- United States

- /

- Capital Markets

- /

- NYSE:RJF

Does Strong Wealth Management Growth Reinforce Raymond James Financial's (RJF) Strategic Positioning?

Reviewed by Sasha Jovanovic

- Raymond James Financial recently reported strong fiscal year results as of September 30, 2025, with substantial growth in revenues and earnings supported by its wealth management business managing over US$1.7 trillion in client assets.

- The company’s continued focus on regulatory compliance and cybersecurity remains central to its operational strategy as it seeks to enhance shareholder value and maintain financial stability.

- We’ll explore how Raymond James Financial’s improved financial performance and asset growth may influence its broader investment narrative and outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Raymond James Financial Investment Narrative Recap

Raymond James Financial’s recent fiscal year results reaffirm its business model centered on growing client assets and disciplined operations, with a strong wealth management franchise now overseeing more than US$1.7 trillion. While these results reinforce confidence in the company’s ability to generate earnings, they don't materially change the biggest short-term catalyst, ongoing financial advisor recruitment, or shift the primary risk, which remains sensitivity to market- and interest-rate-driven volatility weighing on client activity and revenue growth. Among the recent developments, the continued execution of share buybacks, most recently repurchasing over 2 million shares for US$350 million, aligns with Raymond James' capital return commitment. This remains particularly relevant as buybacks can support earnings per share growth even as external uncertainty and competition for assets persist. Yet even in light of robust financials, investors should not overlook the potential consequences if market or rate volatility were to impact client net new asset growth and...

Read the full narrative on Raymond James Financial (it's free!)

Raymond James Financial's outlook anticipates $17.3 billion in revenue and $2.7 billion in earnings by 2028. This reflects an 8.0% annual revenue growth rate and a $0.6 billion increase in earnings from the current $2.1 billion.

Uncover how Raymond James Financial's forecasts yield a $183.80 fair value, a 18% upside to its current price.

Exploring Other Perspectives

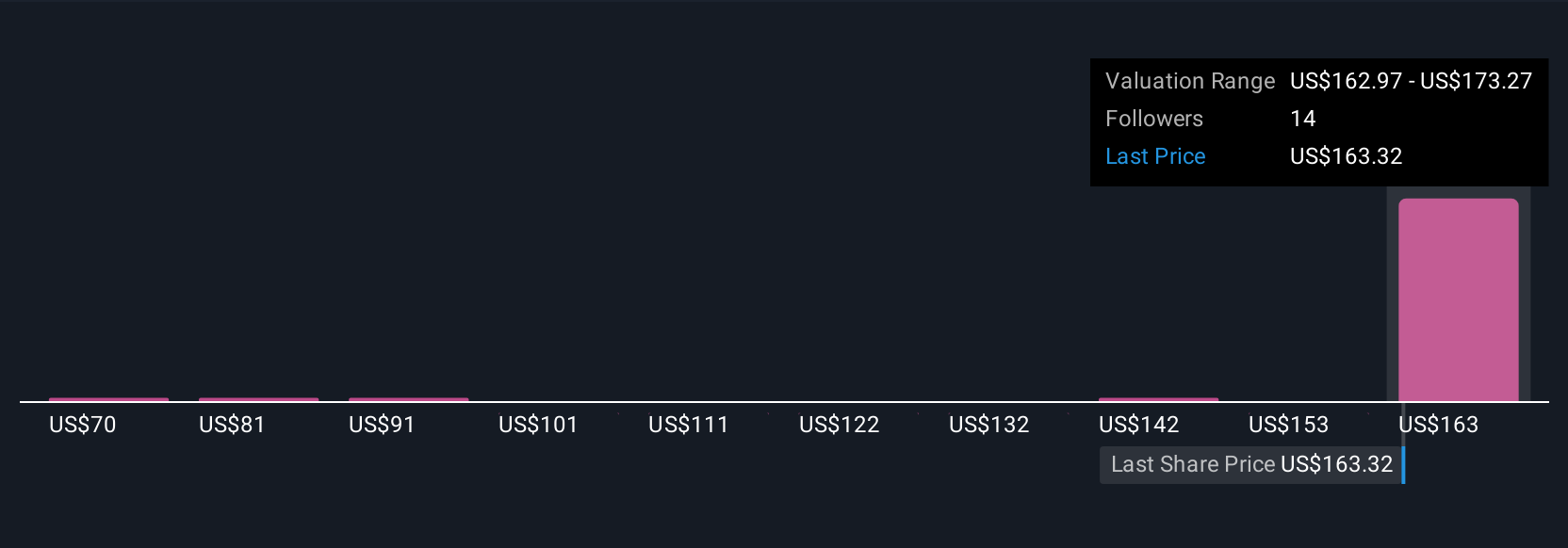

Six fair value estimates from the Simply Wall St Community range from US$70.20 to US$218.64 per share. As analysts focus on advisor recruitment driving future inflows, you can compare how widely opinions differ and explore more reasons behind these varied perspectives.

Explore 6 other fair value estimates on Raymond James Financial - why the stock might be worth as much as 40% more than the current price!

Build Your Own Raymond James Financial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Raymond James Financial research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Raymond James Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Raymond James Financial's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RJF

Raymond James Financial

A diversified financial services company, provides private client group, capital markets, asset management, banking, and other services to individuals, corporations, and municipalities in the United States, Canada, and Europe.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026