- United States

- /

- Capital Markets

- /

- NYSE:SCHW

Charles Schwab (SCHW): Evaluating Valuation After a 4% Monthly Share Price Gain and Recent Earnings Trends

Reviewed by Simply Wall St

Charles Schwab (SCHW) has been drawing increased attention from investors, especially given its recent stock performance compared to financial sector peers. Over the past month, shares have climbed 4%, which signals interest around the company’s ongoing business momentum and earnings outlook.

See our latest analysis for Charles Schwab.

Looking beyond the short-term excitement, Charles Schwab’s 1-year total shareholder return stands at a healthy 23.9%. The share price has pulled back slightly over the past quarter, but momentum appears to be building again following recent gains. This suggests renewed confidence in the company’s ability to balance growth and market challenges.

If Schwab’s recent momentum has you scanning for other opportunities, now might be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

Yet with shares still trading below analyst price targets and impressive recent growth in revenue and net income, the question remains: is Schwab undervalued, or have investors already priced in all the upside?

Most Popular Narrative: 14.3% Undervalued

Charles Schwab’s last closing price of $95.58 sits notably below the fair value estimate of $111.50, sparking renewed debate about the company’s upside and market positioning. The narrative’s data-driven bullishness is rooted in persistent expansion across Schwab’s business lines and accelerating client engagement.

Success in cross-selling advisory, banking, and lending products to existing and newly integrated Ameritrade clients is driving higher engagement, utilization, and non-transactional fee income. Pledged asset line originations and bank lending balances are both up over 100% year-over-year, supporting improved net margins and earnings durability.

Tempted to peek behind the curtain? The quantitative rationale here includes compelling long-range forecasts for core earnings, surprising margin expansion, and a valuation multiple that signals a major shift in how analysts view Schwab’s growth runway. Dive in to unravel exactly what drives this fair value perspective and discover whether those numbers add up to sustained outperformance.

Result: Fair Value of $111.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, unexpected interest rate swings and intensifying competition from digital-first brokers could quickly challenge Schwab’s growth story and affect its profit trajectory.

Find out about the key risks to this Charles Schwab narrative.

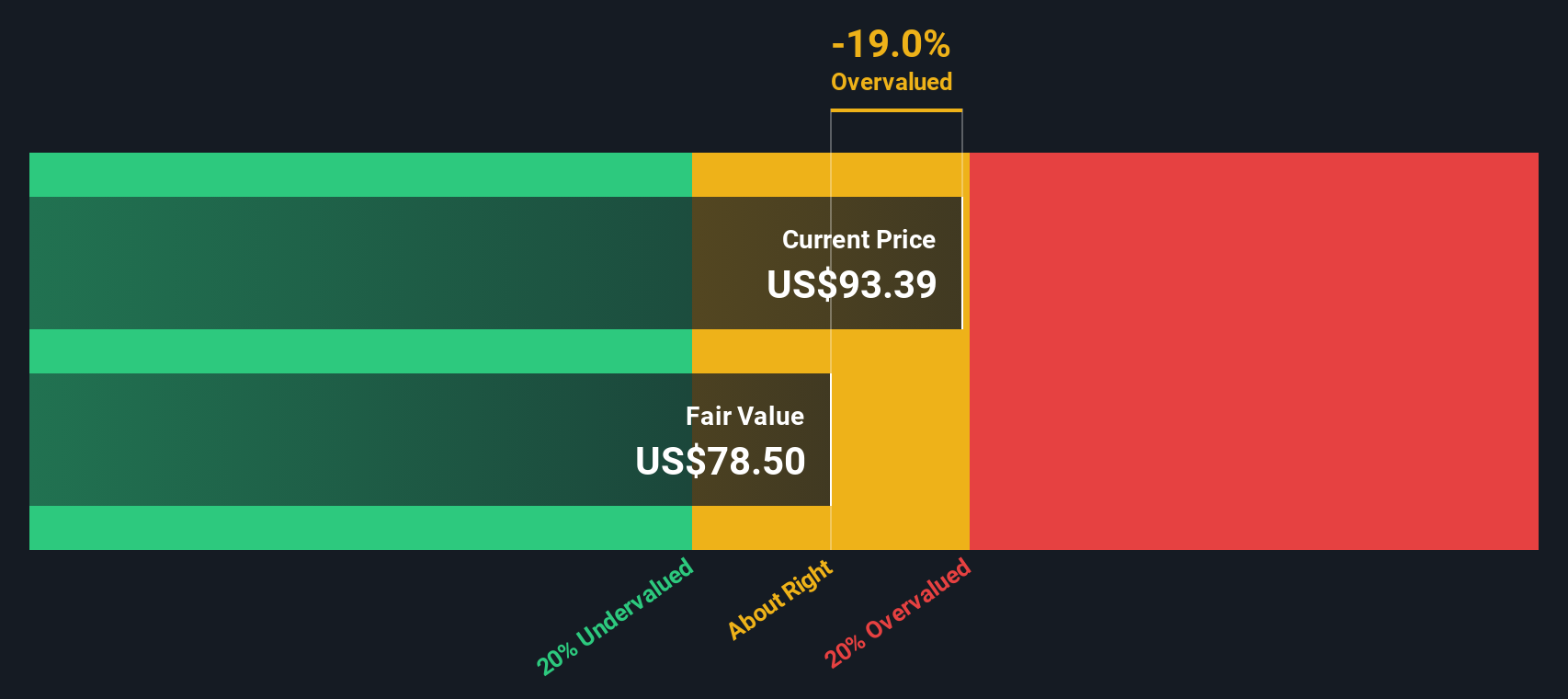

Another View: Using Discounted Cash Flow

While many investors look to analyst price targets, our SWS DCF model tells a different story. According to this approach, Schwab shares currently trade above the model's estimated fair value of $88.82. This suggests the stock may be overvalued from a cash flow perspective. Could these differing views signal caution, or is the market pricing in more growth than models are capturing?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Charles Schwab for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 863 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Charles Schwab Narrative

If the numbers have you thinking differently, or you’d rather investigate the fundamentals on your own terms, you can craft and customize your own story for Schwab in just a few minutes. Do it your way

A great starting point for your Charles Schwab research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don't limit yourself to a single stock. Make the most out of your research time by uncovering themed stock ideas tailored to today's biggest market trends, all with a single click.

- Start building consistent income by targeting companies with robust payouts using these 16 dividend stocks with yields > 3% delivering yields over 3%.

- Ride the next tech wave and get ahead of the curve by sorting through these 24 AI penny stocks transforming the AI landscape.

- Position yourself for tomorrow's winners by finding these 863 undervalued stocks based on cash flows visible through strong cash flows before everyone else catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SCHW

Charles Schwab

Operates as a savings and loan holding company that provides wealth management, securities brokerage, banking, asset management, custody, and financial advisory services in the United States and internationally.

Proven track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives