- United States

- /

- Mortgage REITs

- /

- NYSE:BXMT

Blackstone Mortgage Trust (BXMT): Exploring the Stock’s Valuation Potential After Modest Recent Gains

Reviewed by Simply Wall St

Blackstone Mortgage Trust (BXMT) shares ended the day slightly lower, slipping around 1%. Despite this dip, the stock has managed a modest gain over the past month. This reflects stable investor sentiment as broader market shifts continue.

See our latest analysis for Blackstone Mortgage Trust.

Over the past year, Blackstone Mortgage Trust’s total shareholder return has reached 9.3%, reflecting steady resilience despite some recent volatility. After a soft patch in the last three months, momentum appears mixed. However, long-term investors have still seen meaningful gains.

If you’re interested in exploring what else the market has to offer, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

With shares trading nearly 10% below analyst price targets and solid financial growth reported, does Blackstone Mortgage Trust present an attractive buying opportunity, or is the market already factoring in expectations for future performance?

Most Popular Narrative: 8.6% Undervalued

With Blackstone Mortgage Trust closing at $18.73, the most widely followed narrative pegs fair value at $20.50, highlighting some upside ahead for patient investors. The prevailing expectations reflect a belief in robust profit expansion and transformative portfolio moves that could shape the company’s future growth profile.

The company is focusing on portfolio turnover through repayments and redeployment into high-quality new credit opportunities. This strategy is expected to enhance future earnings by improving the overall credit composition and potentially increasing revenue from new investments. Resolution of impaired loans is anticipated to act as a catalyst for future growth by reducing non-performing assets and allowing the company to recapture earnings potential, which could result in increased net margins as capital is redeployed into more productive investments.

Curious why this valuation stands out? The story hinges on rapid earnings acceleration, bold financial targets, and a significant margin turnaround. The full narrative unveils the assumptions, projections, and optimism that could change how you see BXMT’s future value. Don’t miss how these key variables shape the outlook.

Result: Fair Value of $20.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing uncertainties in tariff policies and timing challenges with loan repayments could disrupt BXMT’s earnings momentum and margin improvement outlook.

Find out about the key risks to this Blackstone Mortgage Trust narrative.

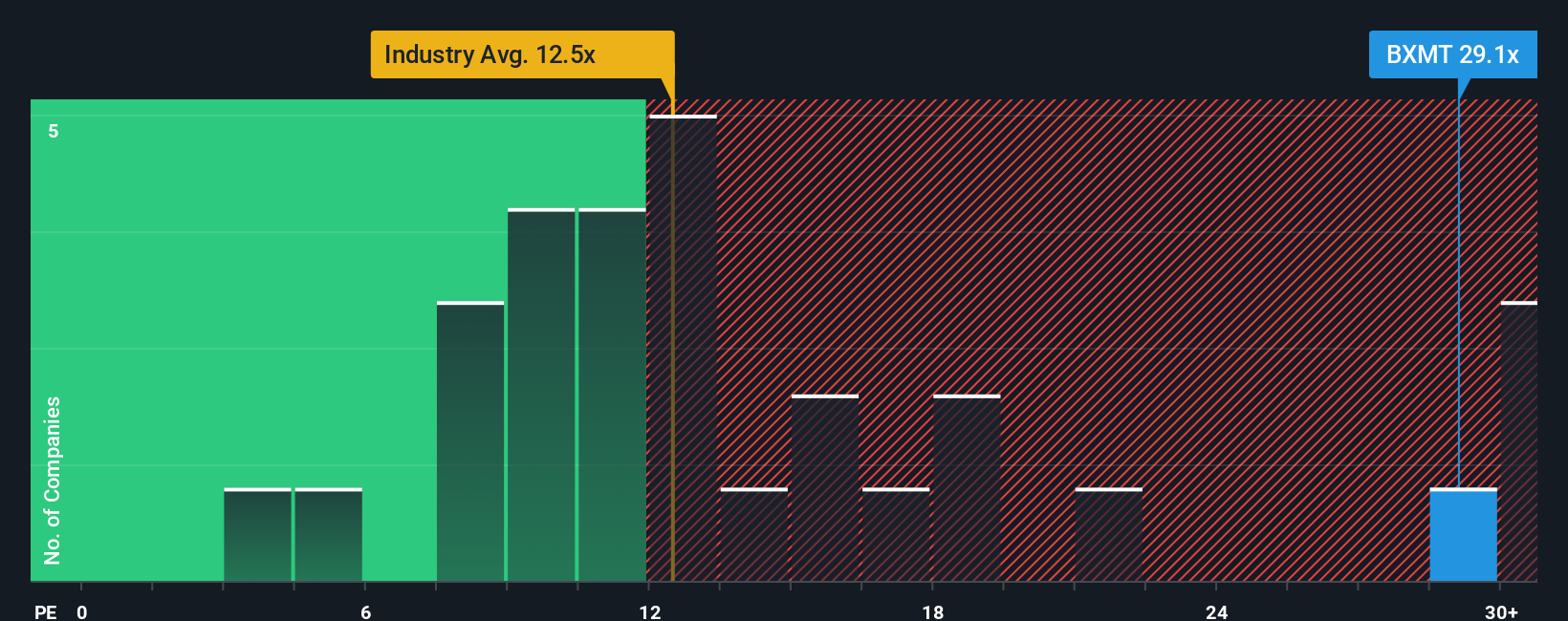

Another View: Market Ratios Raise Questions

While analyst targets suggest upside, market ratios offer a more cautious take. BXMT’s valuation sits well above both industry and peer averages, with its price-to-earnings ratio at 29.6x versus 12.4x for the industry and a fair ratio of just 18.8x. This gap raises valuation risk. Could investor optimism be overextended, or does potential future growth justify the premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Blackstone Mortgage Trust Narrative

If you want a different perspective or prefer digging into the numbers yourself, you can craft your own BXMT story in just a few minutes. Do it your way

A great starting point for your Blackstone Mortgage Trust research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Unlock even more opportunities by checking out expert-curated stock lists that fit your strategy. Act now to ensure you are not missing tomorrow’s winners.

- Capture reliable income streams by reviewing these 14 dividend stocks with yields > 3% for stocks with attractive yields above 3% and robust payout histories.

- Tap into the next wave of health innovation with these 30 healthcare AI stocks, where AI-driven breakthroughs are transforming patient care and medical research.

- Capitalize on undervalued potential with these 920 undervalued stocks based on cash flows that are currently trading well below their intrinsic cash flow value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Blackstone Mortgage Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BXMT

Blackstone Mortgage Trust

A real estate finance company, originates senior loans collateralized by commercial properties in North America, Europe, and Australia.

Moderate growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026