- United States

- /

- Diversified Financial

- /

- NYSE:MA

Is Mastercard Fairly Priced After Recent Digital Payment Push?

Reviewed by Bailey Pemberton

- Wondering if Mastercard stock is fairly priced right now? You are not alone, as many investors are curious about whether Mastercard’s strong reputation is matched by its current valuation.

- Despite relatively flat movement over the past week and a -1.0% dip in the last month, Mastercard has still delivered a solid 5.7% year-to-date return, and it is up 65.6% over three years.

- Recent headlines have focused on Mastercard’s continued push into digital payments solutions and new strategic partnerships, fueling speculation about its growth potential. These developments have kept Mastercard top of mind for both institutional and retail investors alike.

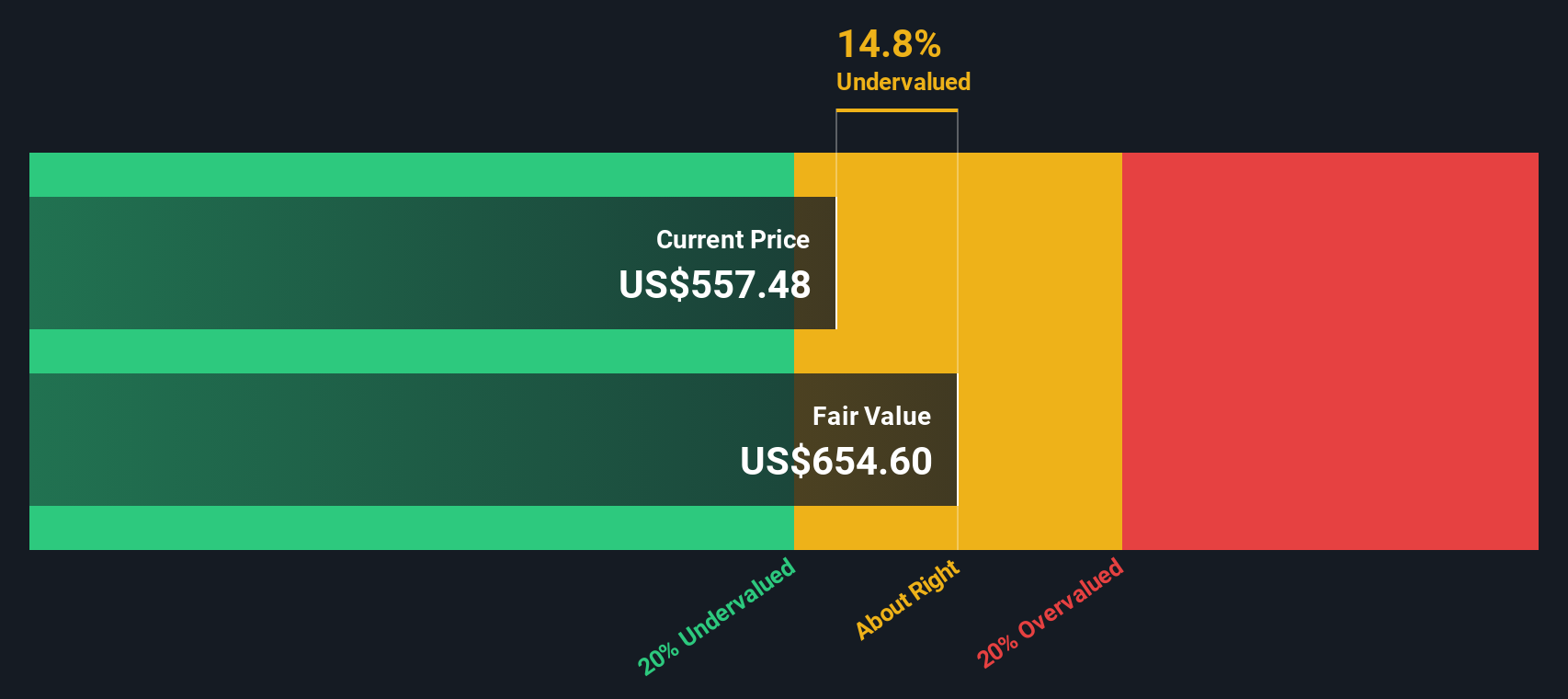

- According to valuation checks, Mastercard scores a 1 out of 6 on our undervaluation scale, suggesting there is plenty to unpack about how it is currently valued. Next up, we will break down the main valuation methods so you can see how they stack up. Be sure to stay to the end for an even more insightful approach you will not want to miss.

Mastercard scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Mastercard Excess Returns Analysis

The Excess Returns valuation model examines whether Mastercard is generating profits above its cost of equity, which is a critical indicator of long-term value creation. This method focuses on how efficiently the company is using the capital invested by shareholders to achieve returns that exceed the minimum required return.

For Mastercard, the numbers are impressive. The company’s Book Value stands at $8.78 per share, with a stable EPS forecast of $26.54 per share. These projections are based on anticipated Return on Equity figures aggregated from 13 analysts. Mastercard’s cost of equity is estimated at $0.94 per share, while its excess return reaches an impressive $25.60 per share. The average return on equity is a notable 208.57%. Additionally, the stable Book Value, as estimated by 8 analysts, is $12.73 per share.

According to these figures, the Excess Returns model calculates a fair value of $628.72 per share for Mastercard. With this approach, the stock appears to be trading at a 12.2% discount relative to its intrinsic value. This suggests the shares are currently undervalued and may offer an opportunity for investors seeking strong, efficient capital allocation.

Result: UNDERVALUED

Our Excess Returns analysis suggests Mastercard is undervalued by 12.2%. Track this in your watchlist or portfolio, or discover 876 more undervalued stocks based on cash flows.

Approach 2: Mastercard Price vs Earnings

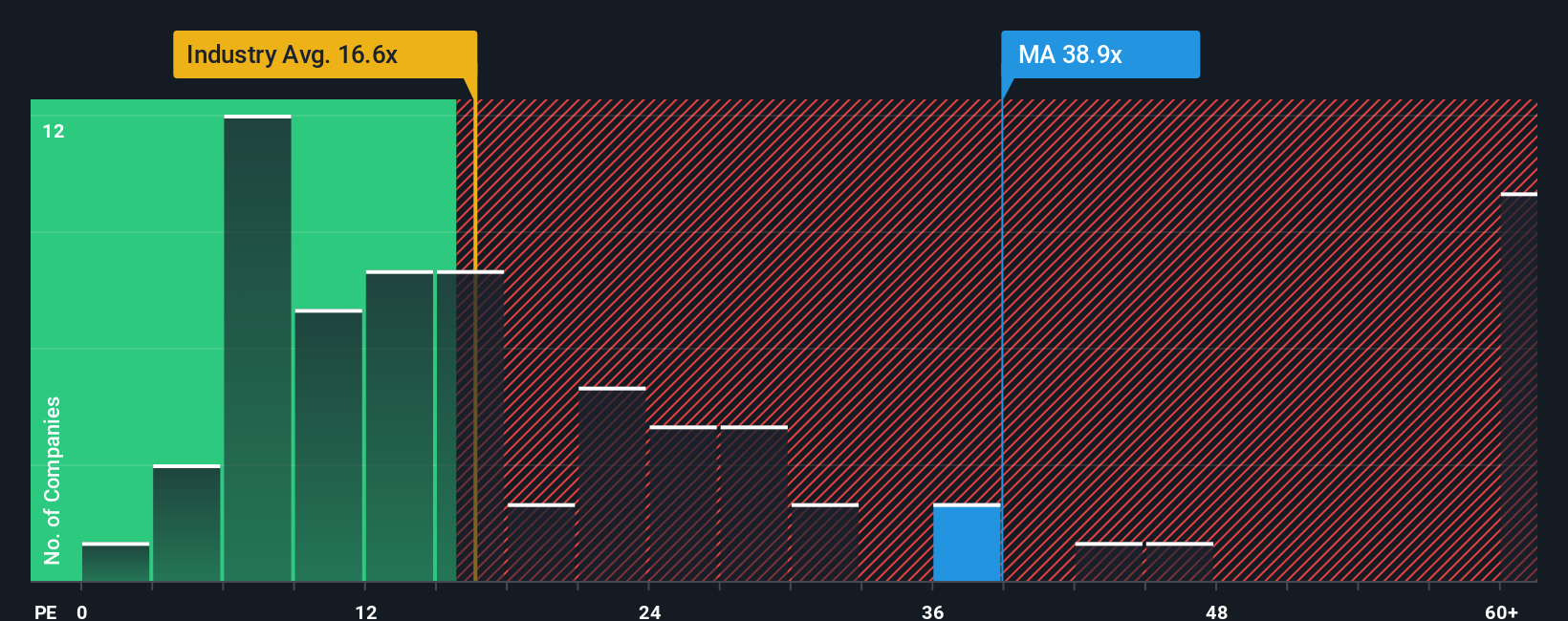

The Price-to-Earnings (PE) ratio is a widely used valuation measure for profitable companies like Mastercard because it relates the share price to earnings, making it a straightforward way to gauge how much investors are willing to pay for each dollar of profit. Since Mastercard has a consistent track record of profitability, using the PE multiple offers a clear window into market expectations.

However, not all PE ratios are created equal. When a company is expected to grow earnings quickly or carries less risk, a higher PE can be justified. Conversely, slower growth or higher risk can drive the "normal" or reasonable PE ratio lower. So, it is important to put Mastercard’s current PE in context.

Mastercard currently trades at a PE of 34.8x, which stands well above the Diversified Financial industry average of 13.1x and the peer average of 16.8x. While this might seem high at first glance, the “Fair Ratio,” Simply Wall St’s proprietary metric that incorporates factors like Mastercard’s earnings growth, profit margins, risk profile, industry, and market capitalization, is 20.4x. Unlike raw peer or industry comparisons, the Fair Ratio aims to reflect a valuation that is more tailored to Mastercard’s unique financial characteristics and future prospects.

Comparing Mastercard’s actual PE of 34.8x to the Fair Ratio of 20.4x suggests the stock is currently trading at a premium that is higher than what is justified by its fundamentals and outlook.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1404 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Mastercard Narrative

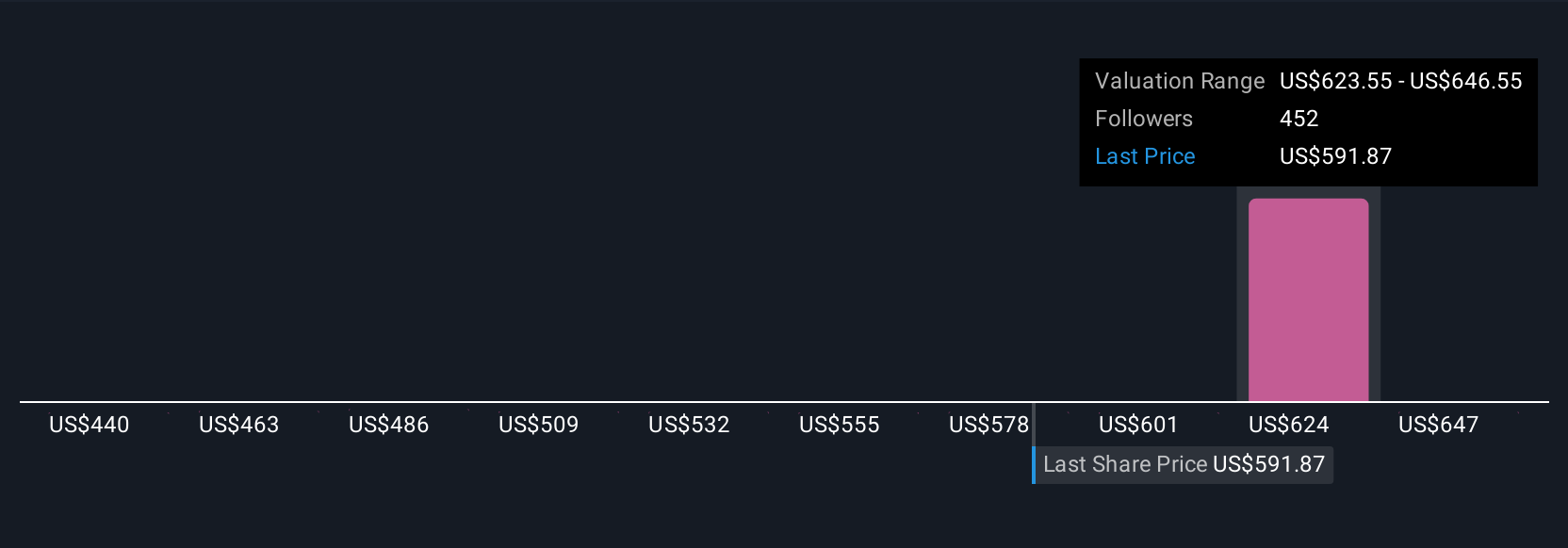

Earlier, we highlighted that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a personal story or perspective about a company that connects your predictions, such as future revenue, earnings, and profit margins, with a fair value based on those beliefs. In simple terms, Narratives allow you to link Mastercard’s business story to a financial forecast, showing how you see the company's future and what you think it is worth.

Available right on Simply Wall St’s Community page, Narratives are easy for anyone to use and help bridge the gap between financial data and real-world decision making. Investors can make smarter buy or sell decisions by comparing their own Fair Value to the current price. Narratives update automatically whenever new news or earnings are released, ensuring your story stays relevant.

For example, one investor might craft an optimistic Narrative for Mastercard, expecting rapid digital payment growth and setting a Fair Value near $690 per share. Another could be more cautious, anticipating slower expansion and regulatory headwinds, placing their Fair Value closer to $520. Narratives make it simple to see these perspectives side by side and decide which best fits your own outlook.

Do you think there's more to the story for Mastercard? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MA

Mastercard

A technology company, provides transaction processing and other payment-related products and services in the United States and internationally.

Solid track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives