- United States

- /

- Capital Markets

- /

- NYSE:MS

Morgan Stanley (MS): Assessing Valuation After Forecast Upgrades and AI Data Center Loan Risk Moves

Reviewed by Simply Wall St

Recent upgrades to earnings and revenue forecasts have put Morgan Stanley (MS) back in the spotlight, and the bank’s moves to trim AI data center loan risk are reinforcing confidence in its balance sheet.

See our latest analysis for Morgan Stanley.

Those upgrades and balance sheet moves are landing in a market that already likes the story. The latest share price is $176.51 with a roughly 41% year to date share price return, while the five year total shareholder return above 230% shows that momentum has been building over a much longer run.

If this kind of financial sector strength has you thinking about where capital is flowing next, it is a good time to explore fast growing stocks with high insider ownership.

But with shares already ahead of analyst targets and long term returns so strong, is Morgan Stanley still trading below its true potential, or has the market already baked in the next leg of growth?

Most Popular Narrative: 4% Overvalued

With Morgan Stanley closing at $176.51 against a narrative fair value of about $169.52, the current price sits slightly ahead of that framework.

The fair value estimate has risen slightly from 168.15 dollars to approximately 169.52 dollars, reflecting a modest upward revision in intrinsic value.

The future P/E has risen modestly from roughly 18.56 times to about 18.73 times, signaling a small increase in the valuation multiple applied to forward earnings.

Want to see what is powering that richer multiple? The narrative leans on steady top line growth, fatter margins and a confident earnings runway. Curious how those pieces fit together into a higher long term profit base and a premium but not extreme earnings multiple? The full breakdown reveals the exact combination of growth and profitability assumptions behind this pricing view.

Result: Fair Value of $169.52 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent fee pressure from passive investing and stricter global regulations could compress margins and challenge the optimistic long term earnings trajectory.

Find out about the key risks to this Morgan Stanley narrative.

Another View: Earnings Multiple Still Looks Reasonable

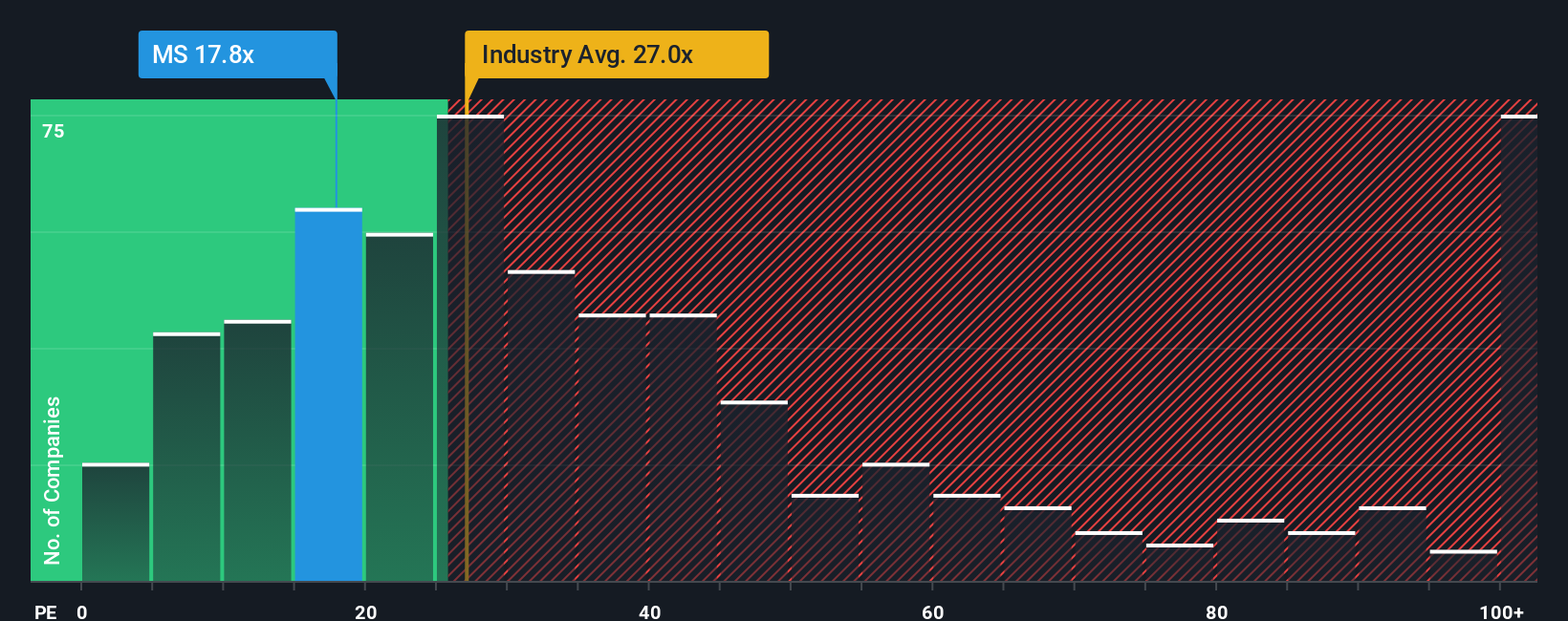

While the narrative fair value suggests Morgan Stanley is about 4% overvalued, its 18x price to earnings ratio sits below the US market at 18.7x, the industry at 25x and a 19.1x fair ratio. That gap points to a valuation that is richer on narrative, but still not stretched on fundamentals. This leaves investors to judge which signal matters more.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Morgan Stanley Narrative

If you see the numbers differently or prefer to dig into the assumptions yourself, you can build a complete view in minutes: Do it your way.

A great starting point for your Morgan Stanley research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next set of opportunities with targeted screens that surface quality stocks most investors overlook but you will not want to miss.

- Boost your income potential by scanning these 15 dividend stocks with yields > 3% that combine attractive yields with solid business profiles.

- Position yourself for growth by tracking these 26 AI penny stocks poised to benefit from rising demand for AI driven solutions.

- Strengthen your value strategy by reviewing these 904 undervalued stocks based on cash flows that trade below their estimated cash flow worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MS

Morgan Stanley

A financial holding company, provides various financial products and services to governments, financial institutions, and individuals in the Americas, Asia, Europe, Middle East, and Africa.

Solid track record average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026