- United States

- /

- Capital Markets

- /

- NYSE:EVR

Evercore (EVR): Valuation Insights Following Strong Third Quarter Earnings and Sustained Deal Activity

Reviewed by Simply Wall St

Evercore (NYSE:EVR) delivered third quarter results that topped market expectations, with both revenue and earnings showing strong year-on-year growth. This performance was credited to steady deal activity and momentum across its business lines.

See our latest analysis for Evercore.

Evercore’s recent string of upbeat updates, ongoing share buybacks, and another dividend affirmation have played into its narrative of consistency, even as the broader sector faces swings. The share price did dip nearly 11% over the past month, but investors who’ve stuck around have still seen a 10.9% total shareholder return over the past year and a stunning 194% over three years. This suggests that long-term momentum is very much intact.

If you’re watching Evercore for signs of what’s next, this could be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

But with shares rebounding from last year's lows and trading close to price targets, investors now face a critical question: is this recent strength a sign that Evercore is undervalued, or has the market already factored in future growth?

Most Popular Narrative: 17% Undervalued

While Evercore's last close price stands at $294.56, the widely-followed narrative puts fair value significantly higher. The gap reflects strong earnings optimism and high conviction in upcoming catalysts.

The ongoing globalization of capital markets and an accelerating trend in cross-border M&A activity are providing an increasingly fertile environment for independent, conflict-free advisors like Evercore. The firm's continued expansion into key international markets, as evidenced by new offices and hiring in EMEA (France, Spain, Italy, Dubai, UK), positions it to capture an increasing share of growing advisory fee pools and drive top-line revenue over the long term.

Curious how Evercore’s push into new markets and evolving deal trends could supercharge its future valuation? The narrative’s bullish outlook is powered by projections for revenue expansion and margin uplift that might surprise even seasoned investors. See what’s fueling the upside for yourself.

Result: Fair Value of $355.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising fixed costs and increasing competition could pressure Evercore’s margins if deal volumes slow. This could potentially challenge the current bullish narrative.

Find out about the key risks to this Evercore narrative.

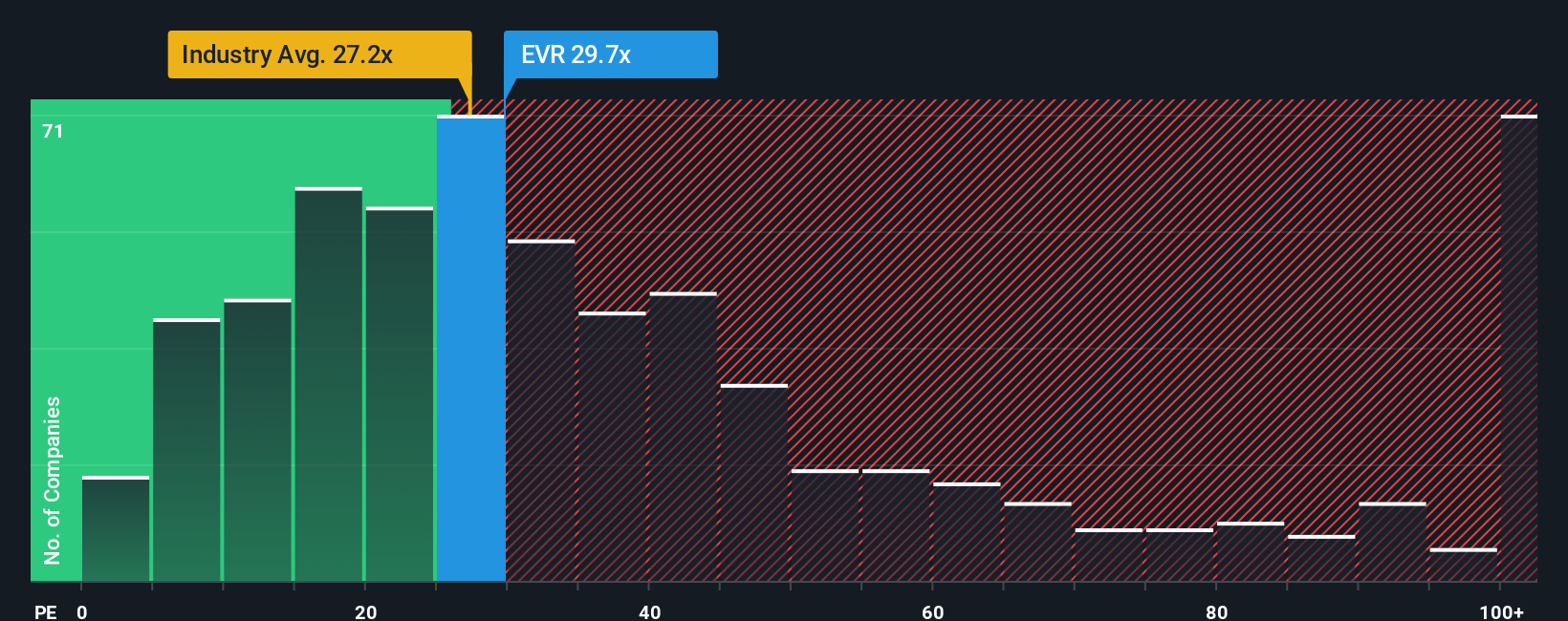

Another View: Multiples Tell a Different Story

Looking at Evercore’s valuation through the lens of earnings multiples offers a more cautious perspective. The current price-to-earnings ratio stands at 21.5x, above the fair ratio of 17.3x and higher than the peer average of 19.4x. While still below the industry average of 25.6x, this gap means investors could face downside if the market shifts closer to the fair ratio benchmark. Does this signal hidden risks to future returns?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Evercore Narrative

If the consensus views do not quite align with your thinking, you can dig into the data and craft your own perspective in just a few minutes. Do it your way

A great starting point for your Evercore research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t limit yourself to just one opportunity when there’s a world of potential waiting. With the right screeners, you could uncover tomorrow’s leaders before everyone else does.

- Tap into market trends and benefit from rapid innovation by checking out these 26 AI penny stocks that are redefining artificial intelligence in business and technology.

- Boost your portfolio’s stability and income with these 22 dividend stocks with yields > 3%, offering attractive yields that can help secure consistent returns, even in changing markets.

- Supercharge your growth potential with these 831 undervalued stocks based on cash flows, brimming with stocks poised for a turnaround and giving you a head start on value opportunities others may miss.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Evercore might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EVR

Evercore

Operates as an independent investment banking firm in the Americas, Europe, Middle East, Africa, and Asia-Pacific.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives