- United States

- /

- Mortgage REITs

- /

- NYSE:NLY

Taking a Fresh Look at Annaly Capital Management’s (NLY) Valuation After Its Better‑Than‑Expected Revenue Results

Reviewed by Simply Wall St

Annaly Capital Management (NLY) is back in focus after quarterly results showed revenue beating Wall Street expectations and economic returns staying solid, even though net interest income came in weaker.

See our latest analysis for Annaly Capital Management.

The earnings beat seems to have reignited interest in Annaly, with the share price up about 24% year to date and a 1 year total shareholder return of roughly 33%, suggesting momentum is building as income investors reassess the risk reward trade off.

If this kind of rebound has you thinking about what else might be setting up for a similar move, it could be a good time to explore fast growing stocks with high insider ownership.

With revenues surging and economic returns robust, yet the stock trading slightly above analyst targets despite a sizable intrinsic value discount, is Annaly still an underappreciated income play, or is the market already pricing in its future growth?

Most Popular Narrative: 3.5% Overvalued

With Annaly Capital Management closing at $22.87 against a narrative fair value of $22.10, the story leans toward a modestly rich pricing, setting up a debate over how durable its earnings power really is.

The analysts have a consensus price target of $21.023 for Annaly Capital Management based on their expectations of its future earnings growth, profit margins and other risk factors.

In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $3.4 billion, earnings will come to $3.2 billion, and it would be trading on a PE ratio of 7.0x, assuming you use a discount rate of 11.0%.

Curious how a mortgage REIT justifies this kind of earnings ramp and margin profile, while still landing on a surprisingly restrained future multiple? The narrative leans on aggressive revenue acceleration, expanding profitability, and a sharply lower valuation bar in a few years time. Want to see exactly how those moving parts combine to support today’s fair value call and price target tension?

Result: Fair Value of $22.10 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising rate volatility and intensifying non agency competition could quickly compress spreads and margins, challenging the bullish earnings ramp implied in current forecasts.

Find out about the key risks to this Annaly Capital Management narrative.

Another Angle on Value

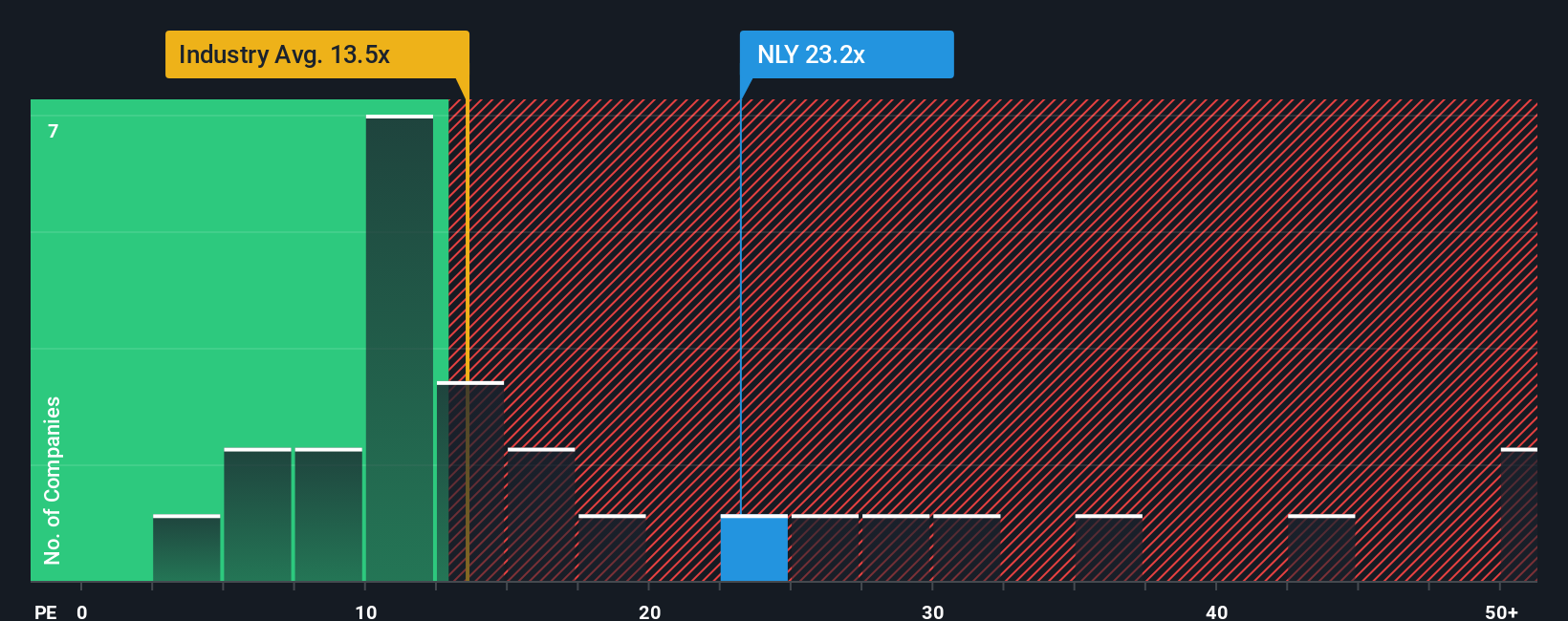

Analysts see Annaly as about 3.5% overvalued versus its narrative fair value of $22.10, yet on earnings it looks far cheaper, with a price to earnings ratio of 11.6x versus a fair ratio of 17.9x and peers closer to 13x. This raises the question of whether the market is underestimating future cash generation or overestimating risk.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Annaly Capital Management Narrative

If the conclusions here do not quite line up with your own view, you can dig into the numbers yourself and build a custom narrative in just a few minutes: Do it your way.

A great starting point for your Annaly Capital Management research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Ready for Your Next Investing Move?

Before you move on, lock in your advantage by scanning fresh ideas on Simply Wall Street, where data driven screeners uncover opportunities most investors overlook.

- Capture potential price mismatches by targeting companies that still look cheap on future cash flows using these 906 undervalued stocks based on cash flows.

- Capitalize on powerful niche themes in tech by zeroing in on these 26 AI penny stocks shaping tomorrow's intelligent infrastructure.

- Strengthen your income stream by focusing on reliable payers through these 15 dividend stocks with yields > 3% with yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NLY

Annaly Capital Management

A diversified capital manager, engages in the mortgage finance business.

Undervalued with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026