- United States

- /

- Capital Markets

- /

- NYSE:DFIN

Donnelley Financial Solutions (DFIN) Is Down 6.6% After ActiveDisclosure Retention Slips And Competition Intensifies – Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- Donnelley Financial Solutions recently reported weakening gross and net retention, with its flagship ActiveDisclosure software showing slower annual recurring revenue growth amid intensifying competition.

- The fading benefit from earlier regulatory tailwinds and rising pressure from rivals such as Workiva raise fresh questions about DFIN’s ability to shift more of its business to higher-margin software.

- Next, we’ll consider how deteriorating retention for ActiveDisclosure may alter Donnelley Financial Solutions’ previously optimistic investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Donnelley Financial Solutions Investment Narrative Recap

To own Donnelley Financial Solutions, you need to believe it can successfully pivot from print-heavy services to a resilient, higher-margin software business. The recent deterioration in ActiveDisclosure retention and slowing ARR growth directly challenges that near term catalyst, while intensifying competition and weaker pricing power now look like the most immediate risk to the story.

The launch of Active Intelligence, an AI capabilities suite initially embedded in ActiveDisclosure, is particularly relevant here. It speaks to DFIN’s effort to deepen product value and stickiness at the same time that retention is weakening, and could become an important test of whether the company can reinvigorate software growth and defend share against rivals like Workiva.

Yet, beneath the surface, rising churn and softer pricing in ActiveDisclosure are signals investors should be aware of as they weigh...

Read the full narrative on Donnelley Financial Solutions (it's free!)

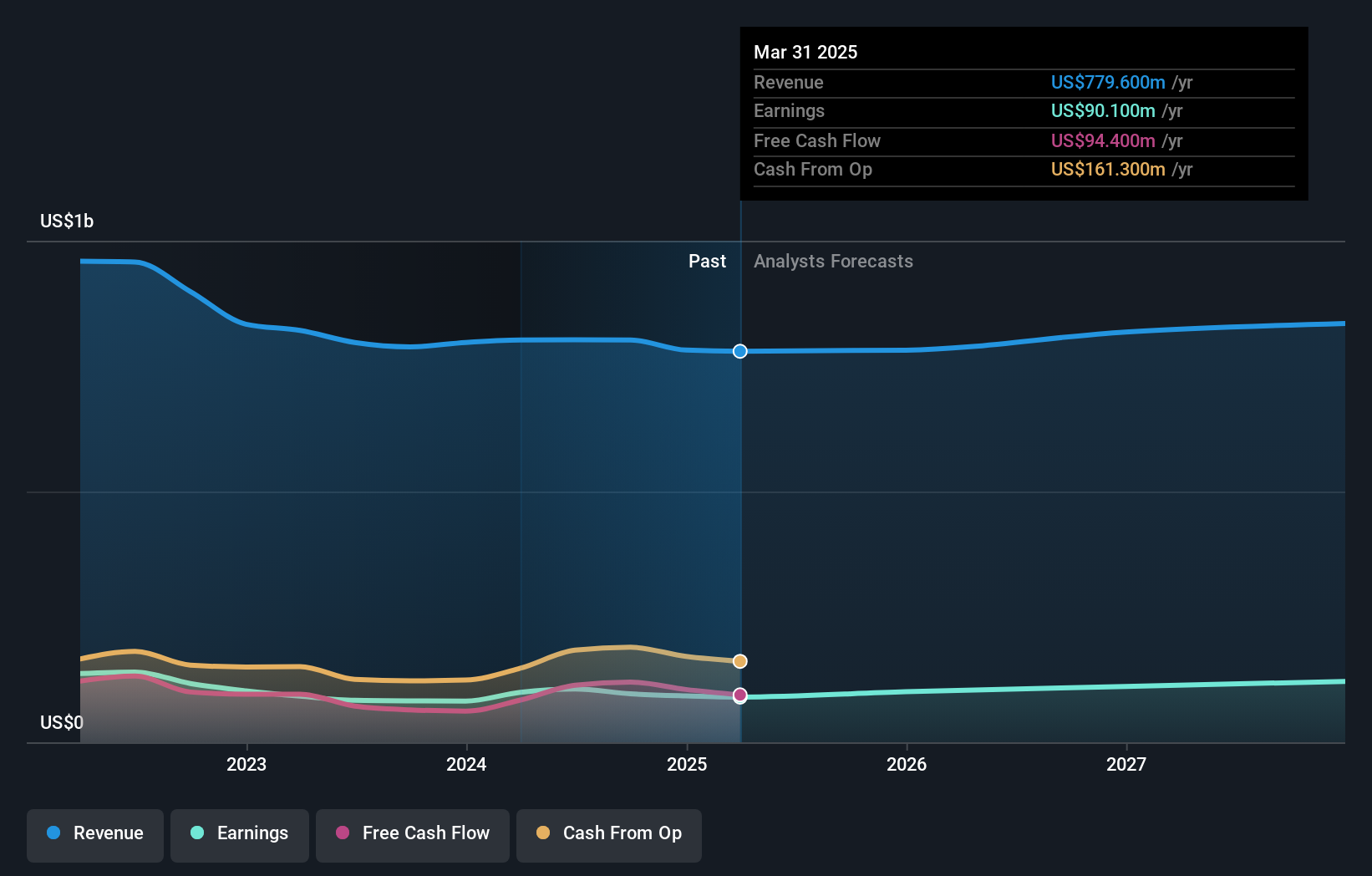

Donnelley Financial Solutions' narrative projects $830.2 million revenue and $127.7 million earnings by 2028. This requires 3.2% yearly revenue growth and about a $45.6 million earnings increase from $82.1 million today.

Uncover how Donnelley Financial Solutions' forecasts yield a $64.33 fair value, a 40% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members see fair value for DFIN clustered between US$57.16 and US$64.33 across 2 independent views, illustrating how far opinions can diverge. You can weigh those against the recent signs of weakening software retention and consider what that might mean for the pace of DFIN’s business mix shift.

Explore 2 other fair value estimates on Donnelley Financial Solutions - why the stock might be worth just $57.16!

Build Your Own Donnelley Financial Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Donnelley Financial Solutions research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Donnelley Financial Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Donnelley Financial Solutions' overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DFIN

Donnelley Financial Solutions

Provides innovative software and technology-enabled financial regulatory and compliance solutions in the United States, Asia, Europe, Canada, and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026