- United States

- /

- Capital Markets

- /

- NYSE:DFIN

A Fresh Look at Donnelley Financial Solutions (DFIN) Valuation After Launch of New AI Suite

Reviewed by Simply Wall St

Donnelley Financial Solutions (DFIN) just launched Active Intelligence, a new suite of AI-powered tools integrated into its software platform. The update aims to help clients streamline regulatory and compliance tasks, particularly with SEC filings.

See our latest analysis for Donnelley Financial Solutions.

DFIN’s new AI-driven tools arrive after a year of mixed momentum. The stock’s 7-day share price return has jumped 8.2% following the announcement, but longer-term share price returns remain in the red year-to-date. Still, Donnelley’s impressive 5-year total shareholder return of nearly 200% points to significant long-term value creation for investors.

If news of DFIN’s technology push has you wondering what else could offer outsize growth, now’s your chance to discover fast growing stocks with high insider ownership

With shares still trading at a notable discount to analyst targets after recent gains, the question for investors is clear: Is DFIN undervalued and positioned for future upside, or has the market already priced in the growth potential?

Most Popular Narrative: 24.4% Undervalued

Compared to Donnelley Financial Solutions’ last closing price of $48.61, the most followed narrative considers fair value to be $64.33. This represents a notable premium that has caught many investors’ attention ahead of upcoming earnings catalysts.

The ongoing global increase in regulatory complexity, such as the recent Tailored Shareholder Reports (TSR) regulation and persistent, evolving ESG and financial disclosure demands, is driving continued adoption of compliance software (for example, Arc Suite and ActiveDisclosure). This is expected to boost recurring revenue and expand margins as compliance shifts from print to software-based solutions.

Want to know what makes this price target tick? There is a bold call hidden in the growth rate and margin boost forecasted in this narrative. Everything hinges on how fast recurring revenues and profits accelerate. Which assumptions are fueling this gap? Find out where expectations may surprise the market.

Result: Fair Value of $64.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if there is slowing growth in key software products or a prolonged downturn in capital markets activity, the outlook could shift quickly and challenge current assumptions.

Find out about the key risks to this Donnelley Financial Solutions narrative.

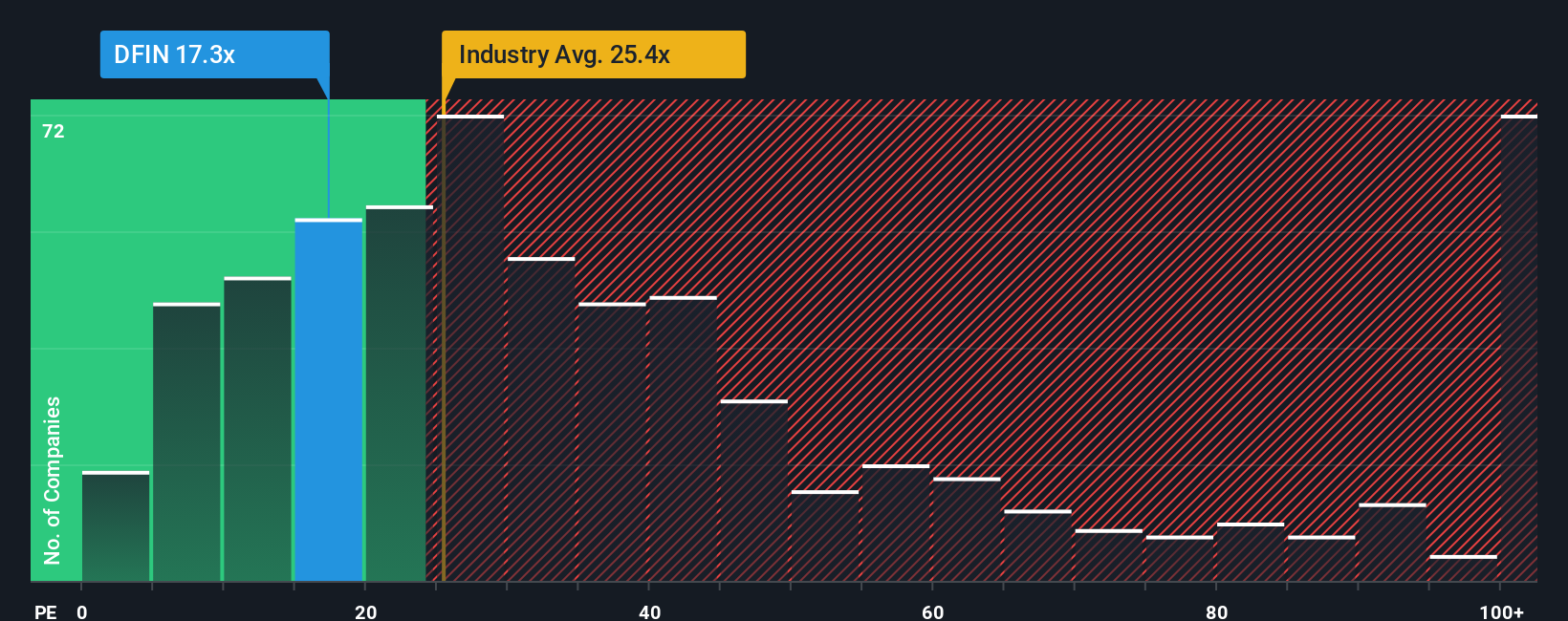

Another View: Valuation by Earnings Ratios

While many see upside based on future growth projections, a look at current earnings multiples presents a different perspective. DFIN is currently trading at a price-to-earnings ratio of 39.7x, which is more than double the average for its peers at 18x and above its fair ratio estimate of 27.2x. This may indicate that the market is expecting rapid improvement and raises the question of whether those forecasts will be realized.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Donnelley Financial Solutions Narrative

If you see things differently or want to dive deeper into the numbers yourself, you can craft your own take in just a few minutes. Do it your way

A great starting point for your Donnelley Financial Solutions research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for Your Next Investing Move?

Smart investors do not just stop at one opportunity. Open new doors and spot winning trends before the crowd by using the Simply Wall Street Screener to sharpen your investing edge.

- Supercharge your portfolio with the growth potential of these 25 AI penny stocks as these stocks capitalize on the surge in artificial intelligence advancements and real-world applications.

- Maximize yield and cash flow with these 15 dividend stocks with yields > 3%. This tool helps users find steady income opportunities by identifying stocks offering reliable payouts above 3%.

- Seize value before the market does by acting quickly with these 928 undervalued stocks based on cash flows, which highlights stocks trading below their intrinsic worth based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DFIN

Donnelley Financial Solutions

Provides innovative software and technology-enabled financial regulatory and compliance solutions in the United States, Asia, Europe, Canada, and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success