- United States

- /

- Consumer Finance

- /

- NYSE:OMF

A Look at OneMain Holdings (OMF) Valuation After Its New $1 Billion 6.75% Senior Notes Deal

Reviewed by Simply Wall St

OneMain Holdings (OMF) is back in focus after its OneMain Finance subsidiary lined up a $1 billion offering of 6.75% Senior Notes due 2033, a move aimed at reshaping its debt stack and financial flexibility.

See our latest analysis for OneMain Holdings.

The note deal lands against a backdrop of strong momentum, with the share price up about 7% over the past month and a robust double digit year to date share price return, while long term total shareholder returns remain especially impressive.

If this kind of debt reshaping has you rethinking your watchlist, it is also worth exploring fast growing stocks with high insider ownership as potential next wave opportunities.

Yet with earnings still growing and shares trading at a hefty intrinsic discount, investors face a key question: Is OneMain quietly undervalued after this debt move, or has the market already priced in its future growth?

Most Popular Narrative Narrative: 2.4% Undervalued

With OneMain trading at $64.65 against a narrative fair value of $66.21, the spread is narrow but points to modest upside grounded in detailed forecasts.

Management's commitment to robust shareholder capital returns via a 7% dividend yield and escalating buybacks, now ahead of the prior year, provides a catalyst for EPS growth and may attract additional yield focused investors if the stock remains undervalued.

Curious how strong revenue expansion, changing profit margins, and a lower future earnings multiple can still add up to upside potential? The full narrative unpacks the math behind that tension.

Result: Fair Value of $66.21 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent credit stress among nonprime borrowers, or tighter funding conditions, could quickly pressure margins and undermine the current undervaluation thesis.

Find out about the key risks to this OneMain Holdings narrative.

Another Way to Look at Value

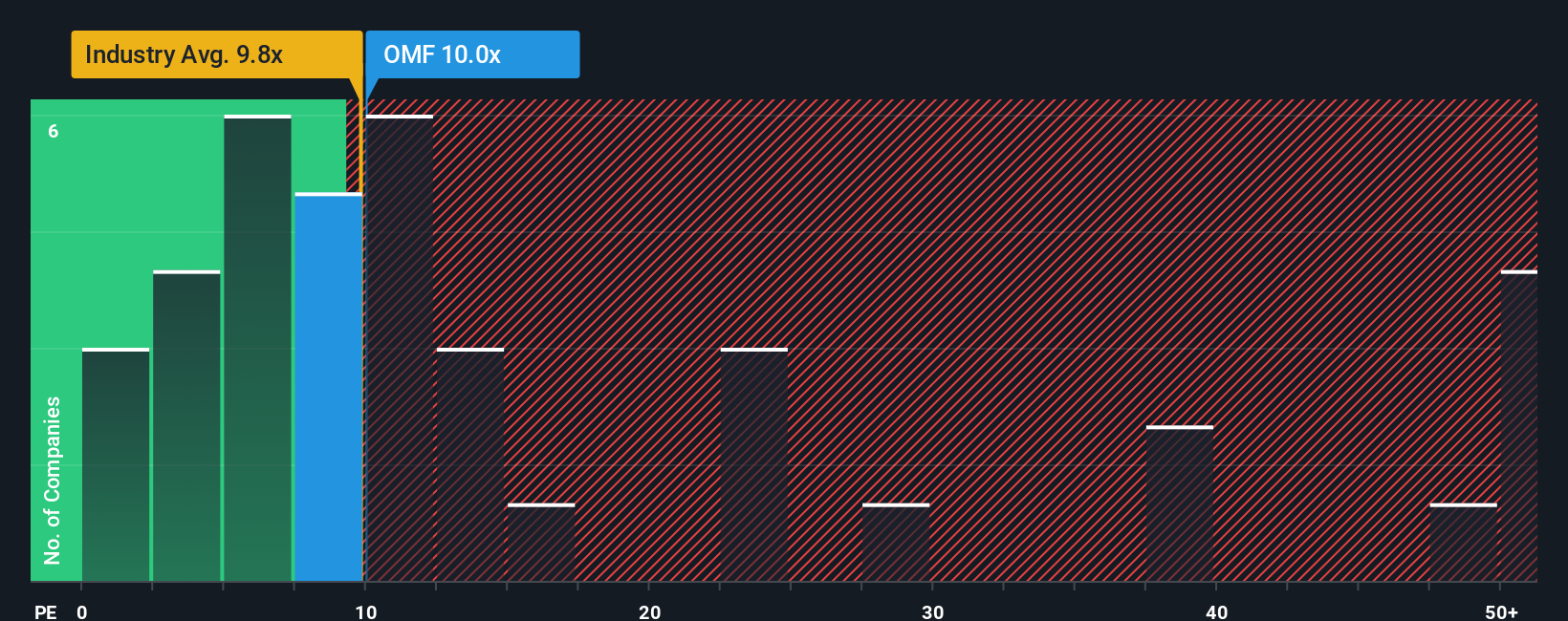

On earnings, OneMain looks mixed. Its P/E of 10.8 times sits slightly above the US consumer finance average of 10.3 times, which hints at a modest premium, yet remains well below a 17.4 times fair ratio and far under peer levels near 48 times, suggesting potential upside if sentiment normalizes. Which signal should investors trust?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own OneMain Holdings Narrative

If you see the story differently, or want to dig into the numbers yourself, you can build a personalized view in just minutes: Do it your way.

A great starting point for your OneMain Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before you move on, consider your next move by scanning fresh opportunities from our screeners that surface potential ideas other investors might be missing.

- Review these 3577 penny stocks with strong financials to explore companies that combine smaller market caps with strengthening fundamentals and the potential for significant price moves.

- Look at these 26 AI penny stocks if you are interested in businesses that are involved in real world applications of machine learning and automation.

- Explore these 902 undervalued stocks based on cash flows if you want to focus on companies where negative sentiment contrasts with solid cash flow profiles and long term business potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OMF

OneMain Holdings

A financial service holding company, engages in the consumer finance and insurance businesses in the United States.

Exceptional growth potential, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026