- United States

- /

- Capital Markets

- /

- NYSE:MS

How Resolving a Tax Dispute and Issuing New Bonds at Morgan Stanley (MS) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- In late November 2025, Morgan Stanley resolved a long-standing Dutch dividend tax dispute by agreeing to pay a €101 million fine tied to historical tax filings, while also announcing several fixed-income offerings with maturities between 2030 and 2035.

- This decisive action removes a significant legal overhang and coincides with the firm's continued effort to diversify funding through new bond issuances.

- Let's explore how the resolution of this major tax case and the new bond offerings may influence Morgan Stanley's investment outlook.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Morgan Stanley Investment Narrative Recap

To be a Morgan Stanley shareholder, one needs confidence in the firm’s ability to drive growth in wealth and asset management while navigating competitive and regulatory challenges. The recent €101 million Dutch tax settlement removes an overhang but does not materially alter the primary short-term catalyst, continued net new asset growth, or the biggest risk, which remains regulatory uncertainty. The legal resolution appears to reinforce Morgan Stanley's operational stability rather than altering its near-term outlook.

Among recent announcements, the expansion of fixed-income offerings is especially relevant. These new bonds, with maturities out to 2035, diversify Morgan Stanley’s funding sources and demonstrate continued access to capital markets, which can provide support for ongoing growth initiatives identified as key catalysts for the firm’s future performance.

However, despite these constructive developments, investors should not overlook the potential for unexpected regulatory shifts that could...

Read the full narrative on Morgan Stanley (it's free!)

Morgan Stanley's outlook anticipates $76.0 billion in revenue and $17.2 billion in earnings by 2028. This forecast is based on a 5.0% annual revenue growth rate and a $3.1 billion increase in earnings from the current $14.1 billion.

Uncover how Morgan Stanley's forecasts yield a $168.15 fair value, in line with its current price.

Exploring Other Perspectives

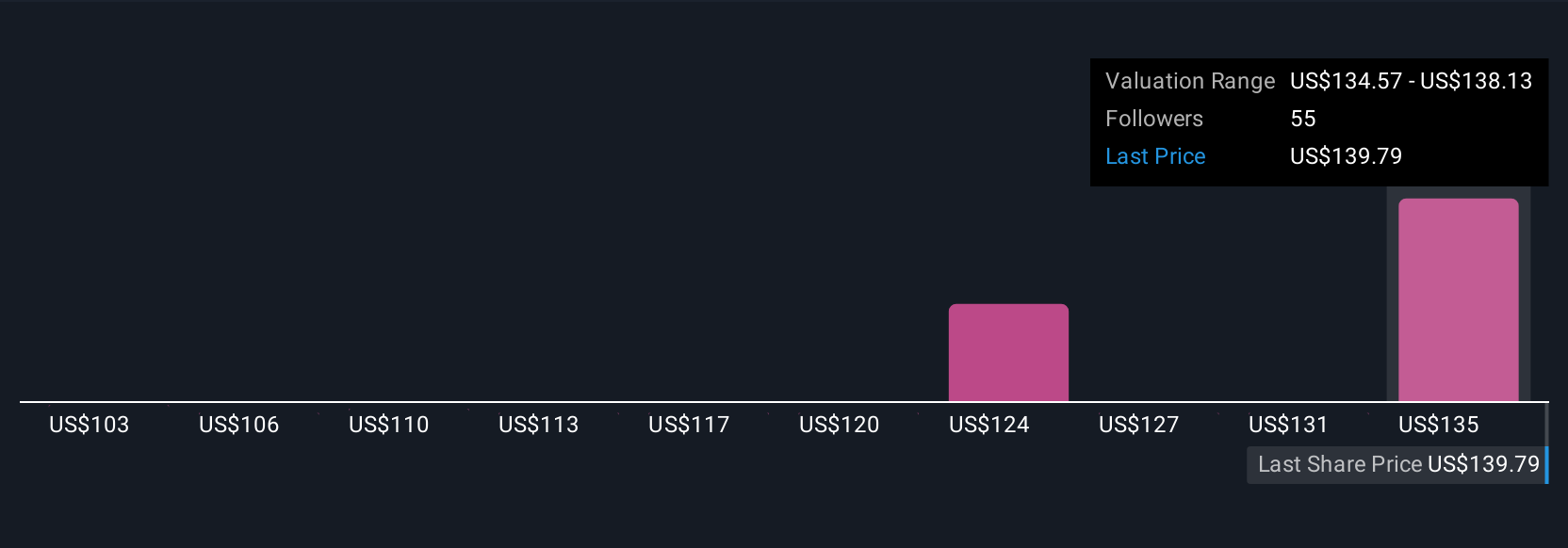

Six fair value estimates from the Simply Wall St Community range between US$102.53 and US$168.15, illustrating broad views on Morgan Stanley’s worth. With regulatory scrutiny still presenting a risk after the tax settlement, you can see just how widely opinions on the company’s future performance can differ, review several perspectives to deepen your understanding.

Explore 6 other fair value estimates on Morgan Stanley - why the stock might be worth 40% less than the current price!

Build Your Own Morgan Stanley Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Morgan Stanley research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Morgan Stanley research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Morgan Stanley's overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MS

Morgan Stanley

A financial holding company, provides various financial products and services to governments, financial institutions, and individuals in the Americas, Asia, Europe, Middle East, and Africa.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026