- United States

- /

- Capital Markets

- /

- NYSE:PJT

Did Record Advisory Fees and Dividends Just Shift PJT Partners' (PJT) Investment Narrative?

Reviewed by Sasha Jovanovic

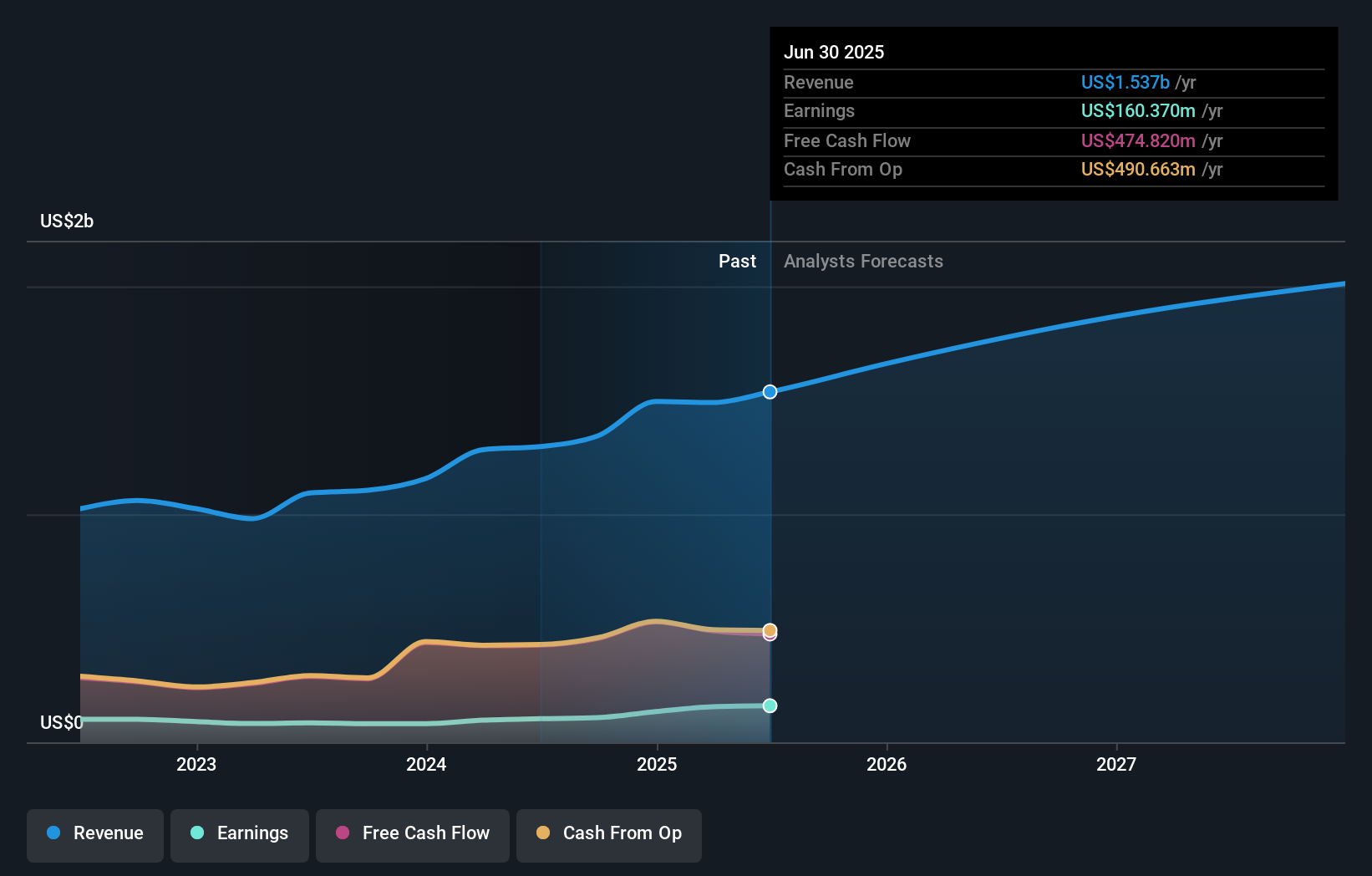

- PJT Partners reported record third-quarter and nine-month financial results, with revenue reaching US$447.09 million and net income at US$39.84 million, while the board declared a quarterly dividend of US$0.25 per share payable on December 17, 2025.

- The firm’s expansion in advisory fee mandates, alongside its top ranking in U.S. restructuring advisory, highlighted its strong position amid a rebound in M&A activity.

- We’ll explore how the sharp growth in advisory fees and expanded team could reshape PJT Partners’ investment narrative moving forward.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is PJT Partners' Investment Narrative?

For anyone considering PJT Partners, the core investment idea leans on the firm’s status as a major player in M&A and restructuring advisory, amplified by a team expansion and record-breaking results. The latest quarterly update puts this thesis in the spotlight, as surging revenue and earnings confirm a substantial rebound in deal activity and show management’s ability to capitalize on market cycles. This news, along with another steady dividend, fits the current narrative but doesn’t drastically shift near-term catalysts, which remain steered by the pace of new advisory mandates and the sustainability of recent fee growth. The main risk, common in this industry, lies in just how quickly the deal environment could change if macro or geopolitical shocks resurface. The price remains close to consensus targets, suggesting the market has already absorbed much of the optimism.

Yet higher costs and market volatility still matter for anyone watching short-term momentum. PJT Partners' shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 3 other fair value estimates on PJT Partners - why the stock might be worth less than half the current price!

Build Your Own PJT Partners Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PJT Partners research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free PJT Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PJT Partners' overall financial health at a glance.

No Opportunity In PJT Partners?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PJT

PJT Partners

An investment bank, provides various strategic advisory, shareholder advisory, capital markets advisory, and restructuring and special situations services to corporations, financial sponsors, institutional investors, and governments worldwide.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives