- United States

- /

- Mortgage REITs

- /

- NYSE:BXMT

Reassessing Blackstone Mortgage Trust (BXMT) Valuation After Its Earnings Miss and Ongoing Dividend Strength

Reviewed by Simply Wall St

Blackstone Mortgage Trust (BXMT) is back in focus after third quarter earnings came in light, with earnings per share at $0.24 versus expectations for $0.36, prompting investors to reassess the income story.

See our latest analysis for Blackstone Mortgage Trust.

The earnings miss has taken some of the shine off Blackstone Mortgage Trust’s earlier rebound, with a 7.93% 1 month share price return cooling into a slightly negative 3 month move, even as the 1 year total shareholder return of 17.28% still signals that income focused investors have largely stayed the course.

If this earnings wobble has you reconsidering where you hunt for yield and stability, it could be a good moment to explore fast growing stocks with high insider ownership as potential new ideas beyond traditional mortgage REITs.

With shares now trading only slightly below analyst targets, but net income still growing faster than revenues, investors face a key question: Is Blackstone Mortgage Trust quietly undervalued, or are markets already pricing in its next leg of growth?

Most Popular Narrative: 3% Undervalued

With Blackstone Mortgage Trust closing at $19.88 against a narrative fair value near $20.50, the valuation case leans on ambitious profit recovery and margin expansion.

The launch of a net lease investment strategy, particularly in defensive business sectors, is expected to provide stable cash flows, enhancing the diversification and resilience of the revenue stream, which could support consistent revenue growth.

Curious how a once loss making lender is projected to rebuild profits, expand margins dramatically, and still trade on a modest future earnings multiple? The narrative connects rapid top line growth, sharply higher profitability, and disciplined capital returns into a single valuation story. Want to see the exact assumptions behind that earnings ramp and multiple reset? Read on to uncover the full blueprint behind this fair value call.

Result: Fair Value of $20.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering impaired loans and uncertain loan repayment timing could easily derail the margin expansion and earnings ramp that underpin this optimistic valuation path.

Find out about the key risks to this Blackstone Mortgage Trust narrative.

Another View: Market Ratios Flash a Caution Sign

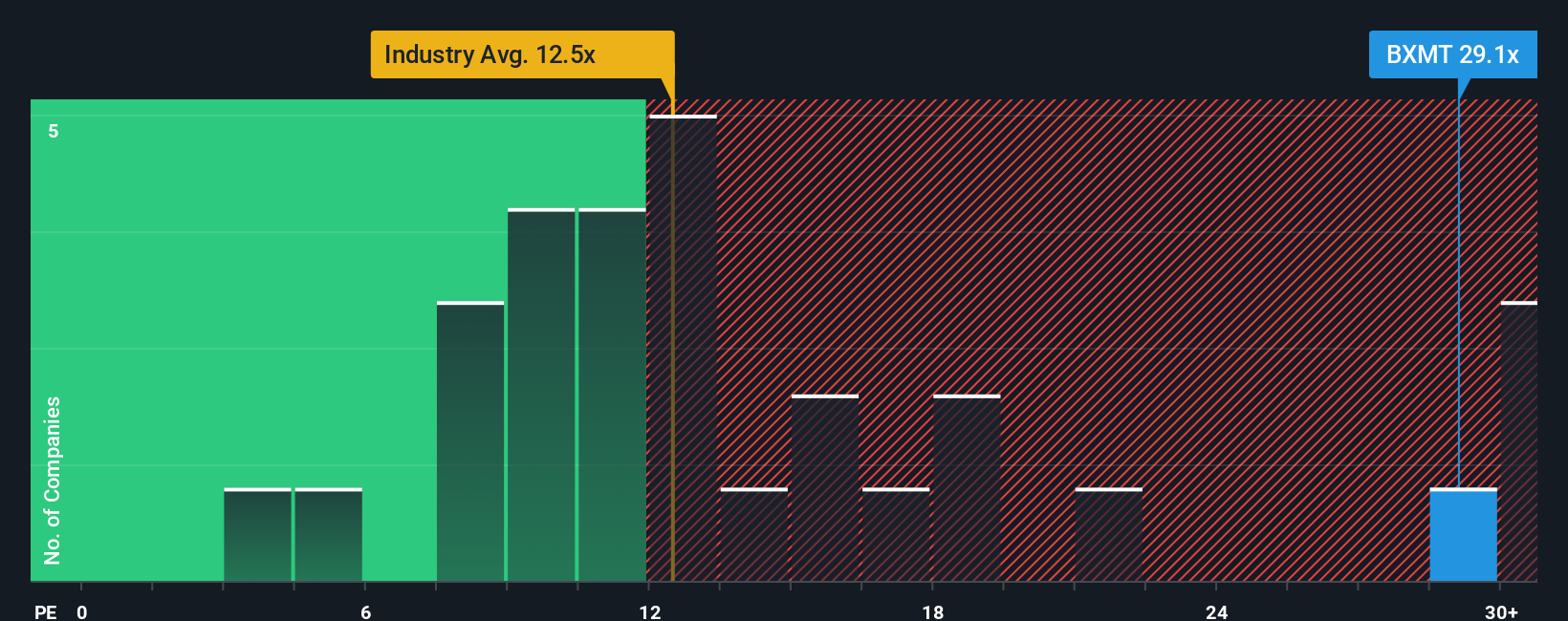

While the narrative fair value suggests only a small upside, the market’s own yardstick paints a tougher picture. BXMT trades on a price to earnings ratio of 31.4 times, more than double the Mortgage REITs industry at 13 times and well above its 17.6 times fair ratio, implying investors are already paying up for that recovery story. If earnings or margins slip, how much multiple risk are you really carrying for a stock sold as a steady income play?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Blackstone Mortgage Trust Narrative

If this story does not quite fit your view, or you prefer to dig into the numbers yourself, you can build a custom narrative in just a few minutes, Do it your way.

A great starting point for your Blackstone Mortgage Trust research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in a few fresh opportunities by using the Simply Wall Street Screener to hunt for returns you will not want to miss.

- Capture potential mispricings by targeting companies that look cheap on fundamentals using these 905 undervalued stocks based on cash flows.

- Ride the next wave of innovation by focusing on cutting edge names powering intelligent automation with these 26 AI penny stocks.

- Strengthen your income strategy by zeroing in on reliable payers through these 15 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Blackstone Mortgage Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BXMT

Blackstone Mortgage Trust

A real estate finance company, originates senior loans collateralized by commercial properties in North America, Europe, and Australia.

Moderate growth potential second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026