- United States

- /

- Diversified Financial

- /

- NYSE:HASI

Leadership Appointment Might Change The Case For Investing In HA Sustainable Infrastructure Capital (HASI)

Reviewed by Simply Wall St

- Earlier this week, HA Sustainable Infrastructure Capital, Inc. announced the appointment of Nitya Gopalakrishnan as Executive Vice President and Chief Operating Officer, bringing a 25-year track record from BlackRock in technology and operational leadership.

- Her experience driving major platform transformations and data strategies could accelerate HASI's efforts to scale its investment platform for future growth.

- We'll examine how Ms. Gopalakrishnan's technology and operational background could shape the company's investment narrative as it grows.

What Is HA Sustainable Infrastructure Capital's Investment Narrative?

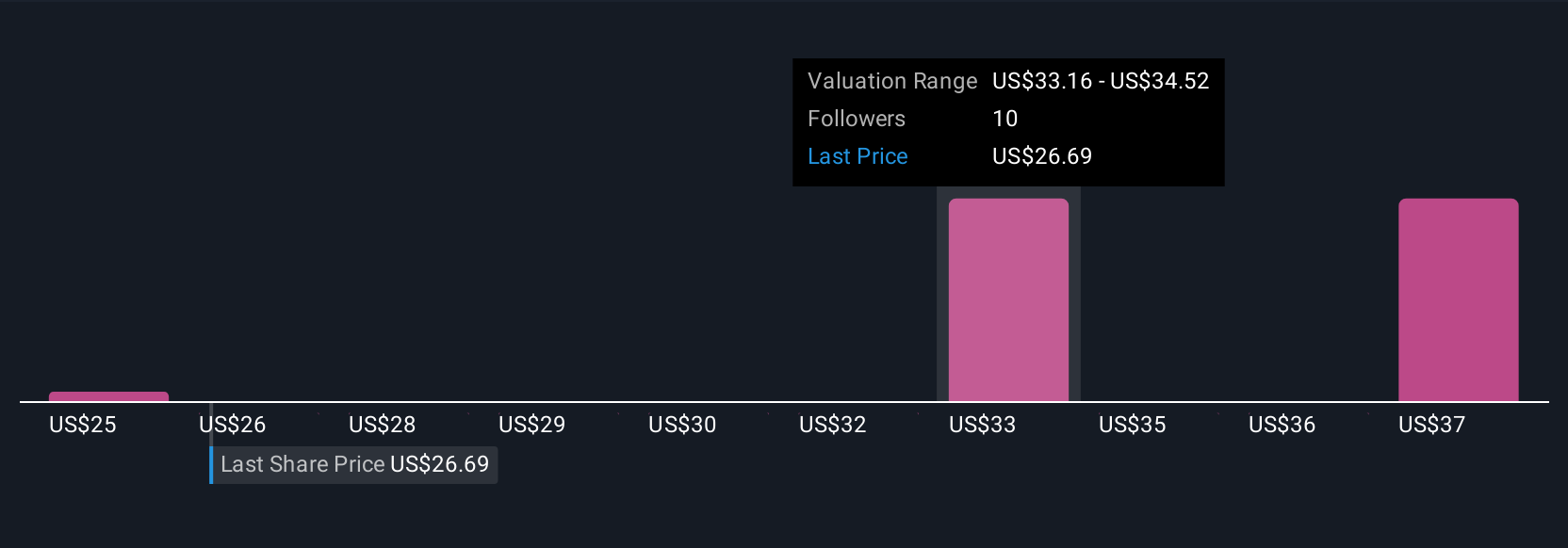

For anyone considering HA Sustainable Infrastructure Capital, it’s all about whether you believe in the company’s ability to deliver growth by investing in sustainable projects, while managing the risks of rapid expansion and capital-intensive operations. The recent hire of Nitya Gopalakrishnan as Chief Operating Officer is interesting, but with only a modest price bump following the news, it seems her appointment alone may not dramatically shift sentiment or near-term catalysts. The crucial drivers remain a higher-than-market forecast revenue growth and ongoing efforts to scale the investment platform, especially as the company works to address recent earnings declines and a high debt load. At the same time, risks such as the sustainability of the dividend and less-than-stellar coverage of debt by operating cash flow are still firmly on the radar, even with the broadened expertise at the top of the house. The real question now is whether upgraded operations and technology leadership can turn those risks into smaller potholes rather than showstoppers.

But despite optimistic signals, debt coverage remains a risk that investors should be watching closely.

Exploring Other Perspectives

Build Your Own HA Sustainable Infrastructure Capital Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your HA Sustainable Infrastructure Capital research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free HA Sustainable Infrastructure Capital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate HA Sustainable Infrastructure Capital's overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- This technology could replace computers: discover the 26 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HA Sustainable Infrastructure Capital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HASI

HA Sustainable Infrastructure Capital

Through its subsidiaries, engages in the investment in energy efficiency, renewable energy, and sustainable infrastructure markets in the United States.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives