- United States

- /

- Mortgage REITs

- /

- NYSE:LADR

Ladder Capital (LADR): A Fresh Look at Valuation Following Recent Gains

Reviewed by Simply Wall St

See our latest analysis for Ladder Capital.

Ladder Capital’s share price has edged higher in recent weeks, with a 3.46% gain over the last seven days and a 2.89% increase over the past month. This suggests some renewed investor interest after a sluggish first quarter. Long-term momentum is reflected in a five-year total shareholder return of 68.24%, while short-term movements indicate cautious optimism rather than a breakout trend.

If you’re curious to broaden your search beyond real estate, now's a good time to discover fast growing stocks with high insider ownership.

With Ladder Capital posting steady gains yet still sitting below analyst price targets, the question for investors is clear: is this stock currently undervalued, or is the market already anticipating future growth?

Most Popular Narrative: 13.9% Undervalued

With the most widely followed narrative putting fair value close to $12.83, and the last close at $11.05, many see an intriguing gap that could point to upside if narrative assumptions play out.

Becoming investment-grade with credit ratings upgrades and successful unsecured bond issuances has significantly reduced Ladder Capital's cost of debt. This has expanded access to deeper capital markets and enabled reinvestment into higher-yielding assets. This structural shift is expected to drive long-term earnings growth and improve net margins as incremental debt becomes less expensive.

Want to know why this valuation has Wall Street watching? Hint: it hinges on forecasts for rising revenues, shrinking profit margins, and an earnings leap fueled by aggressive capital redeployment. Discover which assumptions make all the difference and why consensus is split on how high this stock can climb.

Result: Fair Value of $12.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, signs of falling multifamily rents or a persistently high cost of capital could quickly shift the outlook for Ladder Capital in the months ahead.

Find out about the key risks to this Ladder Capital narrative.

Another View: Price-to-Earnings Tells a Different Story

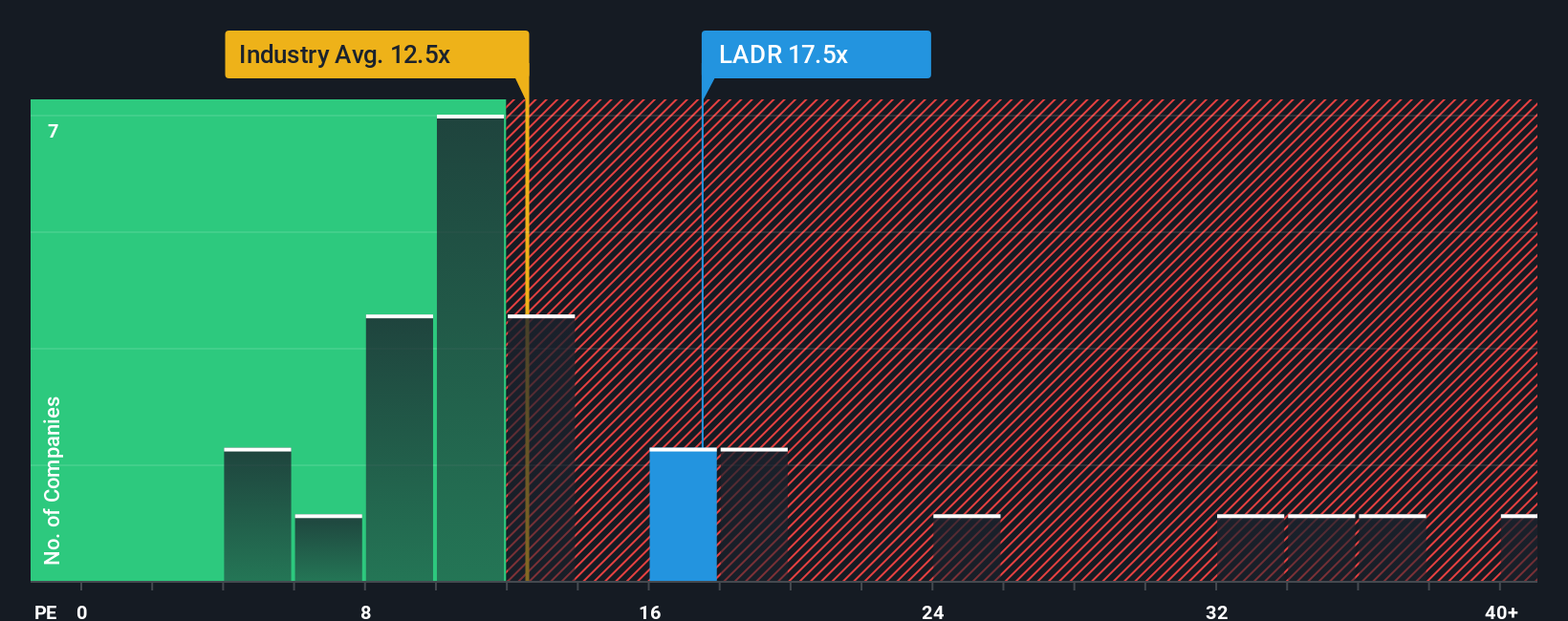

Switching gears, the market’s own price-to-earnings ratio for Ladder Capital sits at 17.7x, which is notably higher than both the industry average (12.8x) and its peer group (11.9x). The fair ratio, based on where the market could realistically head, is 10.4x. This signals the stock may be expensive on this basis, raising questions about whether future earnings growth really justifies the premium, or if the risk of prices reverting to a lower multiple is underestimated.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ladder Capital Narrative

Feel like testing your own perspective or digging deeper into the numbers? It takes just a few minutes to craft your own view and share it. Do it your way

A great starting point for your Ladder Capital research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Expand your opportunities and keep your edge by checking out other standout stocks that could change your portfolio’s outlook for the better.

- Secure dependable income streams by checking out these 15 dividend stocks with yields > 3%, which offers attractive yields above 3%.

- Ride the surge in artificial intelligence by exploring these 25 AI penny stocks, which are transforming industries right now.

- Tap into must-watch undervalued opportunities with these 920 undervalued stocks based on cash flows, supported by strong potential for growth based on cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LADR

Ladder Capital

Operates as an internally-managed real estate investment trust in the United States.

Low risk with limited growth.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.