- United States

- /

- Capital Markets

- /

- NYSE:ICE

Intercontinental Exchange (ICE): Evaluating Valuation Following Big Bet on Prediction Markets with Polymarket Investment

Reviewed by Kshitija Bhandaru

Intercontinental Exchange (ICE) is making headlines with its newly announced investment of up to $2 billion in Polymarket, signaling a direct entry into the expanding prediction market sector. This strategic move aims to boost ICE’s presence in event-driven data and decentralized finance.

See our latest analysis for Intercontinental Exchange.

After news broke about the Polymarket investment, Intercontinental Exchange’s share price saw some renewed attention, following a year in which overall stock momentum has faded. Despite the recent strategic moves, including record-setting trading volumes and a broader climate analytics partnership, ICE has posted a 6.3% share price return year-to-date, but total shareholder return for the past twelve months dipped slightly by 2.3%. That said, its three- and five-year total returns remain impressive, reflecting the company’s ability to deliver growth through evolving market trends and innovation.

If ICE’s expansion into new markets caught your attention, now could be an opportunity to broaden your search and discover fast growing stocks with high insider ownership.

With analyst price targets sitting well above current levels and ICE’s latest moves targeting high-growth sectors, investors might wonder if the stock is undervalued after a quiet year, or if the market is already anticipating its next leg up.

Most Popular Narrative: 21.1% Undervalued

Compared to the last close of $158.75, the narrative sees Intercontinental Exchange trading well below its fair value estimate. The difference rests on ambitious projections and a strong long-term outlook for ICE’s underlying business lines.

The continued expansion and integration of ICE's global electronic trading platforms across asset classes, including record energy, interest rate, and equity contract volumes, suggests ongoing benefits from digitization and greater market electronification. This is likely to drive sustained double-digit growth in transaction revenues and operating leverage.

Want to know what’s fueling this bullish narrative? The underlying fair value hinges on aggressive profit margins and upshifting multiples, based on bold, future-forward growth assumptions. Discover which numbers the consensus is betting on to back up this potential upside.

Result: Fair Value of $201.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower exchange volumes or tougher regulation could quickly challenge the upbeat narrative and prompt a reassessment of ICE’s growth prospects.

Find out about the key risks to this Intercontinental Exchange narrative.

Another View: What Does the Market Multiple Say?

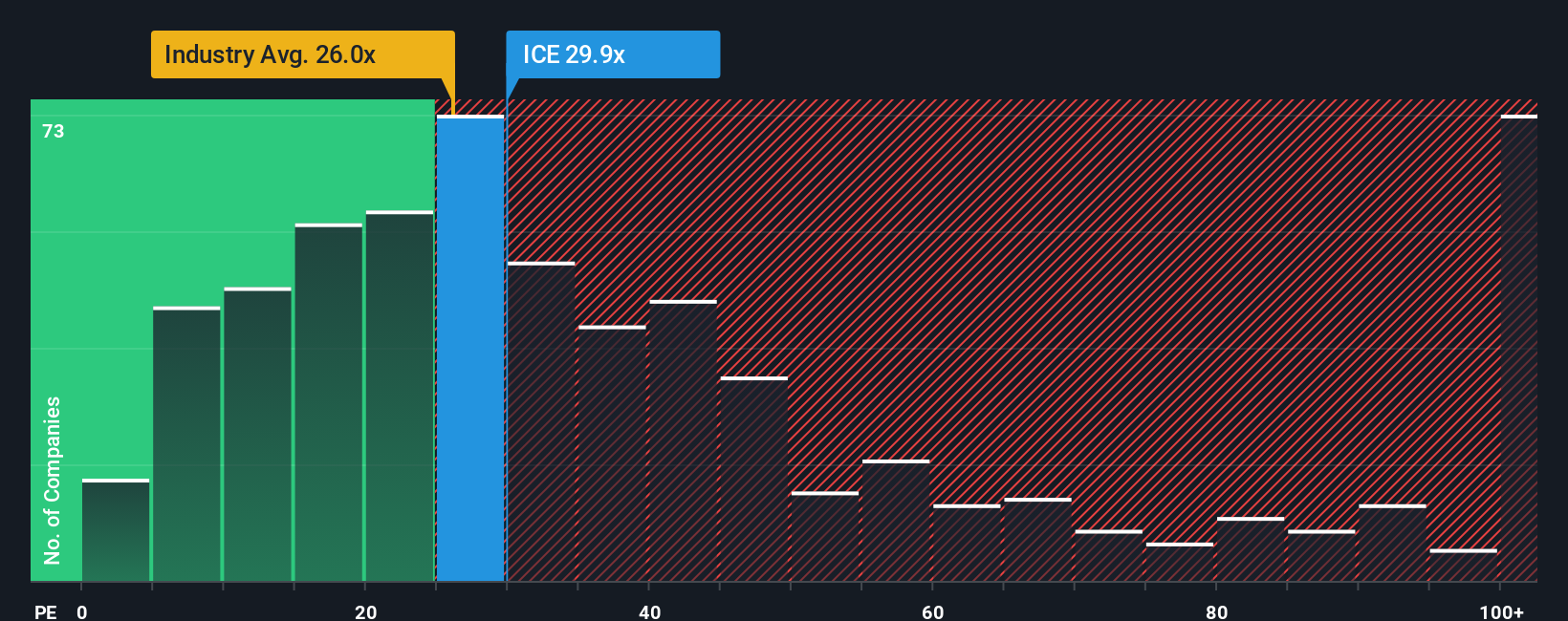

Looking beyond the narrative and fair value estimate, Intercontinental Exchange trades at a price-to-earnings ratio of 30.3x. This is more expensive than both the US Capital Markets industry average of 24.9x and the stock’s own fair ratio of 18.8x, suggesting a premium that may not be fully backed by fundamentals. Does this price signal quality deserving a higher valuation, or could investors face a risk if market expectations reset?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Intercontinental Exchange Narrative

If these perspectives do not resonate with your own, or you’d rather analyze the figures directly, you can draft your perspective in just a few minutes by following the prompt: Do it your way.

A great starting point for your Intercontinental Exchange research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t miss out on tomorrow’s market opportunities. Expand your toolbox and spot powerful trends ahead of the crowd with these handpicked screens.

- Boost your income potential by targeting stocks with stable, attractive yields using these 18 dividend stocks with yields > 3%.

- Tap into the next wave of innovation and uncover breakthrough companies advancing artificial intelligence by following these 25 AI penny stocks.

- Strengthen your portfolio’s value core with a curated watchlist of companies currently trading below their intrinsic worth through these 893 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ICE

Intercontinental Exchange

Provides technology and data to financial institutions, corporations, and government entities in the United States, the United Kingdom, the European Union, India, Israel, Canada, and Singapore.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.