- United States

- /

- Diversified Financial

- /

- NYSE:ESNT

Is Essent Group’s Recent Surge Backed by Strong Valuation Metrics in 2025?

Reviewed by Bailey Pemberton

- Wondering if Essent Group is currently a smart buy? You are not alone, especially with so much chatter about its valuation and long-term potential.

- The stock has climbed 17.8% over the past year and is up 13.6% year-to-date. This signals changing market sentiment and perhaps renewed optimism among investors.

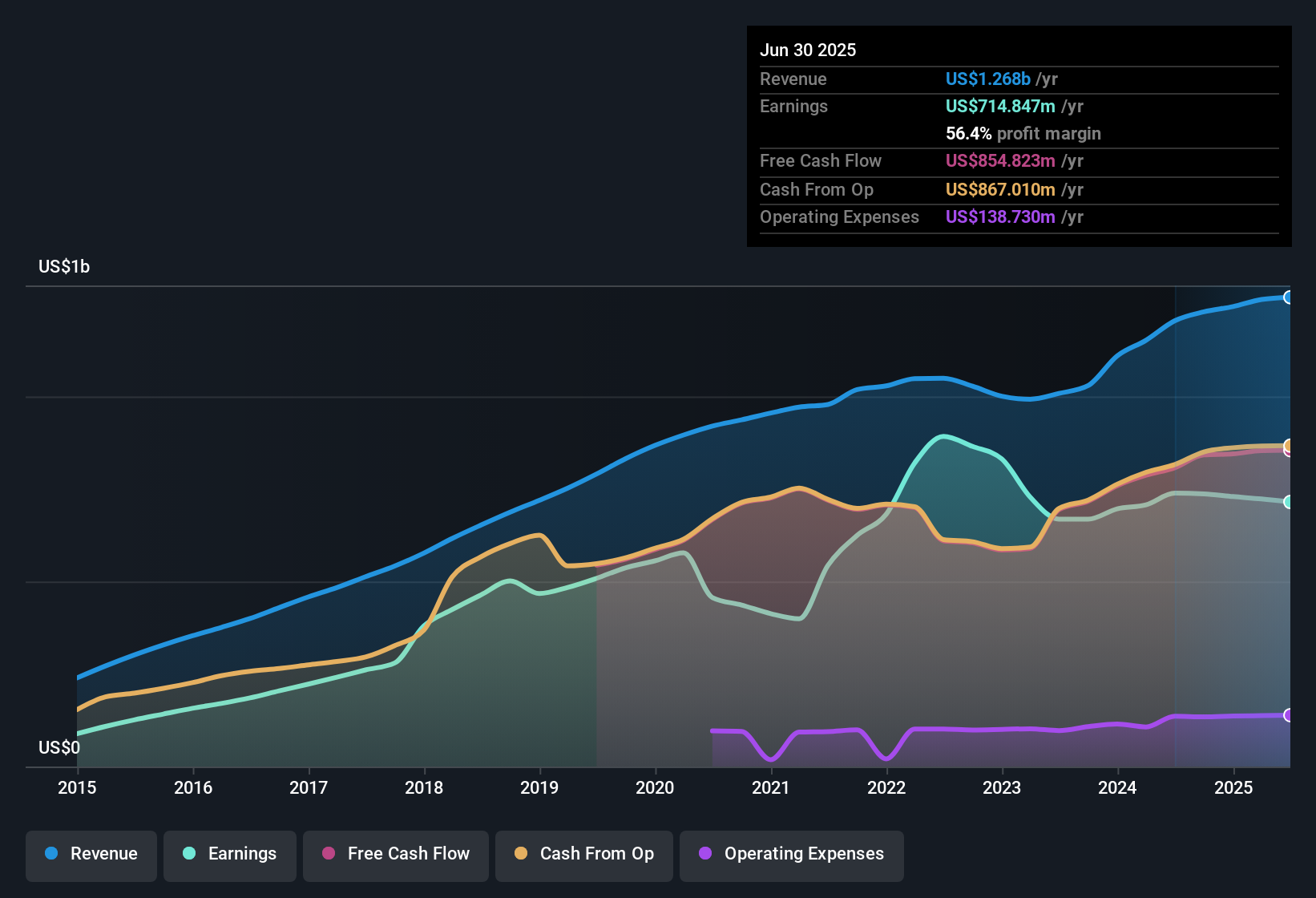

- Recent headlines have highlighted Essent Group's strategic expansion efforts and strong operating performance. These factors have fueled both investor curiosity and notable price gains. These developments are seen as confidence boosters for the company's growth outlook and add helpful context for understanding the recent momentum.

- Essent Group currently scores 5 out of 6 on our undervaluation checks, suggesting it might present compelling value. Let’s dig into how the numbers stack up across traditional valuation approaches, and stay tuned until the end for an even better way to cut through the noise.

Approach 1: Essent Group Excess Returns Analysis

The Excess Returns model evaluates a company’s ability to generate profits above its cost of equity. In other words, it measures how efficiently a company uses shareholder capital to create value. Rather than simply considering profits, this approach assesses whether those profits exceed the minimum return expected by investors.

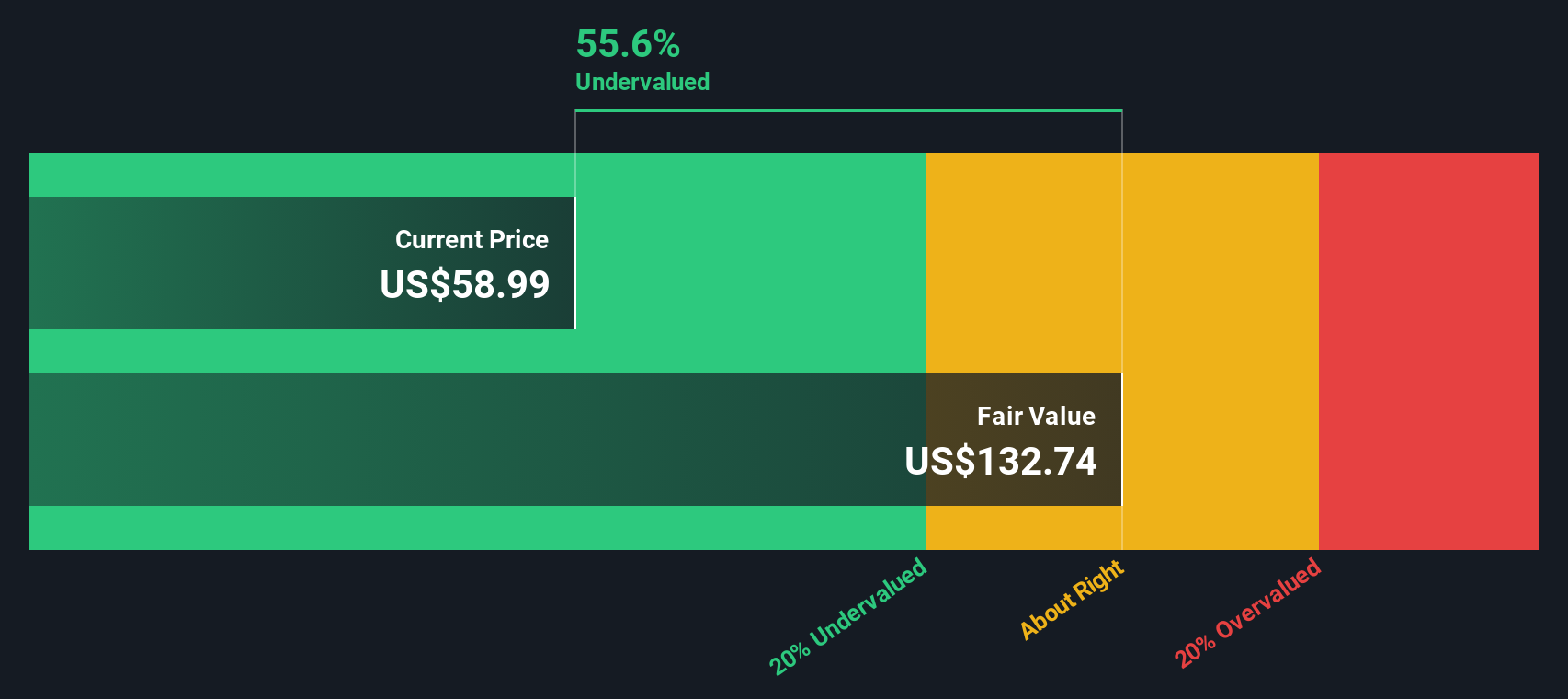

For Essent Group, the data points are impressive. The company’s current book value stands at $56.98 per share and analysts forecast a stable earnings-per-share (EPS) of $7.97, based on weighted return on equity estimates from five analysts. The cost of equity is set at $4.90 per share, giving Essent Group an excess return of $3.07 per share. This indicates the company is generating profit above its cost of capital, which is a positive sign for long-term value creation. The average future return on equity is projected at 11.92%, and the stable book value per share is estimated to reach $66.91, as supported by three analysts.

Based on these excess returns, the intrinsic value indicates the stock is 55.5% undervalued compared to where it's trading now. This analysis points to strong capital efficiency and suggests the market is not fully recognizing Essent Group’s profit potential.

Result: UNDERVALUED

Our Excess Returns analysis suggests Essent Group is undervalued by 55.5%. Track this in your watchlist or portfolio, or discover 840 more undervalued stocks based on cash flows.

Approach 2: Essent Group Price vs Earnings

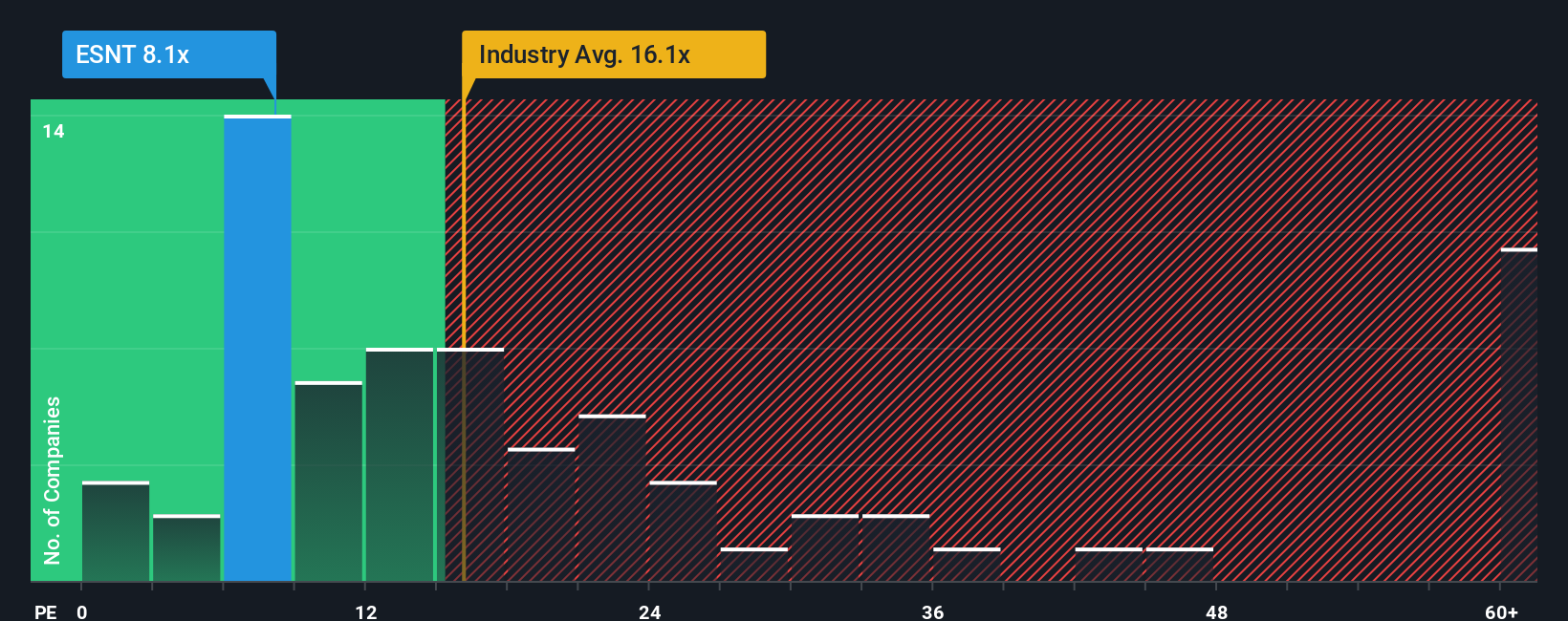

The Price-to-Earnings (PE) ratio is one of the most widely followed valuation multiples for profitable companies like Essent Group. It makes sense here because the company has consistent positive earnings, making the PE a meaningful way to compare its valuation with peers and broader industry benchmarks.

It's important to remember that what counts as a "fair" PE ratio can shift based on growth expectations, profitability, and risk. Generally, companies expected to grow faster or with lower risk deserve a higher PE, while those with more uncertainty or lower growth trends typically trade at lower multiples.

Currently, Essent Group trades at a PE ratio of 8.5x. This is comfortably below the Diversified Financial industry average of 14.8x and the average of its peers at 9.3x. On face value, these comparisons suggest Essent Group might be undervalued based on the market's typical approach.

But instead of only comparing to peers or the industry, it is useful to consider the "Fair Ratio." This is a calculation unique to Simply Wall St that factors in growth prospects, risks, profit margins, industry characteristics, and market capitalization. With all these elements in balance, the Fair Ratio for Essent Group stands at 11.3x. This tailored benchmark is more useful than simple industry comparisons because it is customized to the company’s current and projected fundamentals.

Essent Group’s actual PE ratio is notably lower than its Fair Ratio, suggesting the stock could be undervalued on this basis and may offer an attractive entry opportunity for value-minded investors.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Essent Group Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story or perspective on a company’s future; it is how you connect the dots between qualitative factors, such as business model or industry trends, and the concrete numbers that drive fair value, like estimated revenues, margins, and growth rates. Narratives on Simply Wall St’s Community page make this process easy and accessible for millions of investors, allowing anyone to link the company’s latest news, strategy, or risks directly to their own financial forecasts. By building a Narrative, you can see how changes in forecasts impact fair value, and then quickly compare it to the current share price for a clearer buy or sell decision. Narratives automatically update as new information comes in, keeping your investment thesis dynamic over time. For example, with Essent Group, one investor might build a bullish Narrative based on analyst assumptions highlighting growth and strong capital management, targeting a fair value as high as $70, while a more cautious investor might focus on regulatory and market risks, landing at just $59. Narratives put you in control, letting you visualize and act on your investment story in real time.

Do you think there's more to the story for Essent Group? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Essent Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ESNT

Essent Group

Through its subsidiaries, provides private mortgage insurance and reinsurance for mortgages secured by residential properties located in the United States.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives