- United States

- /

- Diversified Financial

- /

- NYSE:BRK.A

Should Berkshire Hathaway’s (BRK.A) Leadership Split Prompt Investors to Reevaluate Succession and Stability?

Reviewed by Sasha Jovanovic

- On September 30, 2025, Berkshire Hathaway’s board amended its by-laws to formally separate the positions of Chairman and Chief Executive Officer, confirming that Warren Buffett will remain as Chairman while Greg Abel becomes CEO effective January 1, 2026.

- This move marks a significant shift in Berkshire Hathaway’s long-standing governance structure, directly addressing long-running investor interest in a clear succession plan beyond Warren Buffett’s tenure.

- We’ll examine how the formal separation of leadership roles shapes Berkshire Hathaway’s investment narrative and perceptions of management continuity.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Berkshire Hathaway's Investment Narrative?

For Berkshire Hathaway, the big picture is about believing in a company built to weather market cycles through a hands-off, decentralized management approach and a fortress-like balance sheet. The formal separation of the Chairman and CEO roles, with Greg Abel taking over as CEO and Warren Buffett staying on as Chairman, represents the most significant structural change in decades. Yet, for most investors, this transition is about continuity, not disruption: early market reaction has been muted and Berkshire’s size means the big picture remains much the same. In the short term, continued clarity on the succession plan reassures long-term shareholders, especially as Berkshire’s earnings are expected to contract while revenue growth stays moderate. The main risks still center around earnings pressure, sluggish market returns relative to US indexes, and whether the company can maintain its historical discipline and cultural cohesion as the leadership evolves. This by-law update addresses a long-running uncertainty, but given the smooth handover and Abel’s deep experience under Buffett, the near-term catalysts and risks for Berkshire Hathaway stock remain largely unchanged for now.

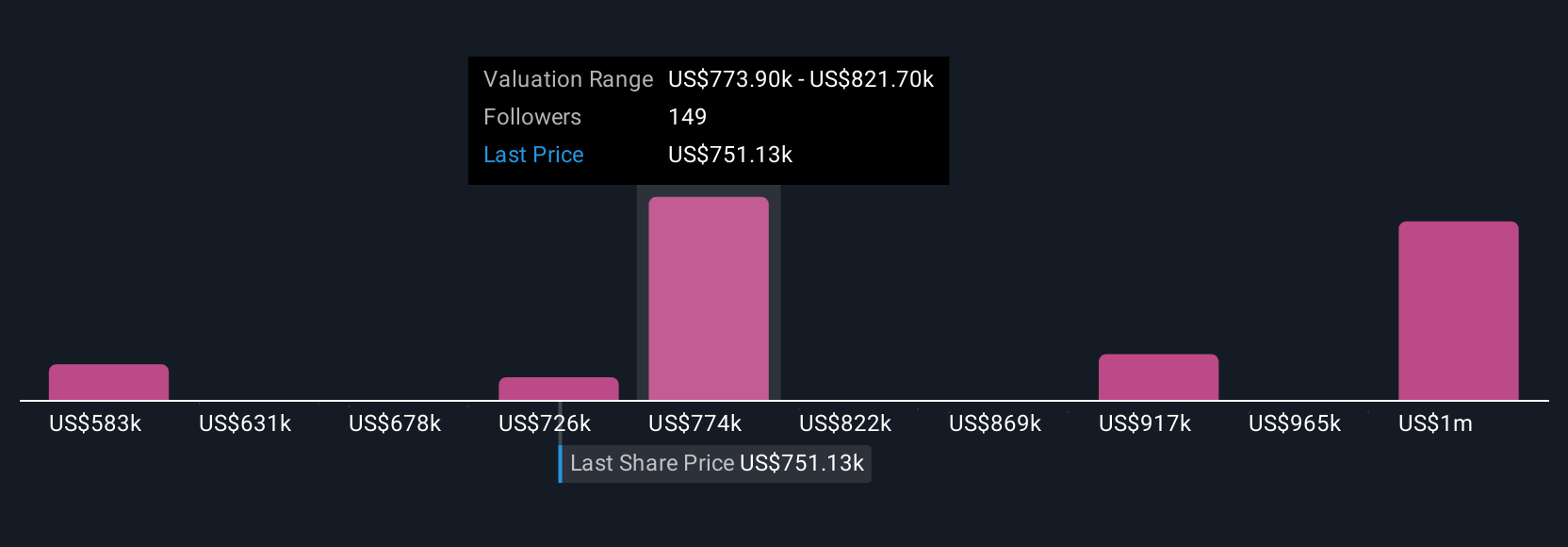

But can Berkshire’s conservative approach withstand pressure if market expectations for growth keep rising? Despite retreating, Berkshire Hathaway's shares might still be trading 30% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 29 other fair value estimates on Berkshire Hathaway - why the stock might be worth as much as 44% more than the current price!

Build Your Own Berkshire Hathaway Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Berkshire Hathaway research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Berkshire Hathaway research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Berkshire Hathaway's overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Berkshire Hathaway might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BRK.A

Berkshire Hathaway

Through its subsidiaries, engages in the insurance, freight rail transportation, and utility businesses.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives