- United States

- /

- Capital Markets

- /

- NYSE:ICE

Did ICE’s Launch of IRM 2 Transform Risk Management for Its Energy Contracts?

Reviewed by Sasha Jovanovic

- On November 17, 2025, Intercontinental Exchange, Inc. (ICE) announced the launch of IRM 2, its latest Value-at-Risk based margining methodology, now covering over 1,000 energy futures and options contracts, including benchmark products across oil, gas, power, emissions, and freight.

- This advancement integrates a sophisticated risk management model that is designed to respond to changing market conditions and provide greater transparency to clients through new analytics tools.

- We’ll explore how ICE’s introduction of the IRM 2 model for energy contracts could affect its broader investment narrative and risk management outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Intercontinental Exchange Investment Narrative Recap

To own Intercontinental Exchange, an investor needs confidence in the company's ability to innovate across electronic trading and risk management while balancing the inherent cyclicality and regulatory exposure of the energy and commodities markets. The launch of IRM 2 increases ICE’s risk management capabilities, but it does not materially influence the most immediate catalyst, expanding transaction volumes, nor does it significantly change the biggest risk tied to volatility and regulatory change in commodities trading.

Among recent company news, the October announcement of a strategic partnership with Loomis Sayles for climate risk data is particularly relevant. This partnership, paired with the IRM 2 rollout, underscores ICE’s ongoing focus on providing advanced analytics, which is central to maintaining competitiveness as market participants demand more transparency and actionable data.

On the flip side, investors should be aware that major regulatory or market structure changes in the energy sector could …

Read the full narrative on Intercontinental Exchange (it's free!)

Intercontinental Exchange's narrative projects $11.4 billion in revenue and $4.1 billion in earnings by 2028. This requires 5.7% yearly revenue growth and a $1.1 billion increase in earnings from the current $3.0 billion.

Uncover how Intercontinental Exchange's forecasts yield a $191.93 fair value, a 22% upside to its current price.

Exploring Other Perspectives

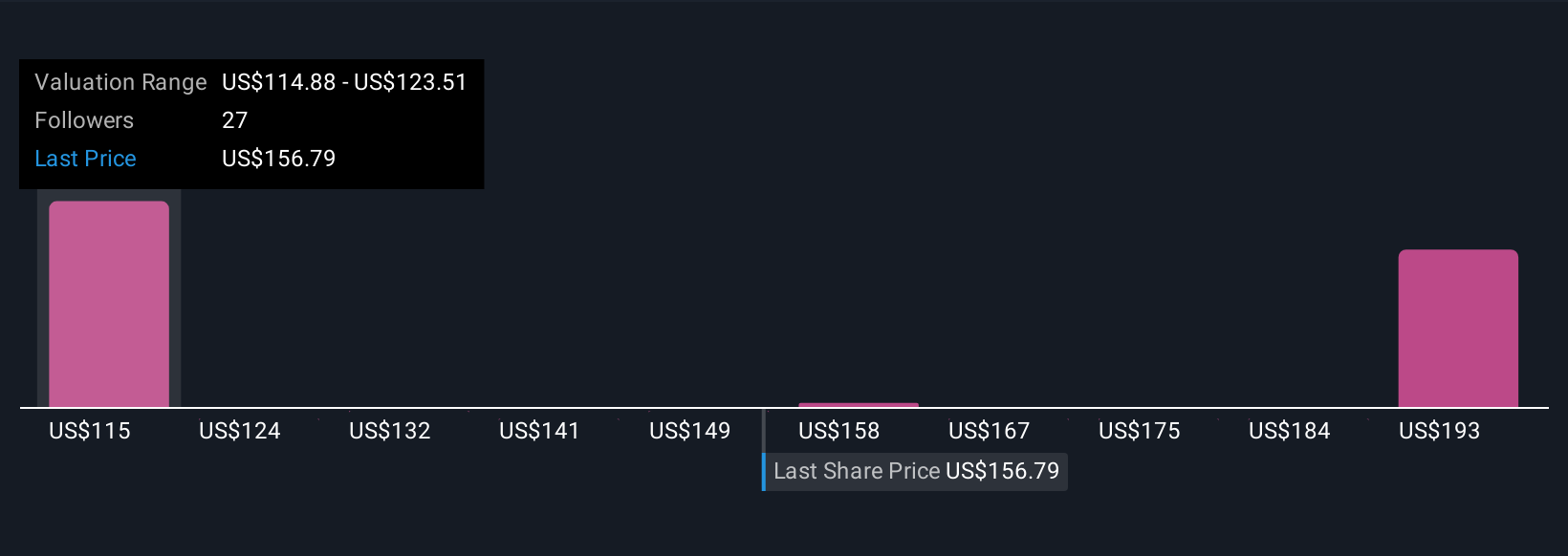

Seven members of the Simply Wall St Community see ICE’s fair value estimates ranging from US$103.45 to US$191.93 per share. These varying perspectives show just how much investor views diverge, particularly as ICE’s future still hinges on energy market cyclicality and the evolving regulatory environment.

Explore 7 other fair value estimates on Intercontinental Exchange - why the stock might be worth 34% less than the current price!

Build Your Own Intercontinental Exchange Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Intercontinental Exchange research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Intercontinental Exchange research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Intercontinental Exchange's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ICE

Intercontinental Exchange

Provides technology and data to financial institutions, corporations, and government entities in the United States, the United Kingdom, the European Union, India, Israel, Canada, and Singapore.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026