- United States

- /

- Consumer Finance

- /

- NYSE:COF

Capital One (COF): Assessing Valuation Following Strong Long-Term Shareholder Returns

Reviewed by Simply Wall St

Capital One Financial (COF) shares have seen modest movements recently, leaving some investors wondering how the stock's valuation stacks up after a long run higher over the past year. The company continues to operate across credit cards, consumer, and commercial banking segments in the US.

See our latest analysis for Capital One Financial.

Capital One Financial’s share price has steadily clawed back momentum following some recent volatility, with a year-to-date price return of 23.31%. When you look at the longer view, the company’s 1-year total shareholder return stands at an impressive 19.02%, and its five-year total shareholder return has soared 159.29%. This indicates that long-term holders have been handsomely rewarded even as short-term sentiment ebbs and flows. The current share price of $220.37 reflects renewed optimism in the company’s growth outlook, suggesting investors are finding reasons to stay confident in its ability to navigate both economic cycles and sector shifts.

If this kind of steady long-term outperformance has you interested in what other opportunities are out there, it’s a great moment to broaden your search and discover fast growing stocks with high insider ownership

But with shares not far below their all-time highs and signs of strong business growth, the critical question remains: Is Capital One Financial trading at a discount, or has the market already priced in all the good news?

Most Popular Narrative: 15.3% Undervalued

With the narrative fair value set at $260.24 and Capital One’s share price closing at $220.37, there is a notable gap between current market levels and what analysts see as justified. This invites a closer look at the potential catalysts influencing this perspective.

The combination with Discover positions Capital One to leverage proprietary payments network infrastructure, enabling it to migrate Capital One debit and some credit card volume to the unregulated Discover network. This transition is expected to generate substantial incremental fee income and interchange revenue over time as scale, acceptance, and brand investments are realized.

Curious why this valuation is so bullish? There is a significant financial engine driving it, built on expectations of growth, margin expansion, and future profits that are comparable to the most technology-focused firms. Interested in the detailed assumptions supporting this price? The full narrative provides insight into the reasoning behind the target.

Result: Fair Value of $260.24 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, significant integration costs with Discover and rising technology investments could put pressure on profit margins if anticipated revenue synergies do not emerge.

Find out about the key risks to this Capital One Financial narrative.

Another View: Examining Valuation Multiples

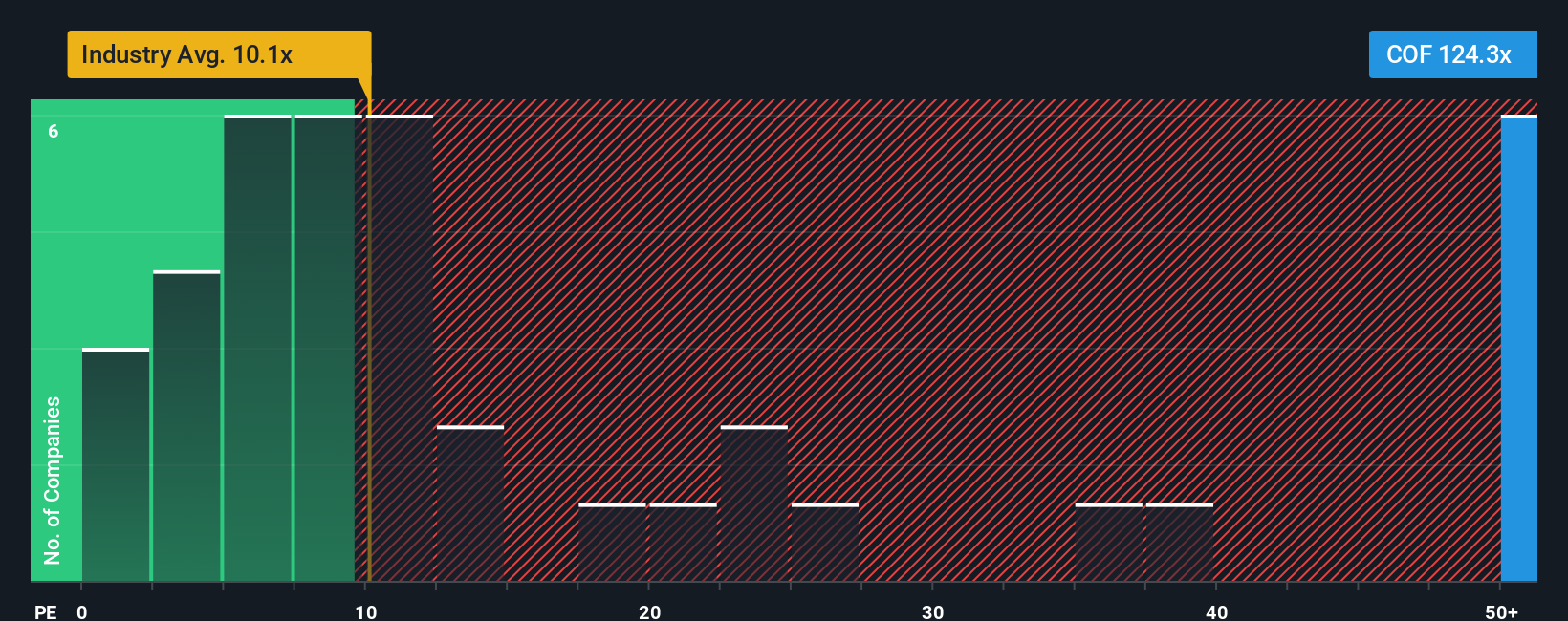

While the analysts’ fair value suggests Capital One Financial is undervalued, its price-to-earnings ratio is currently 121.7x, which is significantly higher than both the industry average of 9.8x and the fair ratio of 30.6x. This indicates the market may be pricing in substantial future growth, increasing the risk if those expectations are not met. Is this optimism justified, or are investors overlooking warning signs?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Capital One Financial Narrative

If you see things differently or want to dive into the financials yourself, crafting your own perspective takes just a few minutes. Do it your way

A great starting point for your Capital One Financial research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more actionable investment ideas?

Don’t settle for yesterday’s winners alone. Let your next move set you apart. Uncover strategies others overlook and position yourself for tomorrow’s opportunities with these targeted ideas:

- Start building wealth by targeting monthly income with top picks among these 14 dividend stocks with yields > 3% boasting yields over 3% and financial stability to match.

- Supercharge your watchlist by joining these 25 AI penny stocks making breakthroughs in artificial intelligence and transforming industries worldwide.

- Gain an edge by targeting undervalued opportunities. See which companies are primed for growth in these 922 undervalued stocks based on cash flows before the rest of the market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:COF

Capital One Financial

Operates as the financial services holding company for the Capital One, National Association, which engages in the provision of various financial products and services in the United States, Canada, and the United Kingdom.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026