- United States

- /

- Capital Markets

- /

- NYSE:EVR

Evaluating Evercore Shares After Recent 7.5% Pullback and Regulatory Headlines

Reviewed by Bailey Pemberton

- Wondering if Evercore could be a bargain or if the market has already priced in its prospects? You are not alone, especially with all the noise surrounding this stock lately.

- Over the past year, Evercore shares have risen 10.8%, with an impressive 195.6% gain over three years. However, recent weeks have seen some pullback as the stock is down 7.5% in the past 7 days and 9.6% for the month.

- Much of this recent movement can be traced to broader market volatility and sector-specific news, such as renewed investor interest in financial firms and updates on proposed regulatory changes affecting advisory revenues. These headlines are stirring up both optimism and caution, making Evercore even more interesting for value-watchers.

- Currently, Evercore scores a 1 out of 6 on our undervaluation checklist, so there is definitely more story to unpack. Next, we will break down the usual valuation playbook. Be sure to read to the end of this article for a deeper way to get to the real value behind these numbers.

Evercore scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Evercore Excess Returns Analysis

The Excess Returns valuation model evaluates a company's ability to generate returns above its cost of equity. It focuses on whether equity capital could earn more elsewhere. For Evercore, this approach highlights how effectively management has allocated capital to drive value for shareholders over time.

Key figures for Evercore in this model include a Book Value of $42.88 per share and a Stable EPS of $13.54 per share, sourced from the median return on equity over the past five years. The cost of equity is estimated at $4.60 per share, with an Excess Return of $8.95 per share. Evercore has maintained an average Return on Equity of 24.18%, signaling outsized profitability compared to peers. The Stable Book Value is projected at $56.01 per share, a figure aggregated from future projections by two analysts.

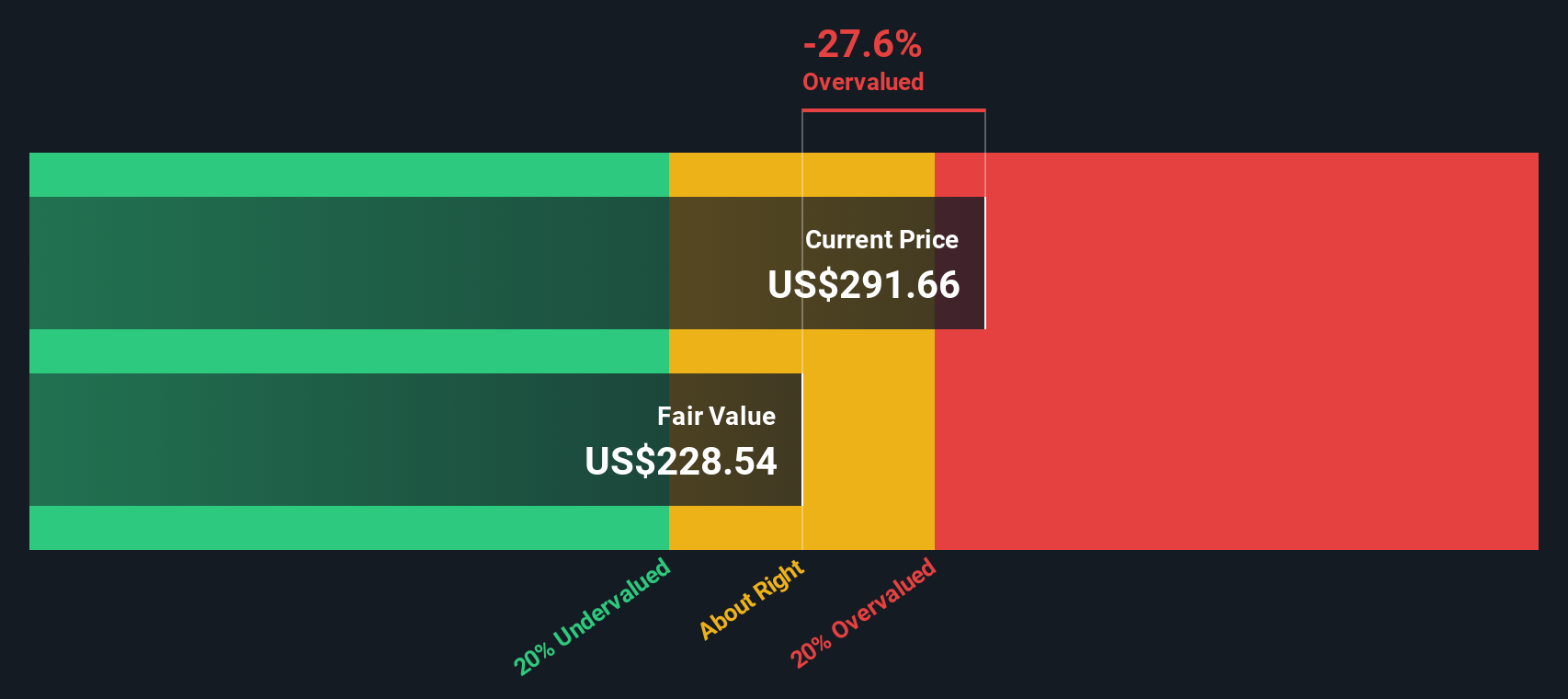

Based on these inputs, the Excess Returns model estimates Evercore's intrinsic value at $230.45 per share. However, as this represents a 29.1% premium above the current share price, the findings suggest that the stock is overvalued by this method.

Result: OVERVALUED

Our Excess Returns analysis suggests Evercore may be overvalued by 29.1%. Discover 844 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Evercore Price vs Earnings

The Price-to-Earnings (PE) multiple is a widely used metric for valuing profitable companies like Evercore because it quickly relates a company's share price to its earnings. It is especially useful for established firms in the financial sector, helping investors assess if the stock price fairly reflects the company’s ability to generate profits.

It's important to note that what counts as a “normal” or “fair” PE ratio can vary based on growth expectations and risk. Companies with stronger earnings growth or lower perceived risk often command higher PE multiples. Conversely, slower-growing or riskier firms typically trade at lower multiples.

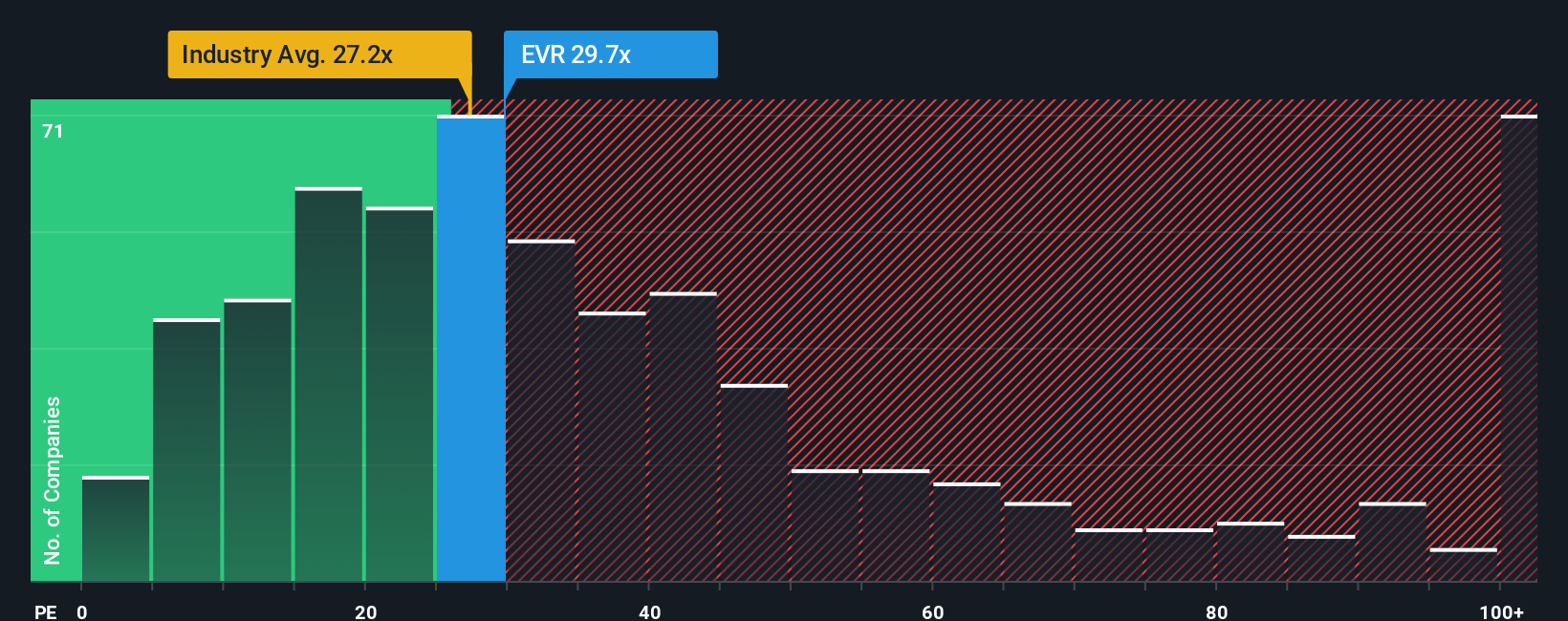

Evercore currently trades at a PE multiple of 21.7x. This compares to a peer average of 19.1x and an industry average of 24.3x in the Capital Markets sector. Simply Wall St's proprietary Fair Ratio for Evercore is 16.8x. Unlike a simple industry or peer comparison, the Fair Ratio factors in Evercore’s unique earnings growth prospects, risk profile, profit margins, industry, and market cap. This holistic approach gives a more customized assessment of where the stock should trade based on its fundamentals.

Since Evercore's current PE is noticeably higher than its Fair Ratio, the multiple suggests the stock is slightly overpriced relative to expectations based on its specific qualities.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1409 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Evercore Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your view of Evercore's story translated into numbers and forecasts. This involves combining facts about the business, your assumptions about future revenue, profit margins, and fair value, along with the reasons behind them. Narratives allow you to connect what you believe will drive Evercore's future (like dealmaking cycles, global expansion, or risks from competition) directly to a financial forecast and ultimately a price you think is fair for the stock.

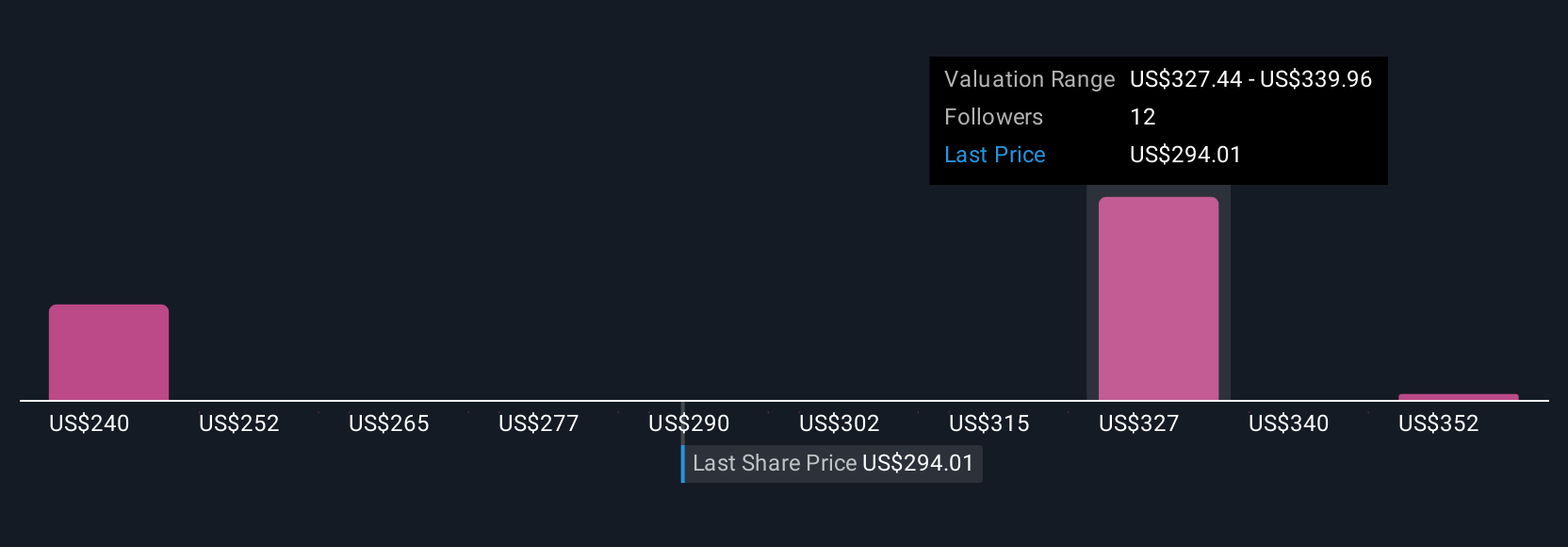

This approach isn’t reserved for the pros. It’s accessible to anyone, and you can start building or reviewing Narratives right from the Community page on Simply Wall St, where millions of investors share their perspectives. Narratives make it easy to decide when to buy or sell by showing the gap between your Fair Value and current share price. Even better, they update instantly as new news or earnings shift the story, giving you a dynamic edge. For example, some Evercore investors believe ongoing global growth and M&A trends justify a high valuation near the $364 price target if revenue accelerates and margins expand. In contrast, cautious Narrative creators highlight the risks from rising costs and cyclical deal volumes, estimating fair value closer to $325 in the current environment.

Do you think there's more to the story for Evercore? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Evercore might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EVR

Evercore

Operates as an independent investment banking firm in the Americas, Europe, Middle East, Africa, and Asia-Pacific.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives