- United States

- /

- Capital Markets

- /

- NYSE:CNS

Cohen & Steers (CNS): Reassessing Valuation After Share Price Slump and ETF Expansion Strategy

Reviewed by Simply Wall St

Cohen & Steers (CNS) has been under pressure this year, with shares sliding more than 32% as investors reassess asset managers in a tougher market and grapple with shifting sentiment toward active strategies.

See our latest analysis for Cohen & Steers.

That drop has left Cohen & Steers trading around $62.40, with a steep year to date share price return of about minus 32%. The one year total shareholder return of roughly minus 36% contrasts with a modest positive three year total shareholder return. This suggests that long term momentum has cooled as investors reassess active managers and wait to see whether its ETF and real assets strategy reignites confidence.

If this shift in sentiment has you rethinking where to look next, it could be worth exploring fast growing stocks with high insider ownership as a way to uncover other potential compounders with management skin in the game.

With shares now trading at a double digit discount to analyst targets despite solid recent earnings growth, the key question is whether Cohen & Steers is temporarily mispriced or if the market is already discounting its future expansion.

Most Popular Narrative Narrative: 13.7% Undervalued

Compared with the last close at $62.40, the most followed narrative sees fair value materially higher, setting up a potential disconnect between price and projections.

Strategic expansion into active ETFs and broader product diversification (including the launch of integrated listed/private real estate strategies) is expected to attract new investor segments and improve client retention, supporting future AUM growth and revenue stability.

Want to see how this product pivot turns into a higher valuation? The narrative leans on bolder revenue trajectories, richer margins, and a reset earnings multiple. Curious which assumptions really move the needle? Read on to see the full playbook.

Result: Fair Value of $72.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained client outflows and rising costs tied to global expansion could undermine the bullish case and delay the expected earnings and valuation uplift.

Find out about the key risks to this Cohen & Steers narrative.

Another Angle on Value

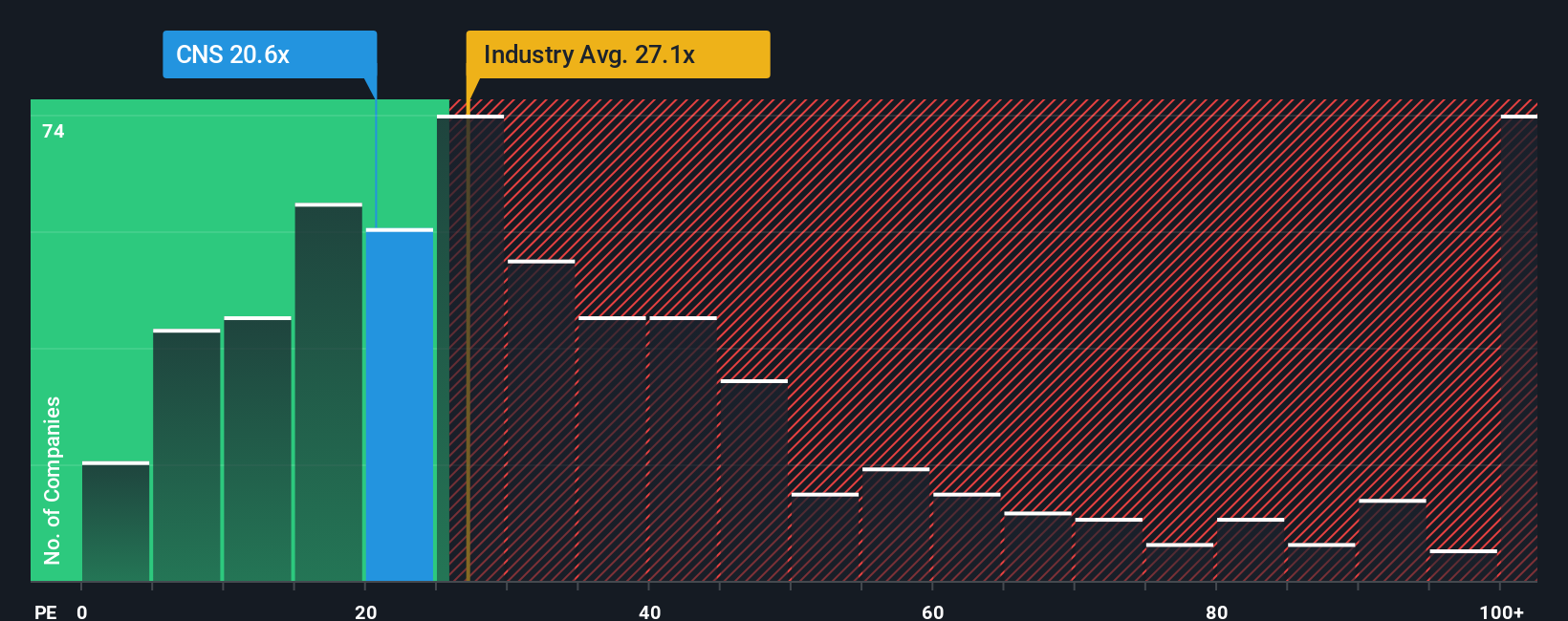

Not everyone agrees Cohen & Steers is cheap. On earnings, it trades at about 19.4 times profits, above a fair ratio of 15.1 times and nearly double the 10.4 times peer average, even if it still sits below the 23.8 times industry level. Is that a safety margin or a warning sign?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Cohen & Steers for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 919 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Cohen & Steers Narrative

If you see the outlook differently or prefer to dive into the numbers yourself, you can shape a custom view in minutes: Do it your way.

A great starting point for your Cohen & Steers research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in an edge by scanning targeted stock ideas on Simply Wall St, where data backed screens point you toward your next opportunity.

- Capture potential mispricings by hunting for quality companies trading below their intrinsic value with these 919 undervalued stocks based on cash flows.

- Ride structural growth trends by zeroing in on innovation leaders through these 25 AI penny stocks.

- Strengthen your income stream by targeting reliable cash generators via these 14 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CNS

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026