- United States

- /

- Capital Markets

- /

- NYSE:GS

Goldman Sachs (GS) valuation after strong Q3 earnings beat and AI-driven transformation momentum

Reviewed by Simply Wall St

Goldman Sachs Group (GS) is back in the spotlight after a strong Q3 earnings beat, with double digit growth in both revenue and net income, and momentum building around its AI driven transformation.

See our latest analysis for Goldman Sachs Group.

That earnings strength is now echoing in the market, with the share price at $854.56 after a 7.75% 1 month share price return and a hefty year to date share price gain of 48.63%. A 5 year total shareholder return of 300.99% shows the long term trend has firmly been one of compounding strength, helped lately by steady fixed income issuance and the planned Innovator Capital Management acquisition, which reinforces the story.

If this kind of momentum has you thinking bigger picture, it could be a good moment to explore fast growing stocks with high insider ownership and see what other fast moving stories are building beneath the surface.

With earnings surging and the share price already above the average analyst target, the key question now is whether Goldman Sachs is still trading below its true potential, or if the market has fully priced in its next leg of growth.

Most Popular Narrative Narrative: 6.5% Overvalued

With Goldman Sachs closing at $854.56 against a narrative fair value near $802, the story centers on whether premium pricing can persist.

Record growth and momentum in Asset and Wealth Management, including strong fee based net inflows for 30 consecutive quarters and rising demand for alternative assets from high net worth and institutional clients, are shifting the revenue mix toward less volatile, high margin streams supporting higher and more durable net margins.

Want to see what is powering that margin confidence, and how future earnings, buybacks and lower capital intensity all stack into one valuation playbook?

Result: Fair Value of $802.53 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent geopolitical tensions and regulatory shifts around capital requirements could unsettle deal activity and margins, challenging the current optimism reflected in forecasts.

Find out about the key risks to this Goldman Sachs Group narrative.

Another View on Valuation

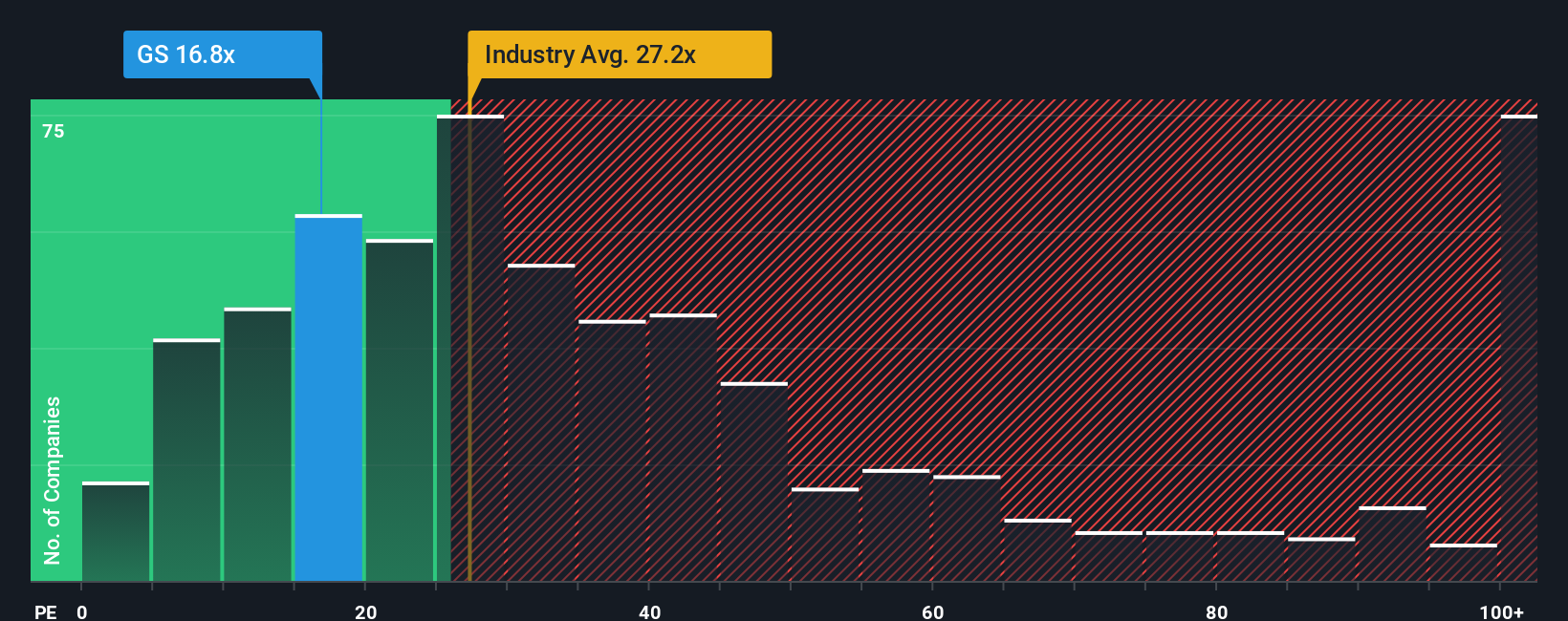

While the narrative fair value suggests Goldman Sachs is slightly overvalued, its 17x price to earnings ratio tells a softer story. That is cheaper than the US market at 18.7x, the Capital Markets industry at 24.2x, and even below a 19.1x fair ratio, which may hint at more upside than downside. Which signal do you trust?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Goldman Sachs Group Narrative

If you would rather put the numbers under your own lens and shape the story yourself in just a few minutes, Do it your way

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Goldman Sachs Group.

Looking for your next smart investment move?

Before you move on, consider scanning curated stock ideas powered by data, not hype, so your next decision can be sharper than the last.

- Review these 906 undervalued stocks based on cash flows to explore stocks that may be trading below what their cash flow strength could justify.

- Examine these 30 healthcare AI stocks at the intersection of medicine and machine intelligence that is reshaping how care is delivered.

- Follow these 81 cryptocurrency and blockchain stocks to monitor companies and assets involved in blockchain adoption and tokenization in digital finance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GS

Goldman Sachs Group

A financial institution, provides a range of financial services for corporations, financial institutions, governments, and individuals in the Americas, Europe, the Middle East, Africa, and Asia.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026