- United States

- /

- Diversified Financial

- /

- NYSE:FOUR

Is Shift4 Payments a Bargain After a 39% Slide and M&A Speculation?

Reviewed by Bailey Pemberton

- Ever wondered if Shift4 Payments could be a hidden value play or a stock whose story is already priced in? You are in the right place for the answers.

- Despite lively debate among investors, the stock has faced noticeable volatility lately. It has dropped 14.3% over the last month and is sitting nearly 39% lower year-to-date, even as its three-year return remains strongly positive.

- Much of this recent share price movement comes in the wake of sector-wide shifts impacting payments companies, as well as M&A rumors in digital transaction headlines. These factors have kept both buyers and sellers guessing about industry direction.

- Shift4's valuation score currently stands at 3 out of 6. While we will dig into how that is calculated using traditional methods, stick around for a better way to think about company value toward the end of this article.

Find out why Shift4 Payments's -34.4% return over the last year is lagging behind its peers.

Approach 1: Shift4 Payments Excess Returns Analysis

The Excess Returns valuation model estimates a company's intrinsic value by examining how much profit it generates above its cost of capital, relative to the equity investors have sunk into the business. In other words, it measures how effectively Shift4 Payments turns shareholder capital into value beyond what investors would expect for the risk they take on.

For Shift4, the key numbers paint a clear picture:

- Book Value: $10.14 per share

- Stable EPS: $3.49 per share (based on median Return on Equity from the past 5 years)

- Cost of Equity: $1.97 per share

- Excess Return: $1.51 per share

- Average Return on Equity: 15.87%

- Stable Book Value: $21.96 per share (weighted estimate from three analysts)

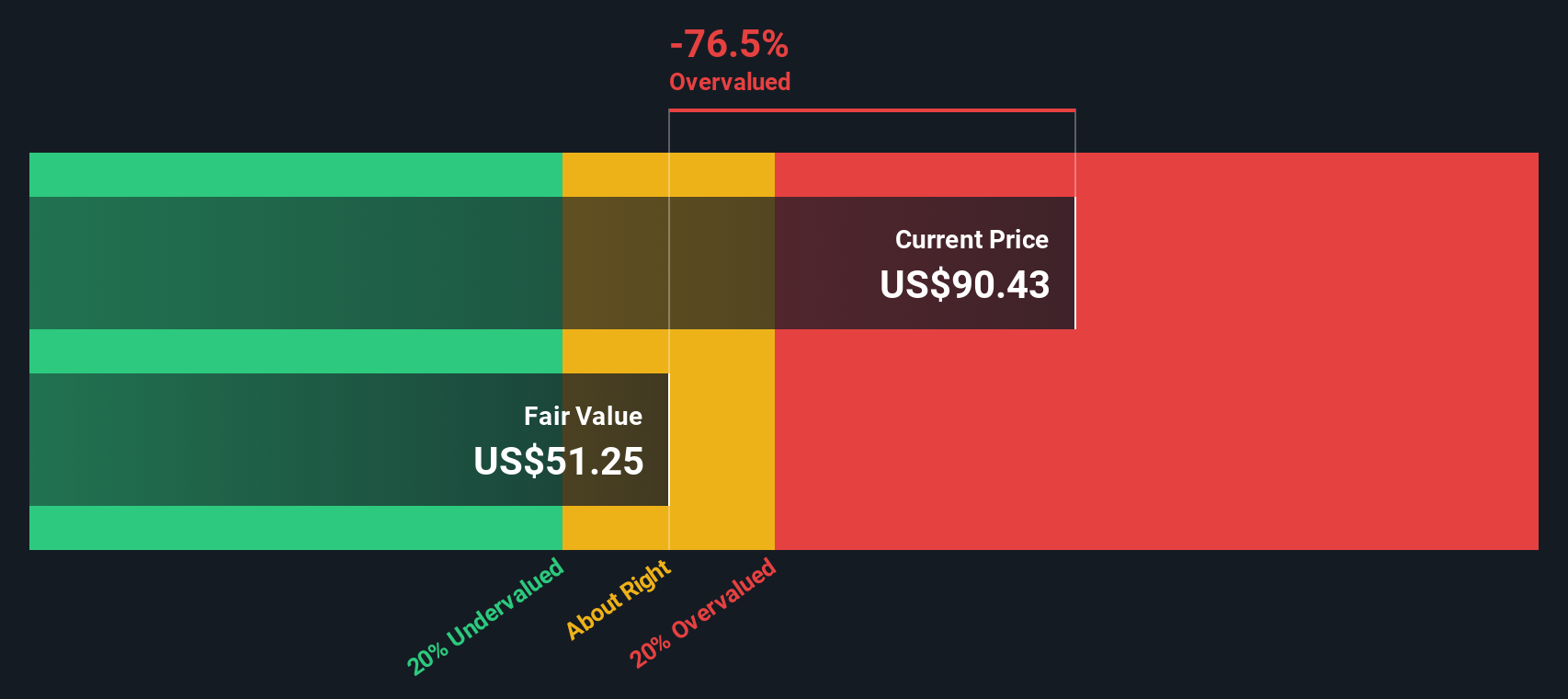

By discounting these excess returns relative to book value, the model assigns Shift4 an intrinsic value of $48.37 per share. Compared to the current share price, this suggests the stock is trading roughly 36.8 percent above where its fundamentals might justify. In short, the market has priced in substantial optimism about Shift4’s growth and profitability.

Result: OVERVALUED

Our Excess Returns analysis suggests Shift4 Payments may be overvalued by 36.8%. Discover 878 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Shift4 Payments Price vs Earnings

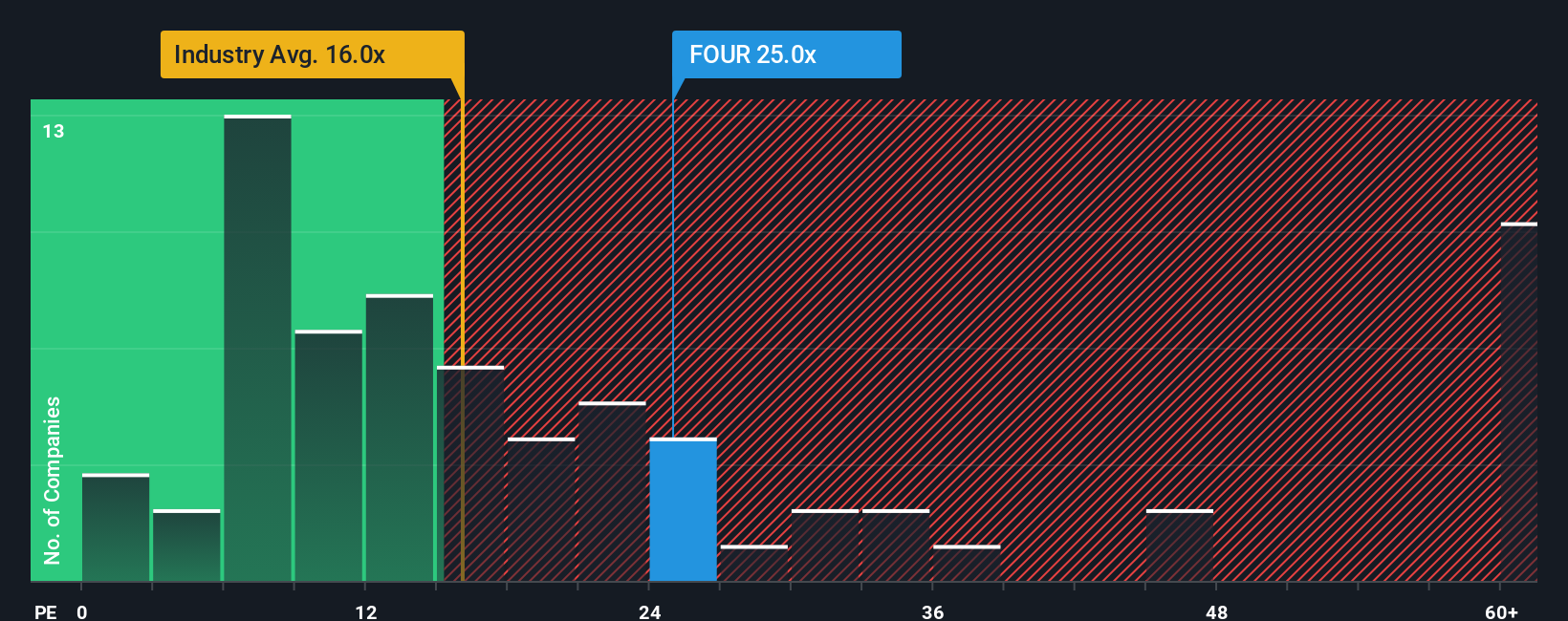

For profitable companies like Shift4 Payments, the Price-to-Earnings (PE) ratio is one of the most commonly used valuation metrics. The PE ratio offers a quick snapshot of how much investors are paying for each dollar of earnings, making it useful for comparing companies of different sizes or tracking valuation over time.

What counts as a “normal” or “fair” PE ratio can vary greatly based on expectations for future growth and perceived risk. Higher-growth firms or those with more stable earnings often warrant a higher PE, whereas companies facing more uncertainty or slower growth tend to trade at lower multiples.

Currently, Shift4 Payments trades at a PE ratio of 27.1x. That is more than double the average PE ratio for the Diversified Financial industry at 13.1x, but well below the peer group average of 62.7x. Simply Wall St’s proprietary Fair Ratio, which takes into account the company’s specific growth outlook, profit margins, position within its industry, market cap, and risks, stands at 27.8x.

Unlike simple peer or sector comparisons, the Fair Ratio gives a much more tailored perspective by blending in future estimates, profitability, and risk profile. This makes it a more reliable benchmark for what investors should reasonably expect to pay for Shift4’s earnings.

Since Shift4’s current PE multiple is nearly identical to its Fair Ratio, the shares look fairly valued on this basis.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1403 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Shift4 Payments Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your investment story for a company; it’s not just about the numbers, but also the logic and assumptions behind them. Narratives let you combine your perspective on a business’s future (such as its likely revenue growth, profit margins, and risks) with financial forecasts to reach your own fair value estimate.

Instead of just accepting static valuations, Narratives connect the company’s story and outlook directly to a fair value that updates as projections or circumstances change. On Simply Wall St’s Community page, used by millions of investors, these Narratives are easy to create, compare, and refine. Whether you are optimistic about Shift4 Payments’ international acquisitions and rapid revenue growth, or cautious about challenges like integration risk and rising competition, Narratives can help you structure your viewpoint.

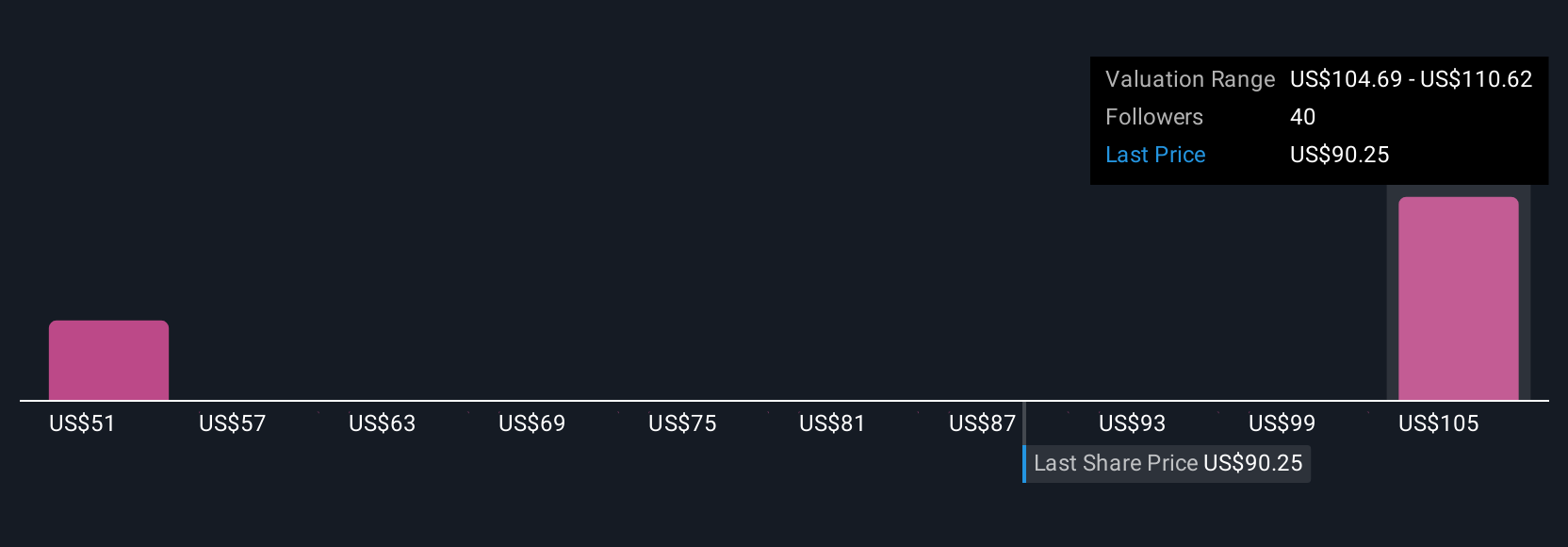

Narratives empower you to decide when to buy or sell by comparing your own Fair Value to the latest market price, and they automatically adjust as new earnings results or industry news arrive. For example, one bullish Narrative expects $863 million in earnings by 2028 and a fair value of $131 per share, while a more cautious view sees just $366.1 million with a fair value of $88. This demonstrates the dynamic range of perspectives possible.

Do you think there's more to the story for Shift4 Payments? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FOUR

Shift4 Payments

Engages in the provision of software and payment processing solutions in the United States and internationally.

Exceptional growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives