- United States

- /

- Capital Markets

- /

- NYSE:MCO

Moody's (MCO): Assessing Valuation After Recent Dip and Long-Term Gains

Reviewed by Simply Wall St

See our latest analysis for Moody's.

This week's dip comes after a gradual fade in momentum for Moody's, with the share price posting a 4.6% drop over the past 7 days and trading at $470.16. However, when you zoom out, the stock's three-year total shareholder return of 63% stands out as a reminder that long-term holders have been well rewarded despite recent softness.

If you’re interested in what other strong movers look like, now is a great time to expand your search and discover fast growing stocks with high insider ownership

With shares trading below analyst targets but following years of strong gains, the real question is whether Moody's is now offering hidden value or if investors have already factored in all of its future growth.

Most Popular Narrative: 13.8% Undervalued

Compared to Moody's last close at $470.16, the most widely followed narrative suggests there is notable upside, with a fair value set much higher. Investors are watching to see if these forecasts hold up in the months ahead.

Moody's is experiencing accelerating demand from the rapid evolution and expansion of private credit markets. This is evidenced by 75% year-over-year growth in private credit revenues, 25% of first-time mandates coming from private credit, and ongoing issuer and investor demand for independent risk assessment. These factors strongly support future revenue growth and earnings resilience as private credit's share in global financing expands.

Want to see what headline-grabbing assumptions lead to this bullish price target? Buried in the narrative are aggressive profit forecasts and a multiple that towers over industry averages. Discover the bold expectations that could reshape how the market prices Moody's in the future.

Result: Fair Value of $545.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, increased regulatory scrutiny and rising competition from AI-powered rivals could limit Moody's pricing power and slow its projected margin gains.

Find out about the key risks to this Moody's narrative.

Another View: Profit Multiples Challenge the Optimism

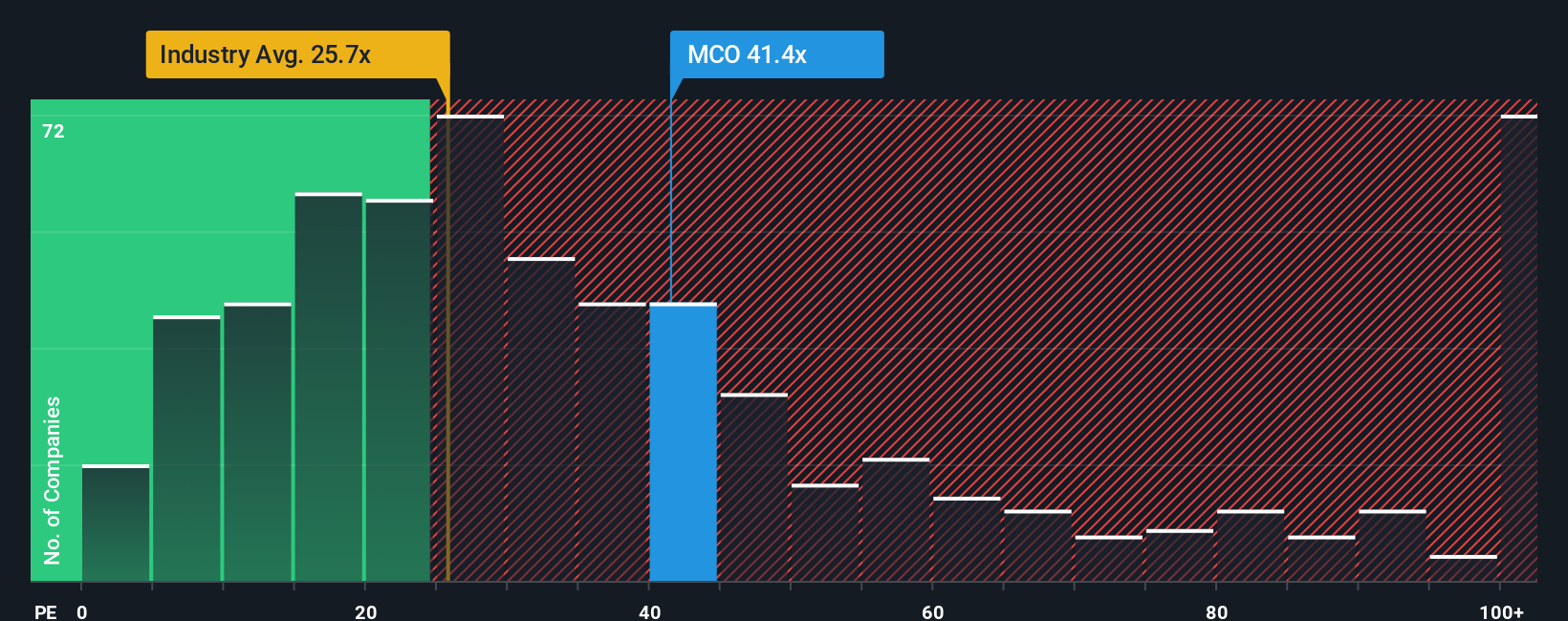

While analyst earnings forecasts are bullish, the company's share price still looks lofty by classic profit yardsticks. Moody's trades at a 37.4x earnings multiple, much higher than both the US industry average of 23.7x and the peer average of 30x. Its ratio is also well above the fair ratio of 17.8x. The market could eventually drift toward this level if sentiment shifts. Is the current premium justified by future growth, or does it set up valuation risk as optimism cools?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Moody's Narrative

If you see the story differently or want to dig deeper into the numbers, start assembling your own take in just a few minutes with Do it your way

A great starting point for your Moody's research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

There’s a whole world of opportunities waiting, and you can unlock them right now with the right tools. Don’t let your next winning investment pass you by.

- Jump on the trend toward automation and robotics by checking out these 27 AI penny stocks which are making headlines for their disruptive potential.

- Capture reliable income streams when you target these 18 dividend stocks with yields > 3% that offer market-beating yields and steady cash flows.

- Stay ahead of innovation as you uncover growth stories inside these 26 quantum computing stocks that are transforming the future of computing and security.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MCO

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026