- United States

- /

- Consumer Finance

- /

- NYSE:PRG

Does PROG Holdings' (PRG) Steady Dividend Reflect Strong Capital Discipline or Cautious Growth Priorities?

Reviewed by Sasha Jovanovic

- PROG Holdings, Inc. recently announced that its Board of Directors declared a quarterly cash dividend of US$0.13 per share, payable on December 2, 2025, to shareholders of record as of November 18, 2025.

- This dividend declaration signals the company’s ongoing commitment to returning capital to shareholders and underscores confidence in its financial stability.

- We’ll now consider how the affirmed dividend may influence PROG Holdings’ investment narrative, particularly in terms of shareholder value priorities.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

PROG Holdings Investment Narrative Recap

To be a shareholder in PROG Holdings, an investor needs conviction in the company's ability to grow its fintech platforms and adapt to evolving consumer demand for flexible payment options. While the latest quarterly dividend of US$0.13 per share reiterates a focus on shareholder returns and financial stability, it does not materially change the immediate catalyst, accelerated profitability in the Buy Now, Pay Later (BNPL) segment, nor does it diminish ongoing risks from soft demand in traditional leasing categories and credit risks tied to subprime customers.

Among recent announcements, the most relevant is the October earnings report, which showed a year-over-year decline in net income despite stable revenue. This underscores the importance of strengthening margins in both established and newer segments like BNPL, as further pressure on earnings or revenue concentration could challenge investor confidence in the growth story.

In contrast, investors should be aware that PROG Holdings’ dependence on subprime and thin-file customers...

Read the full narrative on PROG Holdings (it's free!)

PROG Holdings' narrative projects $2.7 billion in revenue and $141.4 million in earnings by 2028. This requires 2.5% yearly revenue growth and a decrease of $73.3 million in earnings from $214.7 million today.

Uncover how PROG Holdings' forecasts yield a $38.57 fair value, a 41% upside to its current price.

Exploring Other Perspectives

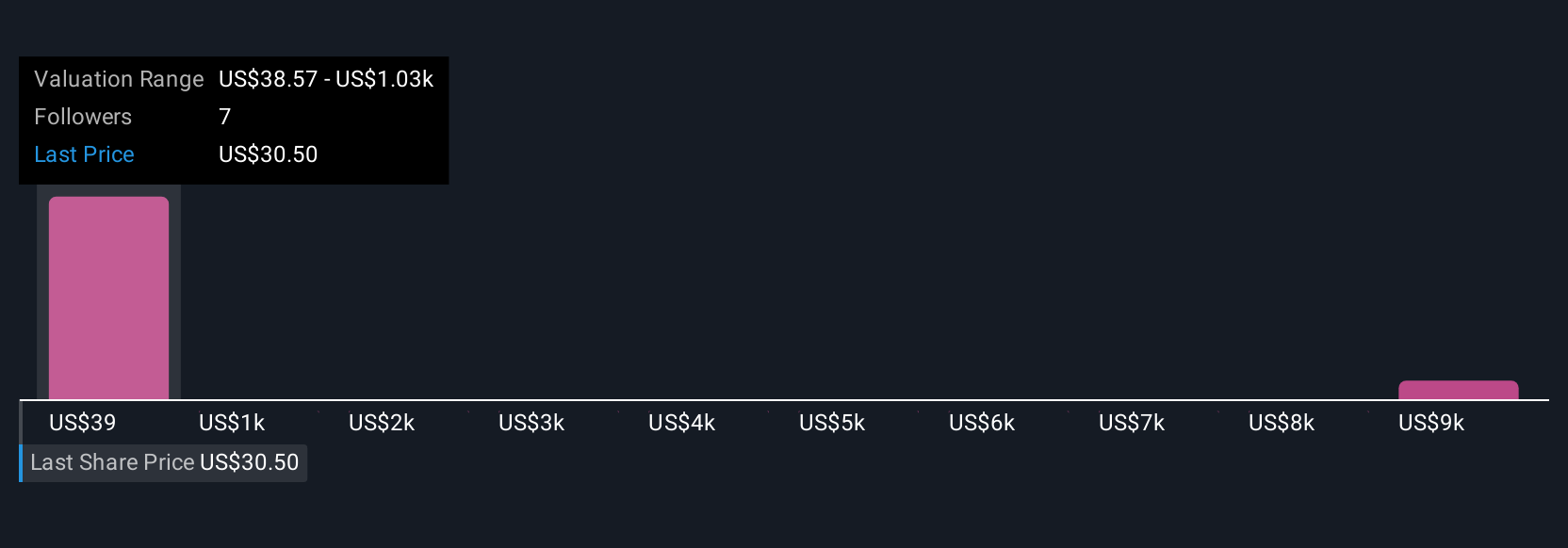

Four recent fair value estimates by the Simply Wall St Community ranged from US$38.57 to US$9,999 per share, illustrating vast differences in individual outlook. Given this diversity, remember that competitive pressure in BNPL could have broader implications for growth and margins, explore for alternative viewpoints.

Explore 4 other fair value estimates on PROG Holdings - why the stock might be a potential multi-bagger!

Build Your Own PROG Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PROG Holdings research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free PROG Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PROG Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PRG

PROG Holdings

A financial technology holding company, provides payment options to consumers in the United States.

Very undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives