- United States

- /

- Diversified Financial

- /

- NYSE:RKT

Rocket Companies (RKT): Evaluating Valuation Following Recent Share Price Pullback

Reviewed by Kshitija Bhandaru

See our latest analysis for Rocket Companies.

Despite the sharp pullback this week, Rocket Companies is still up an impressive 50% on a year-to-date share price basis. This reflects momentum that has built over recent months even as last year’s total shareholder return ended slightly negative. Short-term volatility often follows such strong runs, as investors weigh growth prospects against evolving risk perceptions.

If recent swings have you looking to expand your investing radar, now’s the perfect moment to discover fast growing stocks with high insider ownership

With shares down from recent highs but still well above last year’s levels, the real question now is whether Rocket Companies is trading below its true value or if the market has already factored in every catalyst, leaving little room for upside.

Most Popular Narrative: 7.8% Undervalued

Rocket Companies finished the last session at $16.28, but the most followed narrative assigns a fair value near $17.67. This suggests there could be more upside ahead if the narrative's assumptions prove accurate.

The market may be ascribing premium value to Rocket's data ecosystem and cross-sell capabilities from the expanded "FinTech ecosystem." However, this could prove overly optimistic if younger demographic cohorts delay home-buying due to persistent affordability problems, which could dampen anticipated growth in customer lifetime value and overall revenues.

Want to know what kind of growth could support this valuation? The premium is based on expectations for aggressive revenue, margin, and earnings growth not seen in peers. Discover which financial forecasts are behind this price prediction and whether Rocket can meet these significant expectations.

Result: Fair Value of $17.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent housing affordability issues and fast-changing fintech competition could still challenge Rocket's growth. This raises questions about how sustainable these bullish forecasts really are.

Find out about the key risks to this Rocket Companies narrative.

Another View: Are Shares Priced Too High?

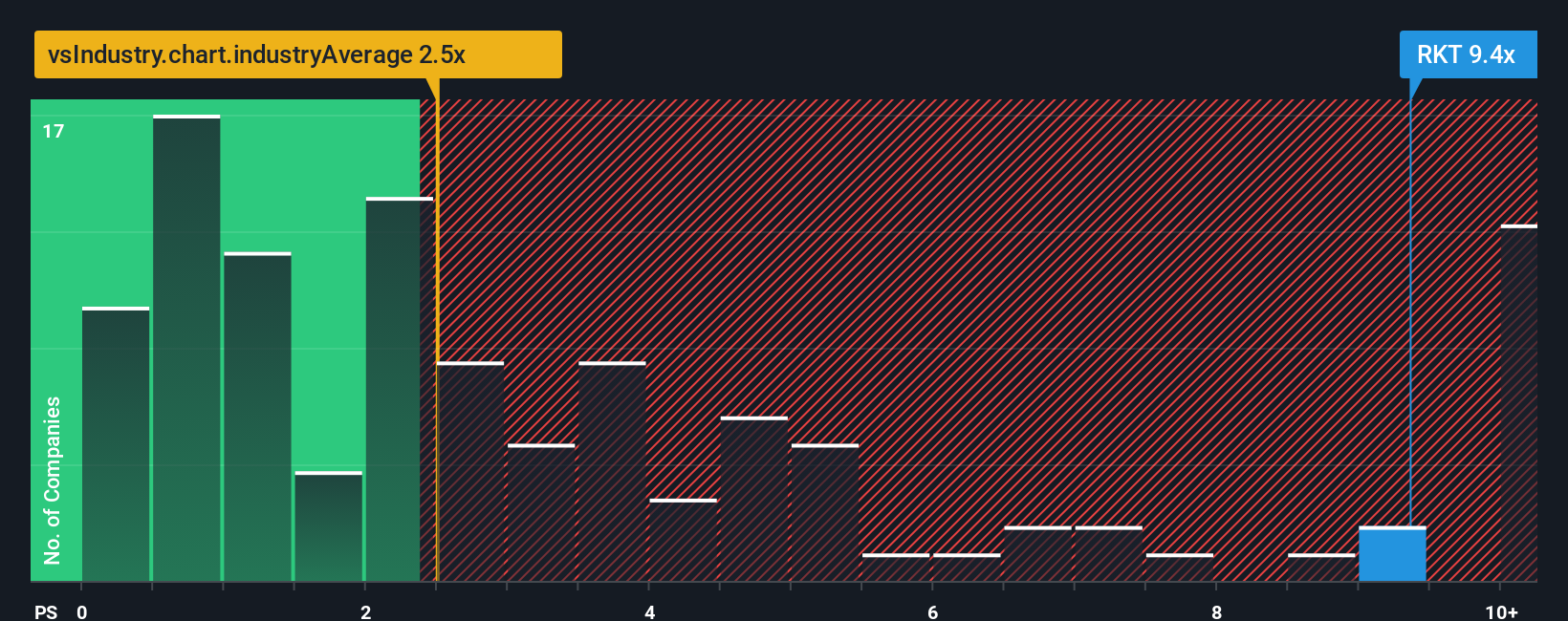

Looking at its price-to-sales ratio, Rocket Companies trades at 8.9x, far higher than both its industry average of 2.7x and its peers at 2.4x. Even the fair ratio points to 7.5x. This premium adds valuation risk. Is the company’s growth potential enough to justify such a lofty multiple?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Rocket Companies Narrative

If you’d rather dig into the numbers and uncover your own angle, it’s quick and easy to construct a personal view. Try it out in under three minutes with Do it your way.

A great starting point for your Rocket Companies research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Act now to expand your watchlist with standout opportunities you might not spot elsewhere. These tailored stock ideas could give your portfolio a powerful edge. Don’t miss your chance to get ahead of the crowd.

- Unlock the potential for steady income by checking out these 19 dividend stocks with yields > 3% featuring companies with attractive yields on the market today.

- Stay on the cutting edge of digital transformation with these 25 AI penny stocks and see which businesses are advancing the future of artificial intelligence.

- Capitalize on value-driven gains as you browse these 898 undervalued stocks based on cash flows, highlighting stocks that might be trading below their intrinsic worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RKT

Rocket Companies

Provides spanning mortgage, real estate, and personal finance services in the United States and Canada.

High growth potential with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives