- United States

- /

- Diversified Financial

- /

- NYSE:NATL

Will NCR Atleos’ (NATL) AI Push Redefine Its Role in Next-Gen Bank Technology Platforms?

Reviewed by Sasha Jovanovic

- Kuwait Finance House recently announced a collaboration with NCR Atleos to deploy conversational AI-powered video avatars at in-branch kiosks, offering real-time customer support, live agent escalation, and enhanced operational capabilities through AI-driven analytics and quality management.

- This initiative highlights a shift toward automating routine banking interactions, enabling more personalized services while allowing human agents to prioritize more complex tasks.

- We'll examine how this move toward AI-powered customer engagement tools could influence NCR Atleos' investment narrative and future technology positioning.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

NCR Atleos Investment Narrative Recap

For NCR Atleos, the investment thesis centers on whether you believe innovations like AI-powered banking kiosks can offset structural challenges facing ATM-based services by creating new, tech-driven opportunities for recurring revenue. While the Kuwait Finance House announcement shows the company is serious about embedding advanced technology in physical branches, it does not materially change the near-term catalyst: sustaining demand for both hardware refresh cycles and digital service upgrades, as declining cash usage remains the key risk for revenue sustainability.

Among recent announcements, the extension of Moto’s partnership to grow the Cashzone ATM network complements the AI kiosk rollout, signposting efforts to shore up the installed base while investing in next-generation branch technologies. The combination of expanding physical reach and digital engagement tools highlights how NCR Atleos is positioning to serve both traditional and emerging customer needs as banks digitize operations.

But on the flip side, investors still need to be alert to the risk that the accelerated shift to contactless and digital banking could...

Read the full narrative on NCR Atleos (it's free!)

NCR Atleos' outlook anticipates $4.9 billion in revenue and $376.6 million in earnings by 2028. This implies 4.4% annual revenue growth and a $248.6 million increase in earnings from the current $128.0 million.

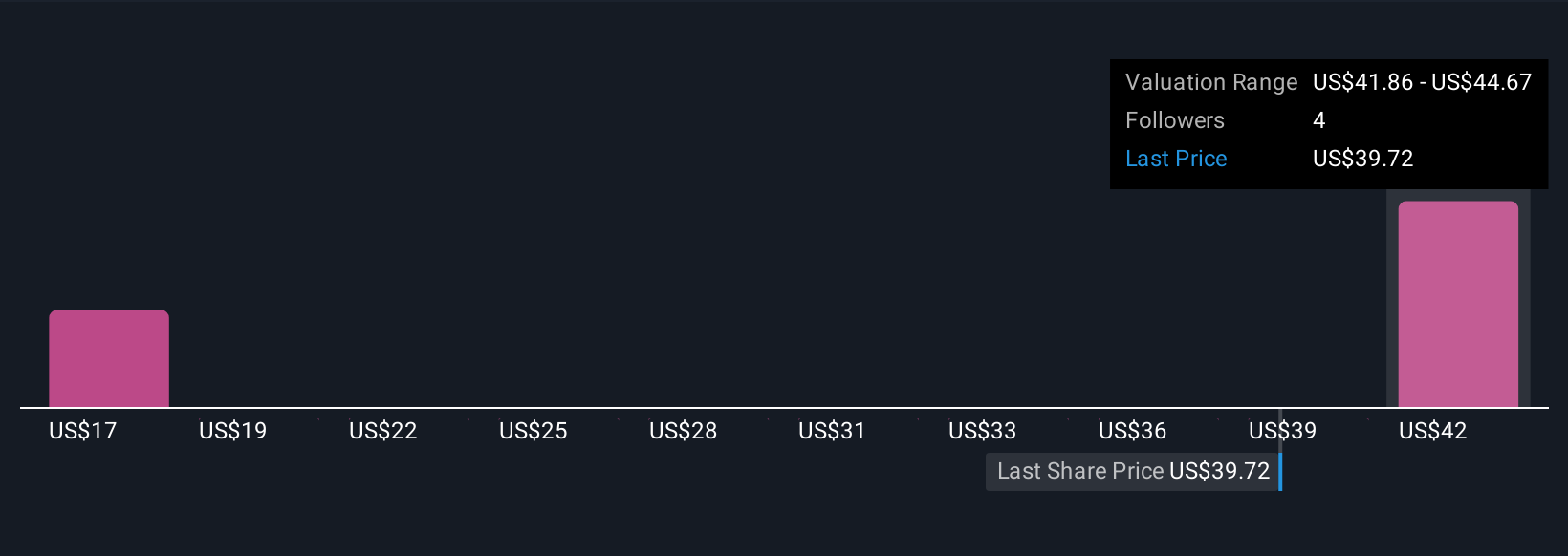

Uncover how NCR Atleos' forecasts yield a $44.67 fair value, a 23% upside to its current price.

Exploring Other Perspectives

With fair value estimates from the Simply Wall St Community ranging from US$16.16 to US$44.67 across 4 contributors, opinions on NCR Atleos’ worth vary widely. Some anticipate innovations in AI banking tech driving growth, while others remain cautious about ongoing pressure from falling cash usage in banking.

Explore 4 other fair value estimates on NCR Atleos - why the stock might be worth as much as 23% more than the current price!

Build Your Own NCR Atleos Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NCR Atleos research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free NCR Atleos research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NCR Atleos' overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NCR Atleos might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NATL

NCR Atleos

A financial technology company, provides self-directed banking solutions to financial institutions, merchants, manufacturers, retailers, and consumers in the United States, rest of the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Reasonable growth potential with very low risk.

Similar Companies

Market Insights

Community Narratives