creation. In this case, Schwab boasts a healthy average return on equity of 19.47%, highlighting its efficiency at converting investments into profits.

Looking deeper, analysts estimate the company’s stable earnings per share at $5.46, while the stable book value is projected at $28.04 per share. The cost of equity stands at $2.51 per share, and the resulting excess return is $2.95 per share. These figures suggest that Schwab is consistently generating profits in excess of what shareholders demand for their capital, according to future estimates from both analysts and consensus projections.

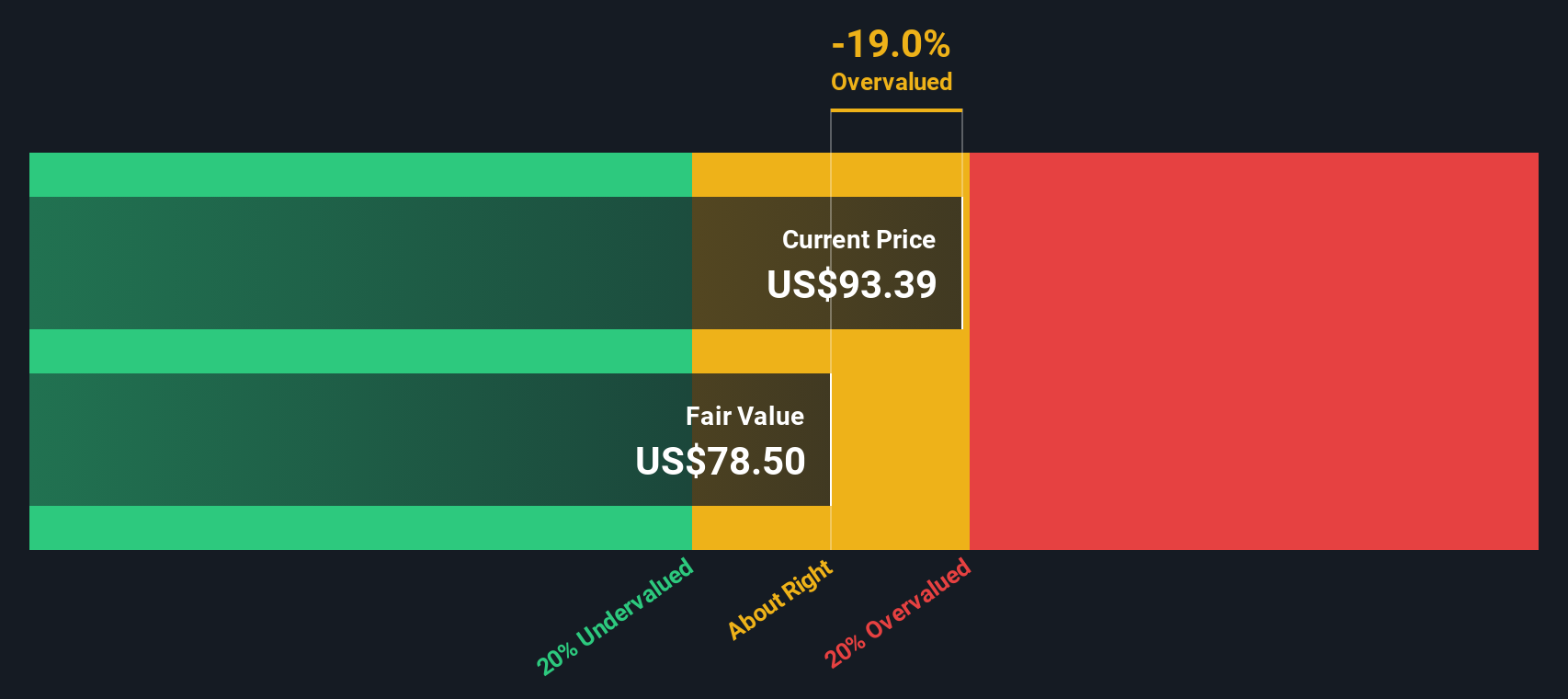

However, the Excess Returns model implies an intrinsic value that is about 19.9% below the current share price, which signals that Schwab stock is overvalued relative to the returns it is expected to generate on new investments.

Result: OVERVALUED

Our Excess Returns analysis suggests Charles Schwab may be overvalued by 19.9%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Charles Schwab Price vs Earnings

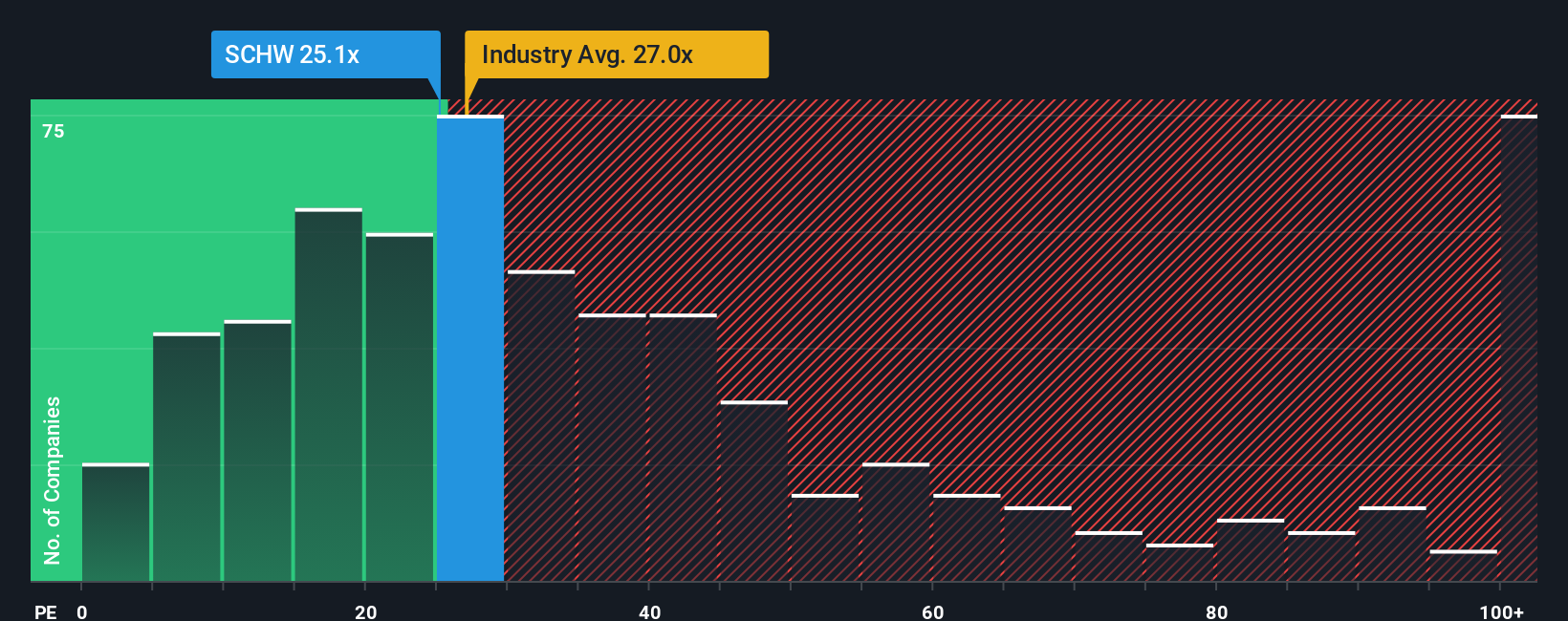

The Price-to-Earnings (PE) ratio is a widely used metric for valuing established, profitable companies like Charles Schwab because it allows investors to quickly compare the market value of a company’s earnings to its share price. Since Schwab has stable profits, the PE ratio offers a practical way to gauge whether the stock is reasonably priced based on its bottom-line performance.

However, evaluating what a “normal” or “fair” PE ratio should be is not straightforward. Investors and analysts consider growth expectations, profit margins, and business risks when determining how much they are willing to pay for a company’s earnings. Companies with higher expected growth or lower risk often warrant higher PE ratios, while those facing headwinds may deserve a discount.

Currently, Charles Schwab trades at a PE of 25.1x. This is just below the Capital Markets industry average of 25.7x and well beneath the average of its direct peers at 36.9x. Beyond these broad benchmarks, Simply Wall St’s proprietary Fair Ratio provides an additional perspective. This custom metric, calculated as 21.3x for Schwab, incorporates company-specific factors like expected earnings growth, profit margins, risks, and the size of the company. It aims to suggest what investors should reasonably pay for Schwab’s earnings given its unique profile, rather than simply following industry norms. Because Schwab’s actual PE sits above its Fair Ratio, this suggests Charles Schwab is currently overvalued on this basis.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Charles Schwab Narrative

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives, a powerful and modern approach that helps you connect a company's story and outlook with real financial forecasts and fair value estimates. Rather than relying solely on ratios or point-in-time models, Narratives allow you to express your own view about Charles Schwab’s future by providing your assumptions for revenue growth, profit margins, and risk, and then seeing how those beliefs translate into fair value estimates.

Each Narrative links your perspective, the “why” behind the numbers, with a forecast and a dynamic valuation, so you gain true context for any investment decision. Narratives are designed to be intuitive and accessible for all investors on Simply Wall St's Community page, empowering millions to build and test their convictions.

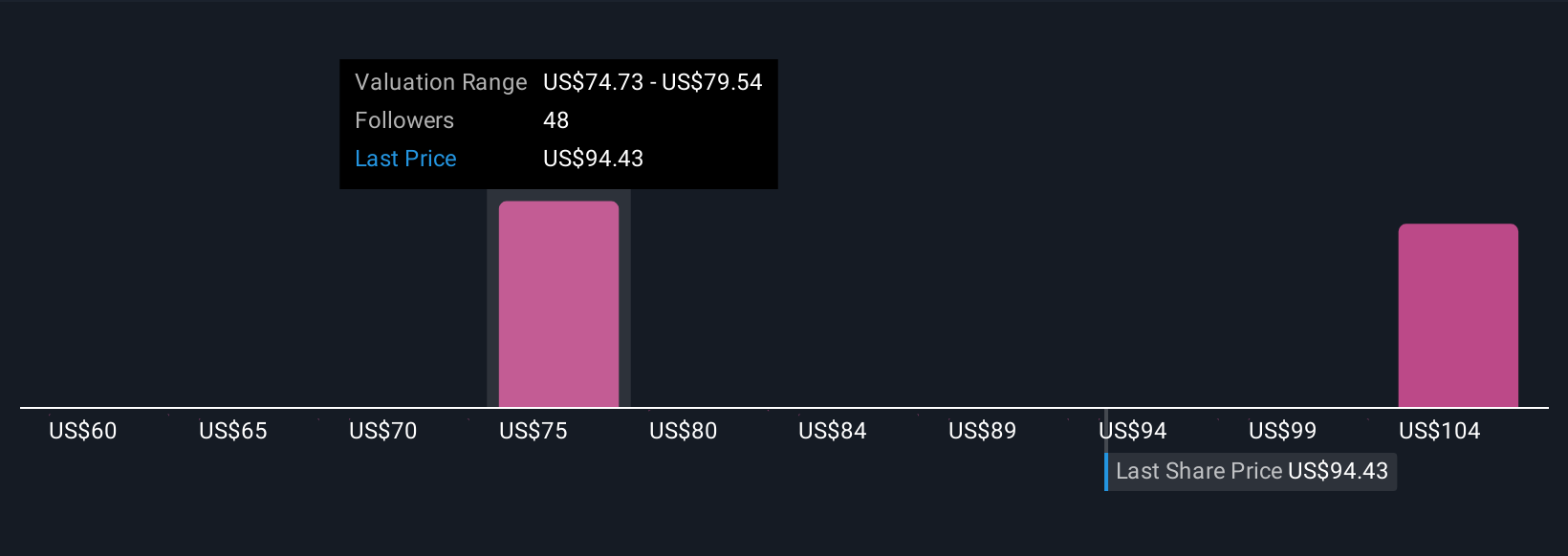

They help you make smarter buy or sell decisions by directly comparing your fair value (based on your beliefs) to the current share price. Every Narrative is kept automatically up to date when new news, earnings, or company events come out. For example, some investors see Charles Schwab thriving on generational wealth transfer and digital innovation, projecting a bullish fair value of $131 per share. More cautious views focusing on competition and rate risk set their targets as low as $84 per share.

Do you think there's more to the story for Charles Schwab? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SCHW

Charles Schwab

Operates as a savings and loan holding company that provides wealth management, securities brokerage, banking, asset management, custody, and financial advisory services in the United States and internationally.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives