- United States

- /

- Consumer Finance

- /

- NYSE:OMF

OneMain Holdings (OMF): Expanding Profit Margins Reinforce Bullish Narrative, Dividend Stability Still Questioned

Reviewed by Simply Wall St

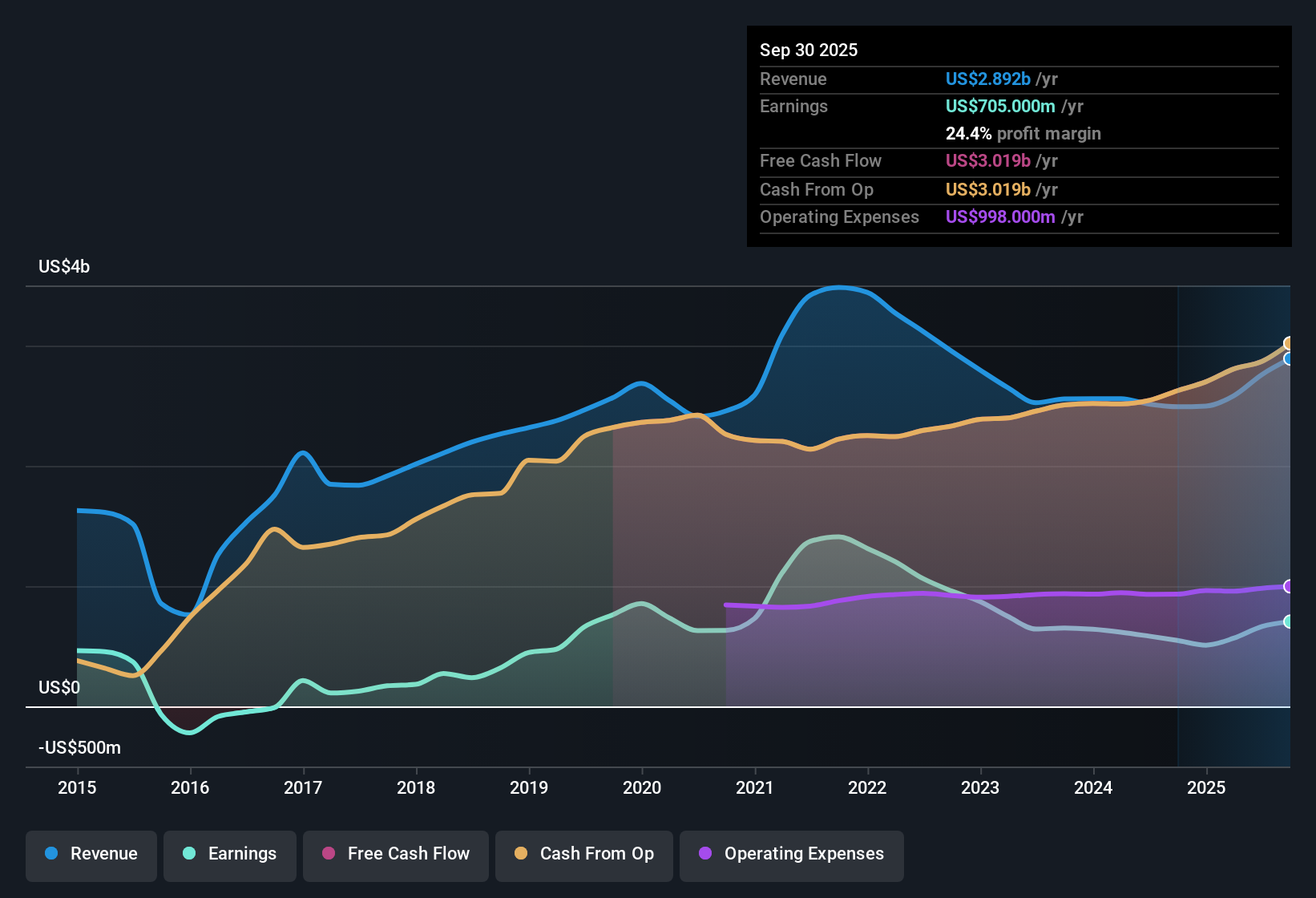

OneMain Holdings (OMF) posted a net profit margin of 24.1%, up from 23.2% last year, as earnings grew 13.7% over the past twelve months. This is well ahead of its five-year average decline of -15.8% per year. Looking ahead, analysts expect earnings to accelerate at 21.4% annually for the next three years, outpacing the broader US market forecast of 15.9% per year. However, revenue growth is projected to trail the market at 7.5% per annum versus 10.3%. With margins expanding and a Price-to-Earnings ratio of 10.6x that stands below the peer average, the latest results put continued profit gains and relative value in the spotlight, even as financial strength and dividend sustainability remain under scrutiny.

See our full analysis for OneMain Holdings.Next, we will compare these headline numbers to the broader narratives investors are following to see where the latest results confirm expectations and where they might offer new insights.

See what the community is saying about OneMain Holdings

Share Price Lags Modest Analyst Target

- OneMain Holdings’ current share price stands at $59.19, just 9.4% below the sole allowed analyst price target of $64.79. This signals that the market is not pricing in a major upside or downside surprise at this point.

- Analysts' consensus view leans cautious. They note that future earnings growth, expected to accelerate at 21.4% per year for the next three years, will only justify upside if margins shrink from 24.1% to 19.3% and the price-to-earnings ratio falls to 8.3x, below the current industry average.

- This relatively small gap between current price and target suggests analysts see OneMain as fairly valued based on expected $1.3 billion in earnings by 2028.

- The 7.5% annual revenue growth rate, while robust, still trails the wider US market. This complicates the case for outperformance beyond the present valuation.

What makes these numbers so divisive? See how the consensus narrative debates margin risk, valuation, and growth in the full breakdown. 📊 Read the full OneMain Holdings Consensus Narrative.

Dividend Yield Promises, but Stability Questions Remain

- OneMain’s 7% dividend yield stands out as a key shareholder return, with management signaling escalating buybacks and a focus on capital returns. Yet there is caution around the sustainability of this payout given ongoing regulatory and economic risks.

- Bears highlight that ongoing expansion into higher-risk borrowers keeps net charge-off rates elevated (7.5% to 7.8% guidance for 2025), and rising funding costs may threaten both earnings and the ability to maintain this yield.

- Any squeeze in funding markets or regulatory interventions could force a reduction in dividends if profitability comes under further pressure.

- Although management is maintaining the yield today, persistent margin and credit pressures make future dividends far from guaranteed, making stability a central concern for wary investors.

Margin Trends Signal Higher Risk and Reward Tradeoff

- Profit margin has grown to 24.1% from 23.2% year-over-year, well above the five-year average. Analysts expect this to contract to 19.3% by 2028 alongside anticipated growth in absolute earnings.

- Consensus narrative observes that ongoing investments in digital lending platforms and credit analytics are intended to preserve margins as OneMain pivots its model. There is a warning, however, that heavy reliance on physical branches and non-prime lending could amplify swings in earnings if competitive and macroeconomic pressures persist.

- This strategic tension, balancing technology-driven operating leverage with branch-based servicing, will be crucial in determining whether margin gains prove temporary or support a long arc of profitability.

- Improved underwriting and customer acquisition costs provide some buffer, but gains may be difficult to hold if new fintech competitors accelerate share gains among non-prime borrowers.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for OneMain Holdings on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot an opportunity or risk others may have missed? Shape your own take on OneMain's performance in just a few minutes. Do it your way

A great starting point for your OneMain Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite OneMain Holdings’ rising earnings and margin gains, persistent concerns remain around dividend stability and credit risks from non-prime borrowers and higher funding costs.

If dependable shareholder income matters most to you, steer toward these 2009 dividend stocks with yields > 3% to compare stocks offering high yields with stronger payout consistency and lower risk.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OMF

OneMain Holdings

A financial service holding company, engages in the consumer finance and insurance businesses in the United States.

Good value with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives