- United States

- /

- Capital Markets

- /

- NYSE:KKR

Will KKR's (KKR) Major PayPal Loan Deal Transform Its European Credit Investment Strategy?

Reviewed by Sasha Jovanovic

- On November 17, 2025, PayPal announced a new agreement under which KKR will purchase up to €65 billion of European Buy Now, Pay Later loan receivables and provide a replenishing loan commitment of up to €6 billion, expanding their existing partnership across France, Germany, Italy, Spain, and the UK.

- This deal highlights KKR’s increasing involvement as a provider of credit in the growing European BNPL market, reinforcing its diversification into asset-based finance and real estate funding.

- We’ll explore how KKR’s expanded role in European BNPL receivables acquisition and credit solutions may influence its investment narrative.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

KKR Investment Narrative Recap

To be a KKR shareholder, you need to believe in the company's ability to scale its asset-based finance and private credit operations globally, while effectively managing asset quality and liquidity risks. The recent PayPal BNPL agreement confirms KKR's commitment to credit expansion and supports its most important near-term catalyst, growth in credit fee revenue, though it does not fundamentally alter the biggest risk, which remains potential asset underperformance if market headwinds arise.

Another relevant client announcement, the £350 million refinancing provided to Cain for a prime UK logistics portfolio, fits within KKR’s broader push into credit and real assets. This underscores the firm’s diversification efforts and ability to deploy capital across sectors, reinforcing its strategy to grow durable, fee-based earnings even during volatile periods.

By contrast, investors should also be aware that rapid credit expansion exposes KKR to the risk of asset quality issues in less favorable cycles, especially if...

Read the full narrative on KKR (it's free!)

KKR's narrative projects $13.7 billion revenue and $5.4 billion earnings by 2028. This requires a 13.9% yearly revenue decline and a $3.4 billion earnings increase from $2.0 billion today.

Uncover how KKR's forecasts yield a $157.14 fair value, a 28% upside to its current price.

Exploring Other Perspectives

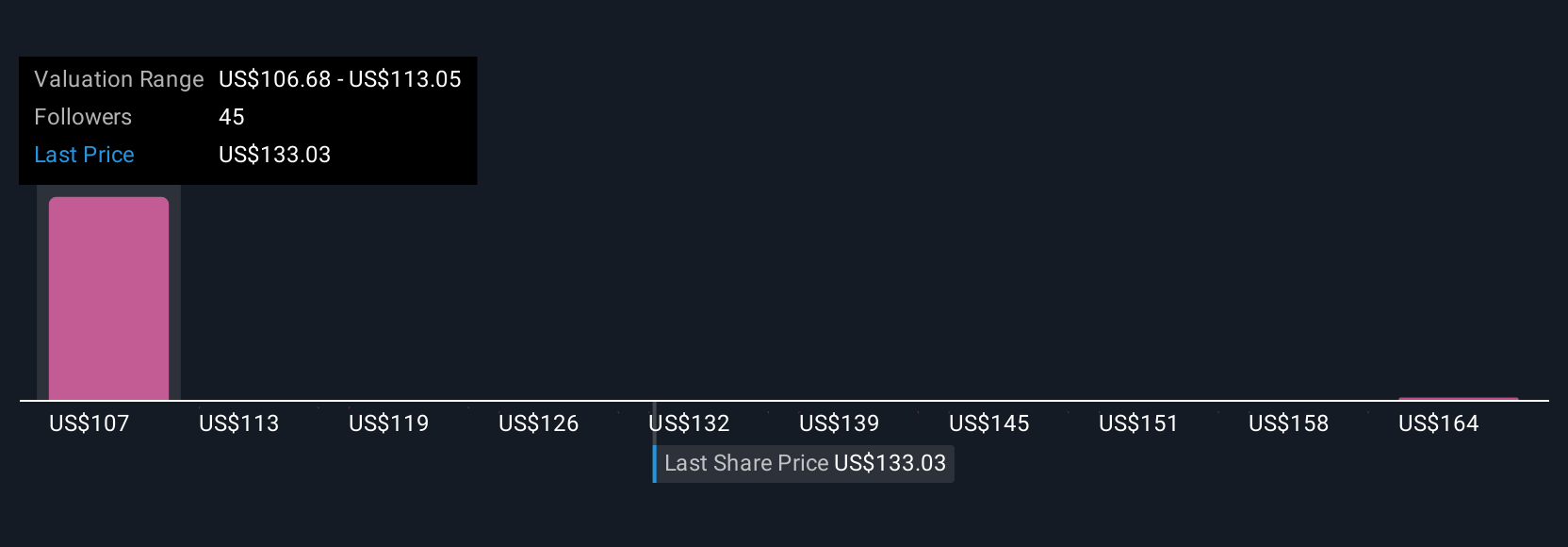

Five members of the Simply Wall St Community put KKR's fair value between US$62.66 and US$170.36, marking wide-ranging expectations. While these opinions reflect diverse forecasts for future performance, accelerating fee-based AUM growth remains a focal point for many as KKR deepens its role in global private credit, offering multiple viewpoints to compare.

Explore 5 other fair value estimates on KKR - why the stock might be worth as much as 39% more than the current price!

Build Your Own KKR Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your KKR research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free KKR research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate KKR's overall financial health at a glance.

No Opportunity In KKR?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KKR might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KKR

KKR

A private equity and real estate investment firm specializing in direct and fund of fund investments.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026