- United States

- /

- Diversified Financial

- /

- NYSE:FIS

Assessing FIS Stock After a 21.9% Drop and Shifting Fintech Sentiment in 2025

Reviewed by Bailey Pemberton

- Thinking about whether Fidelity National Information Services is actually a bargain right now? You are not alone, and this question has plenty of investors curious given its recent market moves.

- Fidelity National Information Services shares have had quite a ride, dropping 7.8% in the past week and sinking 21.9% since the start of the year. This has definitely shifted the conversation about its potential and risk profile.

- Industry chatter has been growing around digital payments and the future of fintech services, especially as the sector deals with shifting demand and evolving competition. These talking points have recently colored sentiment on major payment infrastructure companies like FIS. Market observers have also flagged several strategic updates and partnerships in the fintech world that may explain some of the recent volatility.

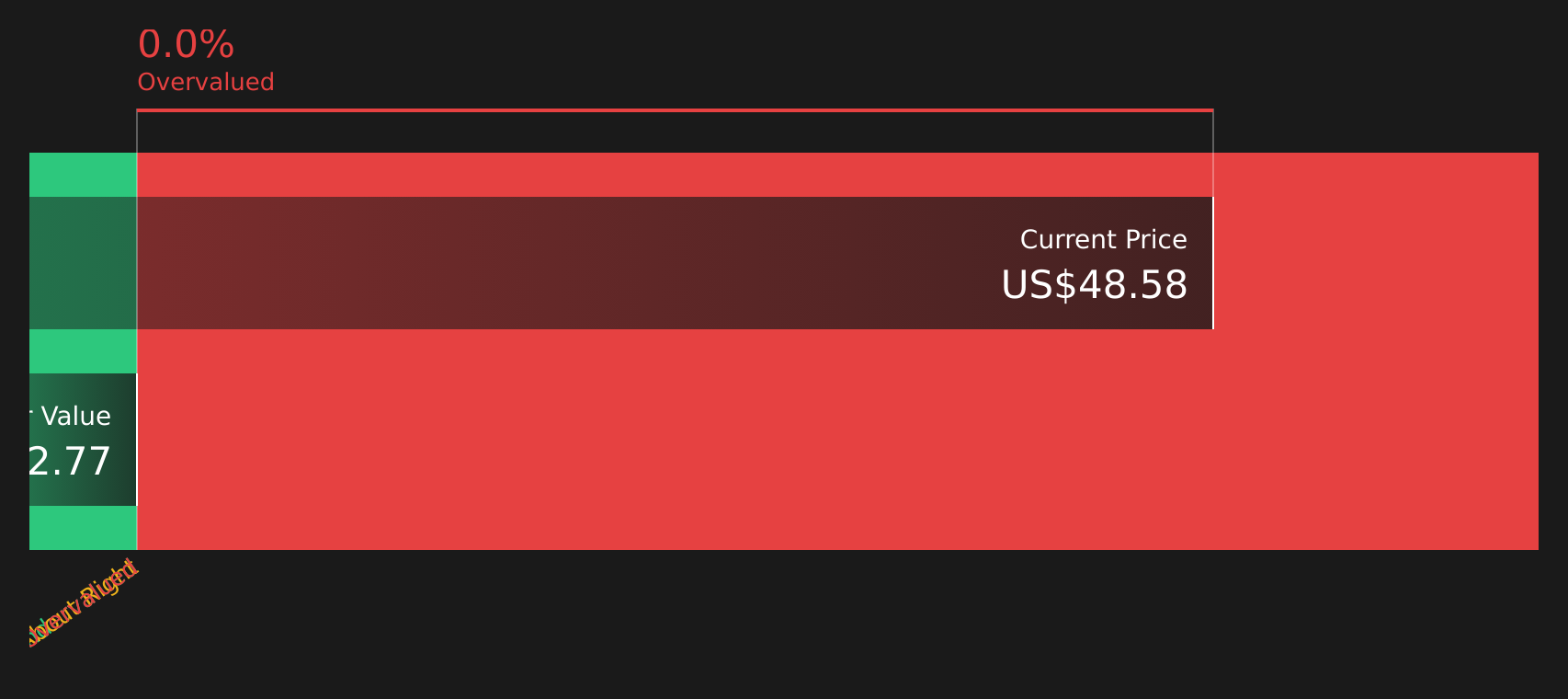

- On our valuation checks, Fidelity National Information Services scores a 3 out of 6, so there is a clear case for digging deeper into various valuation methods. We will look at all the approaches and stick around for a different angle on value that just might surprise you by the end of the article!

Approach 1: Fidelity National Information Services Excess Returns Analysis

The Excess Returns model evaluates a company by looking at how much value it creates over and above its cost of equity. In other words, it examines how profitable its investments are compared to what shareholders require as a minimum. This approach is particularly useful for financial companies, where traditional cash flow models can be challenging to apply.

For Fidelity National Information Services, the average Return on Equity stands at an impressive 21.35%, indicating strong profitability relative to its equity base. The company’s Book Value per share is $27.09, while the projected Stable Book Value is expected to slightly rise to $29.64, based on weighted future estimates from four analysts. Earnings per share are also projected to remain robust, with a Stable EPS forecast of $6.33 (based on inputs from five analysts).

After accounting for a Cost of Equity of $2.43 per share, the Excess Return generated for shareholders is $3.89 per share. This suggests that the company continues to deliver significant value above the minimum return shareholders expect.

Based on this analysis, the estimated intrinsic value points to the stock being 40.8% undervalued compared to its current market price, signaling a potentially attractive buying opportunity for investors.

Result: UNDERVALUED

Our Excess Returns analysis suggests Fidelity National Information Services is undervalued by 40.8%. Track this in your watchlist or portfolio, or discover 832 more undervalued stocks based on cash flows.

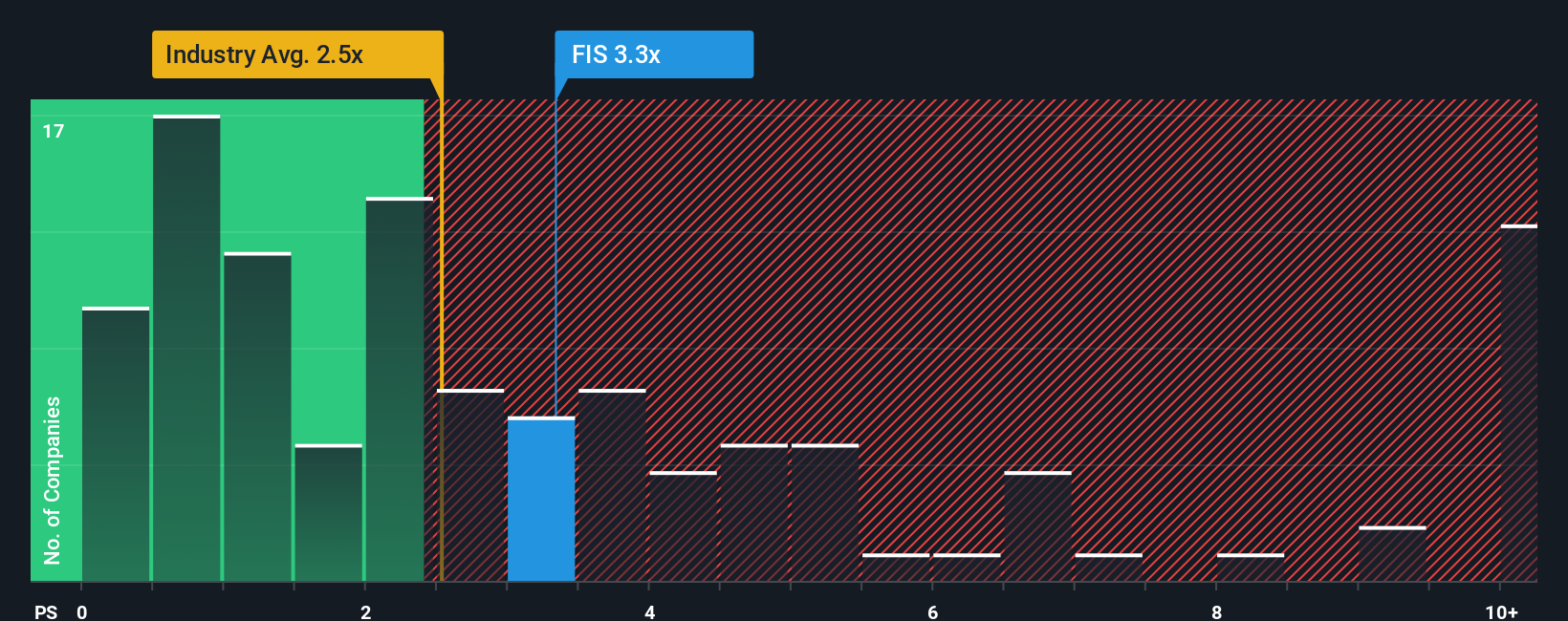

Approach 2: Fidelity National Information Services Price vs Sales

The Price-to-Sales (P/S) ratio is often a preferred valuation tool for assessing profitable companies in the diversified financial sector, particularly for firms like Fidelity National Information Services that generate significant revenue even when profits fluctuate due to investment or restructuring activity. The P/S multiple gives investors a view of how much the market is willing to pay for every dollar of the company’s sales, regardless of accounting adjustments or non-cash charges.

Traditionally, what is considered a “normal” or “fair” P/S ratio depends heavily on a company’s growth prospects, risk profile, and the broader industry conditions. Companies expected to grow sales faster than their peers can often command a premium multiple. The same applies to businesses with lower risk or more reliable revenue streams.

Currently, Fidelity National Information Services trades at a P/S ratio of 3.17x. Compared to the industry average of 2.40x and a peer group average of 2.55x, FIS appears to be priced at a premium to its competitors. However, taking a more nuanced view, Simply Wall St calculates a proprietary “Fair Ratio” of 3.12x for the stock. The Fair Ratio goes beyond simple peer or industry comparisons by considering the company’s unique mix of growth, risk, profit margins, size, and sector dynamics. This offers a more tailored benchmark for valuation.

Since Fidelity National Information Services’ current P/S multiple is extremely close to its Fair Ratio (3.17x vs 3.12x), the stock is trading at about its fair value on this metric.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

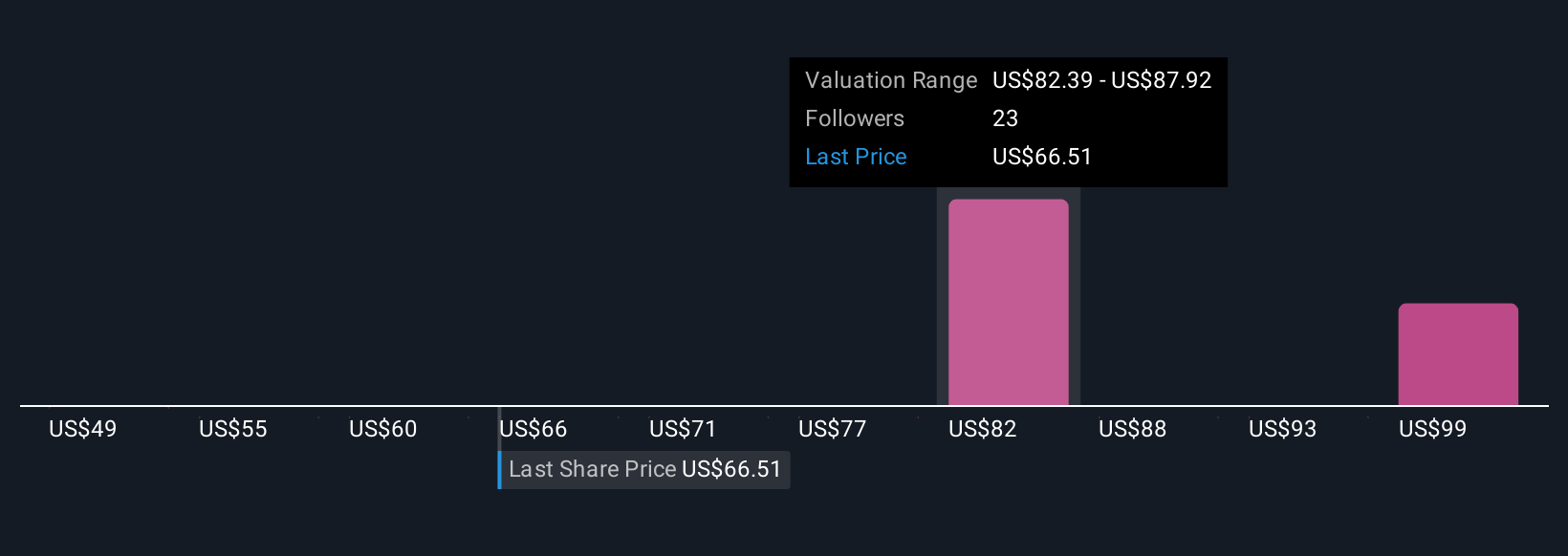

Upgrade Your Decision Making: Choose your Fidelity National Information Services Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your story about a company; it’s the rationale and outlook you bring to the table, including your own assumptions about future revenue, earnings, and margins, all linked together to estimate a fair value for the stock.

Instead of just comparing ratios or analyst targets, Narratives let you easily connect your understanding of Fidelity National Information Services’ business drivers to a financial forecast and then to a fair value, making sense of what actually matters most to you as an investor.

This approach is already widely used by millions on Simply Wall St’s platform, where Narratives are available within the Community page and update automatically with new information, such as news or company earnings releases.

With Narratives, you can quickly see whether your own fair value is above or below the current share price and decide whether to buy, hold, or sell, on your terms and with your expectations. For example, one investor might project peak industry growth and set a high fair value of $100 per share, while another may focus on fintech competition and target a more conservative $70 per share. This illustrates how different Narratives lead to different decisions.

Do you think there's more to the story for Fidelity National Information Services? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FIS

Fidelity National Information Services

Fidelity National Information Services, Inc.

Reasonable growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives