- United States

- /

- Mortgage REITs

- /

- NYSE:DX

Dynex Capital (DX): Evaluating Valuation As Shares Gain Momentum

Reviewed by Simply Wall St

See our latest analysis for Dynex Capital.

Dynex Capital’s 1-year total shareholder return of nearly 30% signals a strong run and has outpaced its steady share price climb in recent months. The momentum appears to be building, with gains accelerating as sentiment toward mortgage REITs has brightened.

If you’re tracking where market momentum could lead next, consider broadening your outlook with a search for fast growing stocks with high insider ownership.

With shares gaining steam and an impressive annual return on the books, the key question now is whether Dynex Capital is still trading at an attractive value, or if the market has already priced in the next stage of growth.

Price-to-Earnings of 11.6x: Is it justified?

Dynex Capital’s price-to-earnings (P/E) ratio of 11.6 times earnings is below both the broader US market and its mortgage REIT industry peers, placing the stock in attractive territory for value-focused investors.

The price-to-earnings ratio measures how much investors are willing to pay today for a dollar of the company’s earnings. It is an industry standard for REITs and helps gauge whether Dynex Capital’s market price properly reflects its earnings prospects and risk profile.

This multiple suggests the market may be underestimating Dynex Capital’s recent surge in earnings growth, especially compared to peers. The stock trades below the US market average of 18.7x and is also lower than the industry average (12.9x) and peer average (13.6x). When compared to an estimated fair price-to-earnings ratio of 15.5x, the current level could indicate possible upward re-rating if growth trends continue.

Explore the SWS fair ratio for Dynex Capital

Result: Price-to-Earnings of 11.6x (UNDERVALUED)

However, potential risks such as shifts in interest rates or changes in government policy could quickly alter Dynex Capital’s current positive trajectory.

Find out about the key risks to this Dynex Capital narrative.

Another View: Discounted Cash Flow Shows a Different Picture

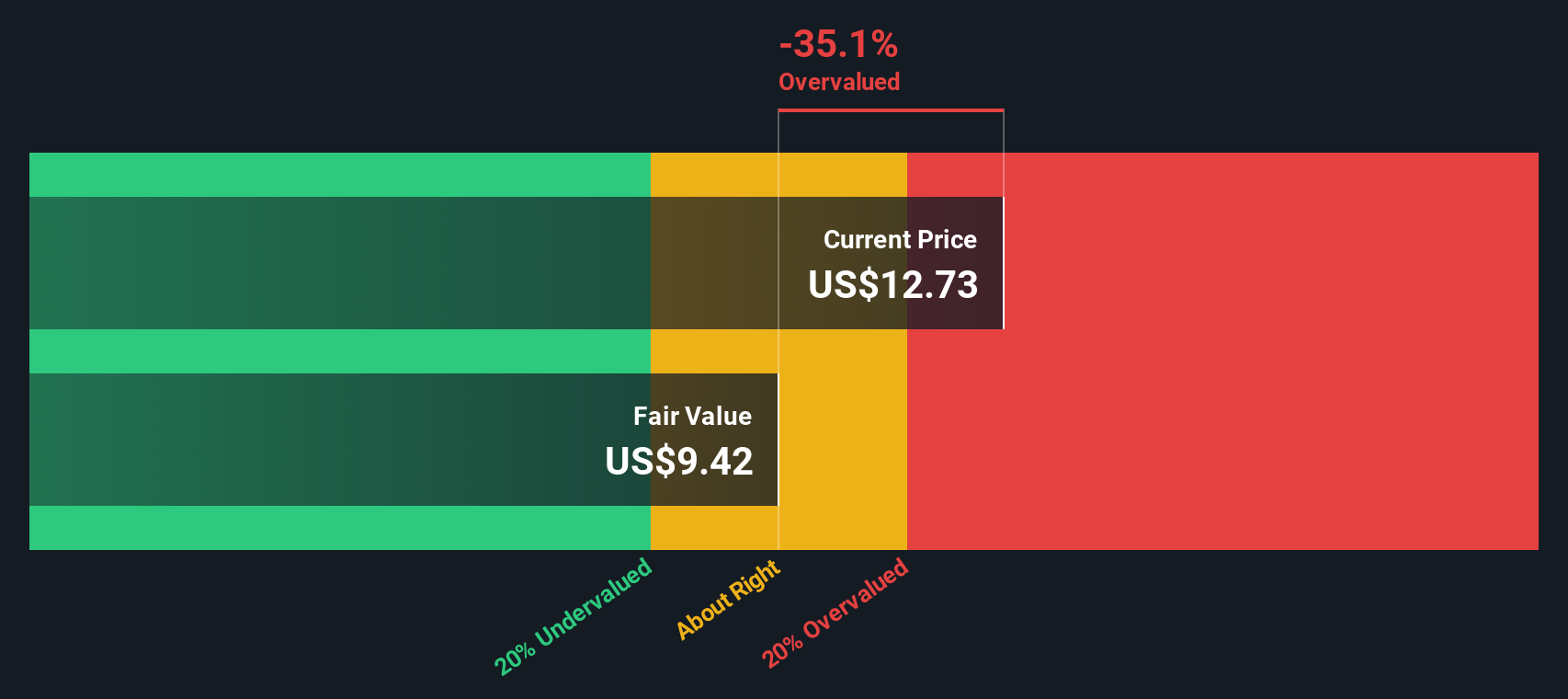

While the price-to-earnings ratio puts Dynex Capital in a favorable light, our DCF model tells a different story. According to the SWS DCF model, Dynex is trading above its estimated fair value of $9.08, which makes the current price appear overvalued. This highlights a key risk: expectations could be running too far ahead of the fundamentals.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Dynex Capital for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 929 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Dynex Capital Narrative

If you see the numbers differently or want to dig into the details yourself, there is an easy way to build your own narrative in just a few minutes: Do it your way.

A great starting point for your Dynex Capital research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors look beyond a single stock and expand their research horizons by finding fresh opportunities before the crowd using the powerful Simply Wall Street Screener.

- Spot high yields and steady cash flow, and take advantage of these 14 dividend stocks with yields > 3% that consistently offer strong returns for income-focused portfolios.

- Jump ahead on breakthrough technology trends by checking out these 25 AI penny stocks that are redefining entire industries with artificial intelligence.

- Start growing your next big win with these 929 undervalued stocks based on cash flows priced with room to run, giving you an edge in undervalued markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DX

Dynex Capital

A mortgage real estate investment trust, invests in mortgage-backed securities (MBS) in the United States.

High growth potential with proven track record.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026