- United States

- /

- Diversified Financial

- /

- NYSE:PFSI

Could PennyMac’s Recent Tech Upgrade Signal a Shift in Mortgage Strategy as Rate Cuts Loom? (PFSI)

Reviewed by Sasha Jovanovic

- In recent days, PennyMac Financial Services' Chief Financial Officer sold 8,775 shares, shortly after the company adopted a new loan origination technology platform and reported significantly higher quarterly pretax income compared to the previous year.

- A key insight is that investor sentiment toward the company was shaped primarily by market expectations of a potential Federal Reserve interest rate cut, which is considered especially relevant for the mortgage finance sector.

- We'll assess how the potential for lower interest rates could impact PennyMac's position in the mortgage origination and servicing market.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

PennyMac Financial Services Investment Narrative Recap

To be a shareholder in PennyMac Financial Services, you must believe in the company's capacity to manage its large mortgage servicing portfolio while capturing upside from mortgage origination when interest rates fall. The recent insider sale by the CFO does not materially impact the main short-term catalyst, which is the potential for Federal Reserve interest rate cuts; however, the most significant current risk remains the ongoing sensitivity to interest rate changes, as elevated rates would suppress origination volumes and pressure margins. Among the recent developments, PennyMac’s adoption of a new loan origination technology platform stands out as vital in the current context. This initiative directly connects to the company’s strategy to enhance efficiency through automation, potentially reducing costs and supporting profitability if origination volumes recover thanks to lower rates. On the other hand, investors should pay close attention to how persistent high interest rates might...

Read the full narrative on PennyMac Financial Services (it's free!)

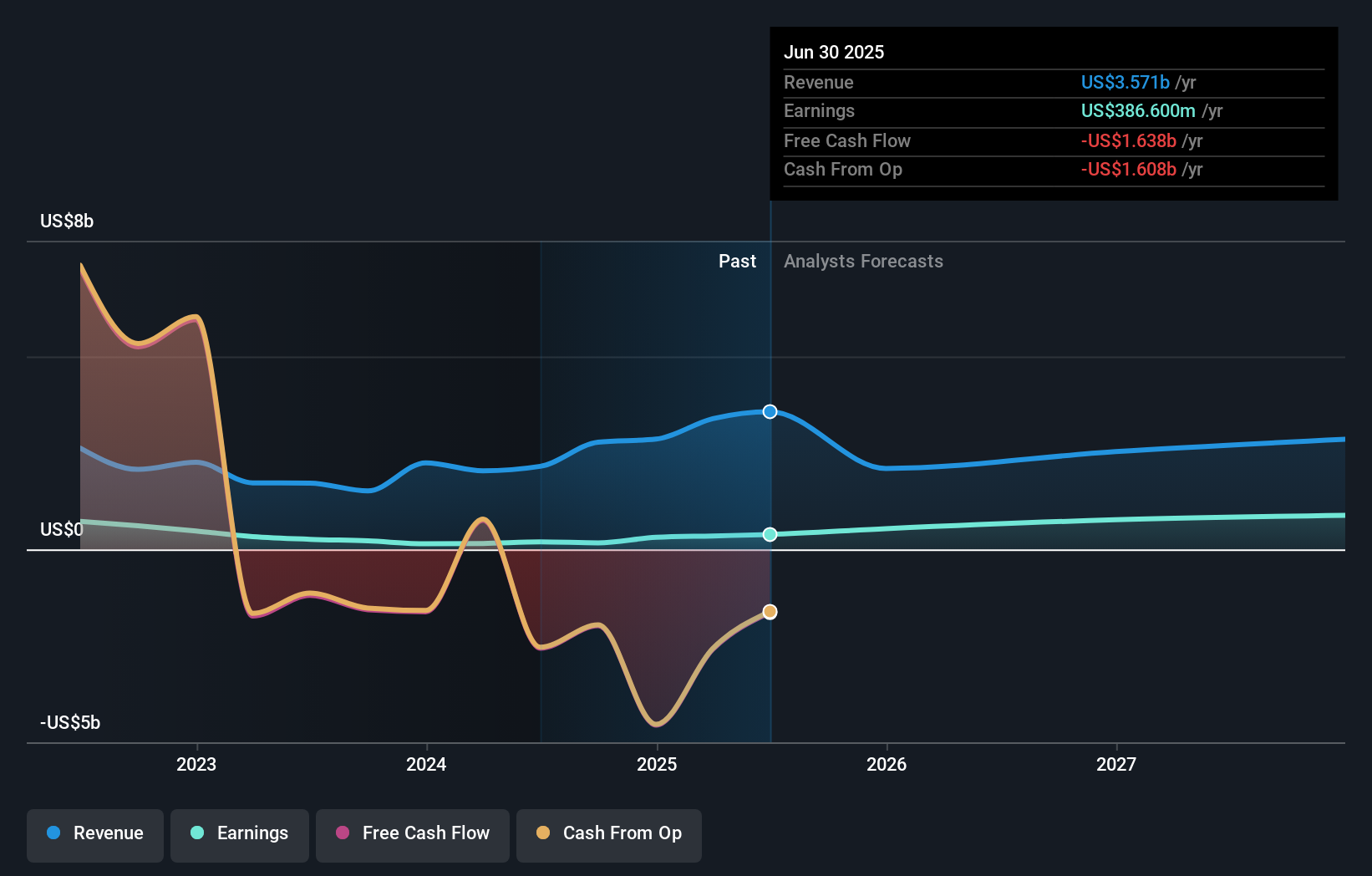

PennyMac Financial Services’ outlook anticipates $2.5 billion in revenue and $1.1 billion in earnings by 2028. This requires an annual revenue decline of 11.0% and a $713 million increase in earnings from the current $386.6 million.

Uncover how PennyMac Financial Services' forecasts yield a $138.57 fair value, a 9% upside to its current price.

Exploring Other Perspectives

Private investors in the Simply Wall St Community have set their fair value estimates for PennyMac Financial Services between US$126.24 and US$138.57, based on just 2 perspectives. While interest rate moves remain the main catalyst for the business, these differing opinions highlight the range of views on future earnings and risk, consider each when evaluating your outlook.

Explore 2 other fair value estimates on PennyMac Financial Services - why the stock might be worth as much as 9% more than the current price!

Build Your Own PennyMac Financial Services Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PennyMac Financial Services research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free PennyMac Financial Services research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PennyMac Financial Services' overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PFSI

PennyMac Financial Services

Through its subsidiaries, engages in the mortgage banking and investment management activities in the United States.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026