- United States

- /

- Diversified Financial

- /

- NYSE:FOUR

Does FOUR’s Growing Sports Partnerships Reflect a Sustainable Edge in Venue Payments?

Reviewed by Sasha Jovanovic

- On November 19, 2025, the Ottawa Senators announced they selected Shift4 Payments to power food and beverage concessions payments for home games at the Canadian Tire Centre, leveraging Shift4's end-to-end commerce technology.

- This partnership highlights Shift4’s expanding footprint in the sports and entertainment sector, where its integrated payment ecosystems are increasingly used to enhance fan experiences and streamline venue operations.

- We'll examine how the Ottawa Senators partnership demonstrates Shift4's traction in high-profile venues and its implications for future growth.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

Shift4 Payments Investment Narrative Recap

To be a Shift4 Payments shareholder, you need confidence in the company’s ability to scale its unified payments ecosystem across entertainment, hospitality, and retail, while successfully integrating acquisitions and managing financial leverage. The Ottawa Senators agreement extends Shift4's reach into Canadian sports venues, reinforcing its traction in high-profile environments, but this kind of partnership has only a marginal impact on the immediate catalyst for the business, which remains the successful execution and integration of large international acquisitions; this, in turn, also represents the most significant near-term risk given the complexity and financial commitments involved.

One particularly relevant recent announcement is the Cincinnati Bengals partnership from November 12, 2025, which mirrors the Ottawa Senators deal and underscores Shift4's movement into major North American sports venues. Both highlight the company's sector focus and merchant adoption, yet the underlying commercial success still hinges on integrating broader technology platforms from recent acquisitions to unlock margin expansion and cross-sell opportunities.

In contrast, investors should also be acutely aware of how increased financial leverage from acquisition-related financing could limit flexibility should market conditions change...

Read the full narrative on Shift4 Payments (it's free!)

Shift4 Payments' narrative projects $7.0 billion in revenue and $613.9 million in earnings by 2028. This requires 24.8% yearly revenue growth and a $406.2 million earnings increase from $207.7 million today.

Uncover how Shift4 Payments' forecasts yield a $95.90 fair value, a 30% upside to its current price.

Exploring Other Perspectives

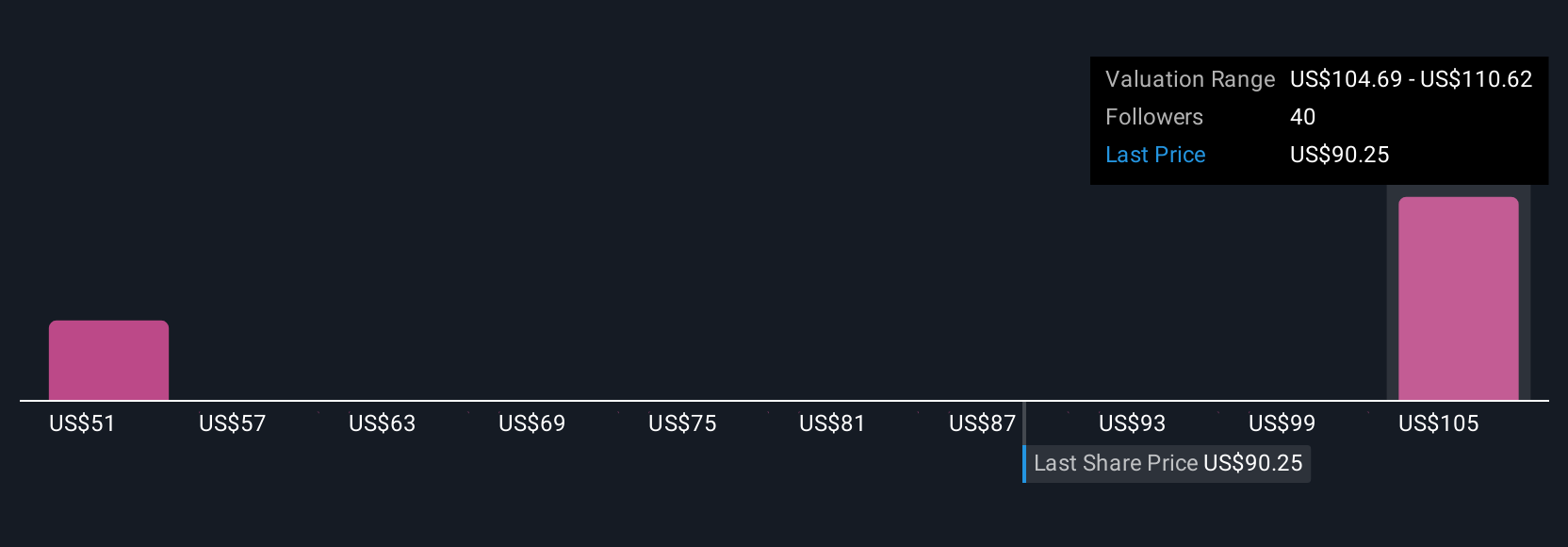

Five members of the Simply Wall St Community valued Shift4 between US$49 and US$106 per share, reflecting mixed sentiment about future performance. As you consider these wide-ranging views, remember that successfully managing integration risk from recent acquisitions could be pivotal for the company’s prospects, so perspectives differ, and it pays to explore several angles.

Explore 5 other fair value estimates on Shift4 Payments - why the stock might be worth as much as 44% more than the current price!

Build Your Own Shift4 Payments Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Shift4 Payments research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Shift4 Payments research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Shift4 Payments' overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FOUR

Shift4 Payments

Engages in the provision of software and payment processing solutions in the United States and internationally.

Exceptional growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026