- United States

- /

- Insurance

- /

- NYSE:WDH

Three US Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

As major stock indexes in the United States continue to extend their gains, buoyed by optimism about the economy and potential interest rate cuts, investors are increasingly looking for robust opportunities. One key indicator of a promising investment is high insider ownership, which often signals confidence from those closest to the company.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 21.6% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.6% |

| PDD Holdings (NasdaqGS:PDD) | 32.1% | 21.7% |

| GigaCloud Technology (NasdaqGM:GCT) | 25.7% | 24.1% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 12% | 32.3% |

| Hims & Hers Health (NYSE:HIMS) | 13.7% | 40.9% |

| On Holding (NYSE:ONON) | 28.4% | 24.7% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.4% | 60.9% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 74.9% |

| BBB Foods (NYSE:TBBB) | 22.9% | 70.7% |

Let's explore several standout options from the results in the screener.

Capital Bancorp (NasdaqGS:CBNK)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Capital Bancorp, Inc., with a market cap of $340.86 million, operates as the bank holding company for Capital Bank, N.A.

Operations: Capital Bancorp, Inc. generates revenue from its segments as follows: Opensky ($70.71 million), Corporate ($2.74 million), Commercial Bank ($78.21 million), and Capital Bank Home Loans (CBHL) ($5.84 million).

Insider Ownership: 35%

Revenue Growth Forecast: 26.7% p.a.

Capital Bancorp demonstrates strong growth potential with forecasted revenue growth of 26.7% per year, outpacing the US market. Insider ownership is high, with substantial insider buying and no significant selling in the past three months. Recent earnings show a net income increase to US$8.21 million from US$7.32 million a year ago, and diluted EPS rising to $0.59 from $0.52, indicating solid financial performance despite some net charge-offs and executive changes.

- Get an in-depth perspective on Capital Bancorp's performance by reading our analyst estimates report here.

- The analysis detailed in our Capital Bancorp valuation report hints at an deflated share price compared to its estimated value.

Bridge Investment Group Holdings (NYSE:BRDG)

Simply Wall St Growth Rating: ★★★★★★

Overview: Bridge Investment Group Holdings Inc. operates in the real estate investment management sector in the United States and has a market cap of $951.94 million.

Operations: Bridge Investment Group Holdings generates revenue primarily as a fully integrated real estate investment manager, amounting to $368.47 million.

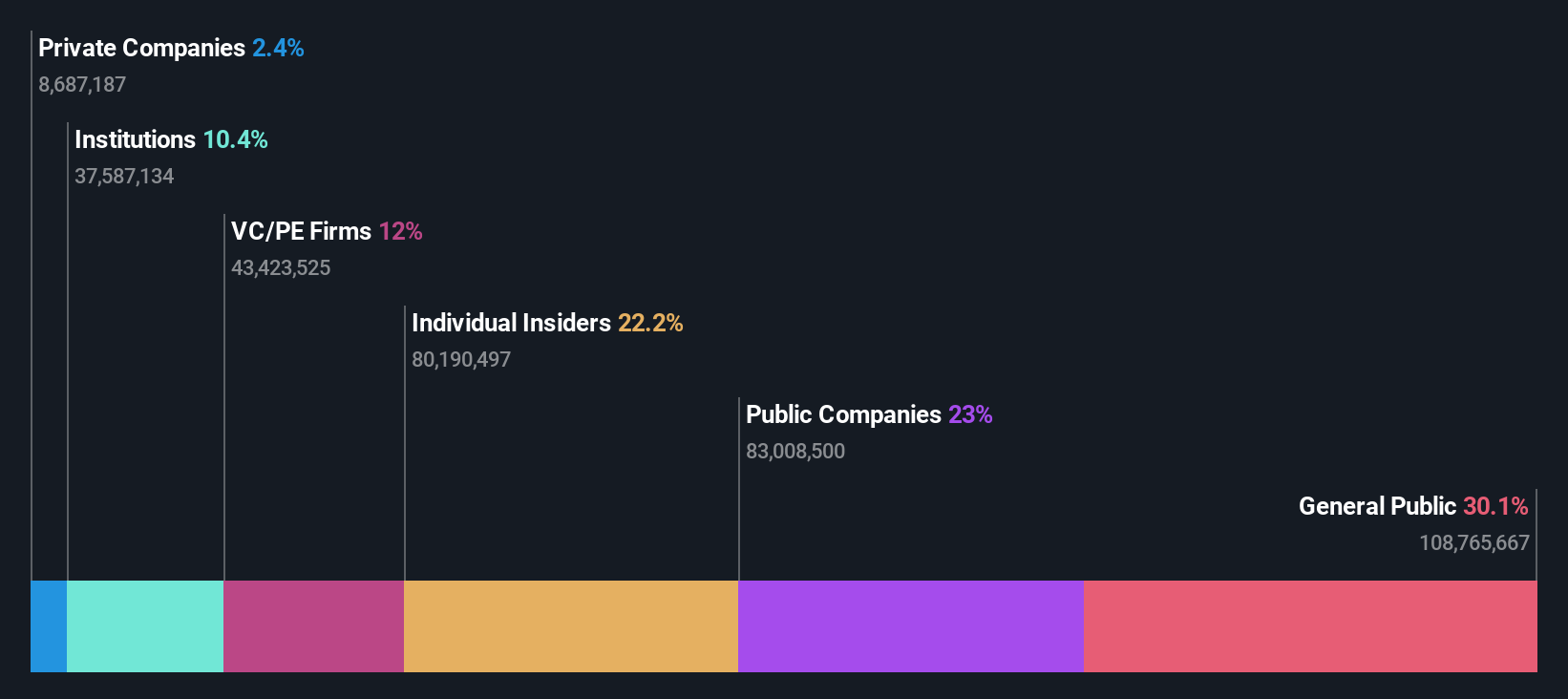

Insider Ownership: 11.3%

Revenue Growth Forecast: 20% p.a.

Bridge Investment Group Holdings shows promising growth potential, with revenue forecasted to grow faster than the US market at 20% per year. Recent earnings for Q2 2024 reported a significant increase in net income to US$13.67 million from US$1.43 million a year ago, despite challenges like interest payments not being well covered by earnings. The company also maintains high insider ownership and has recently announced efforts to preserve affordable housing through strategic partnerships.

- Click here to discover the nuances of Bridge Investment Group Holdings with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, Bridge Investment Group Holdings' share price might be too pessimistic.

Waterdrop (NYSE:WDH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Waterdrop Inc. (NYSE: WDH) operates through its subsidiaries to offer online insurance brokerage services in China, with a market cap of approximately $383.70 million.

Operations: Waterdrop Inc. generates revenue primarily from its insurance segment (CN¥2.41 billion) and crowd funding segment (CN¥188.01 million).

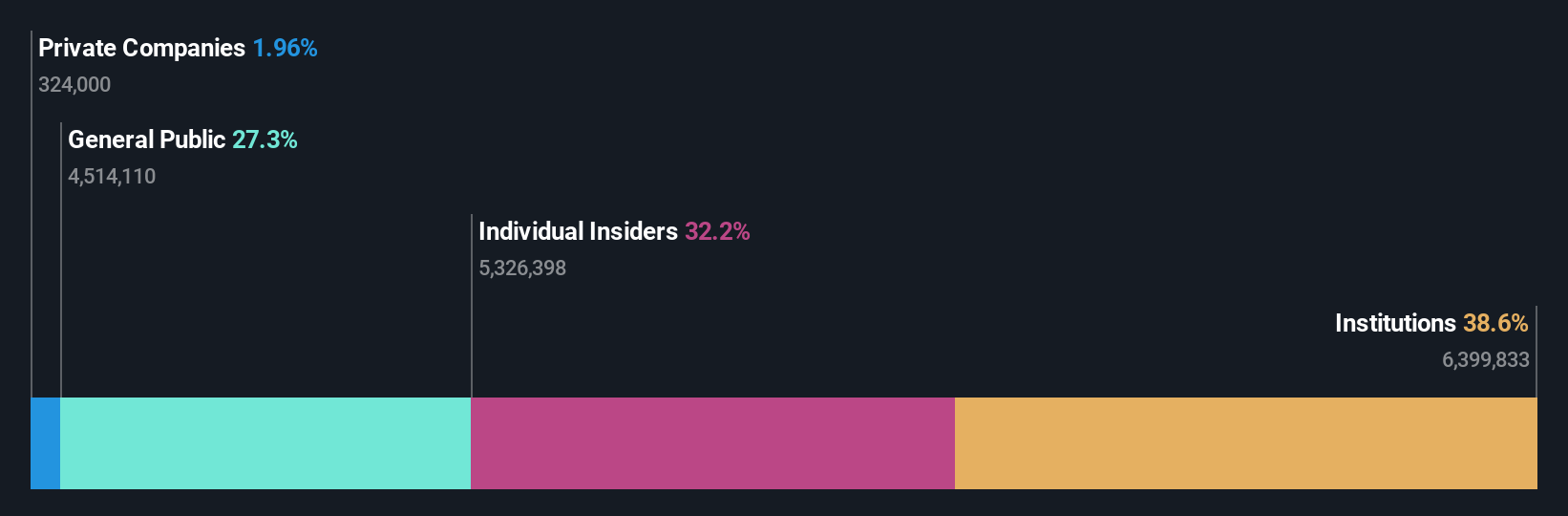

Insider Ownership: 21.7%

Revenue Growth Forecast: 11% p.a.

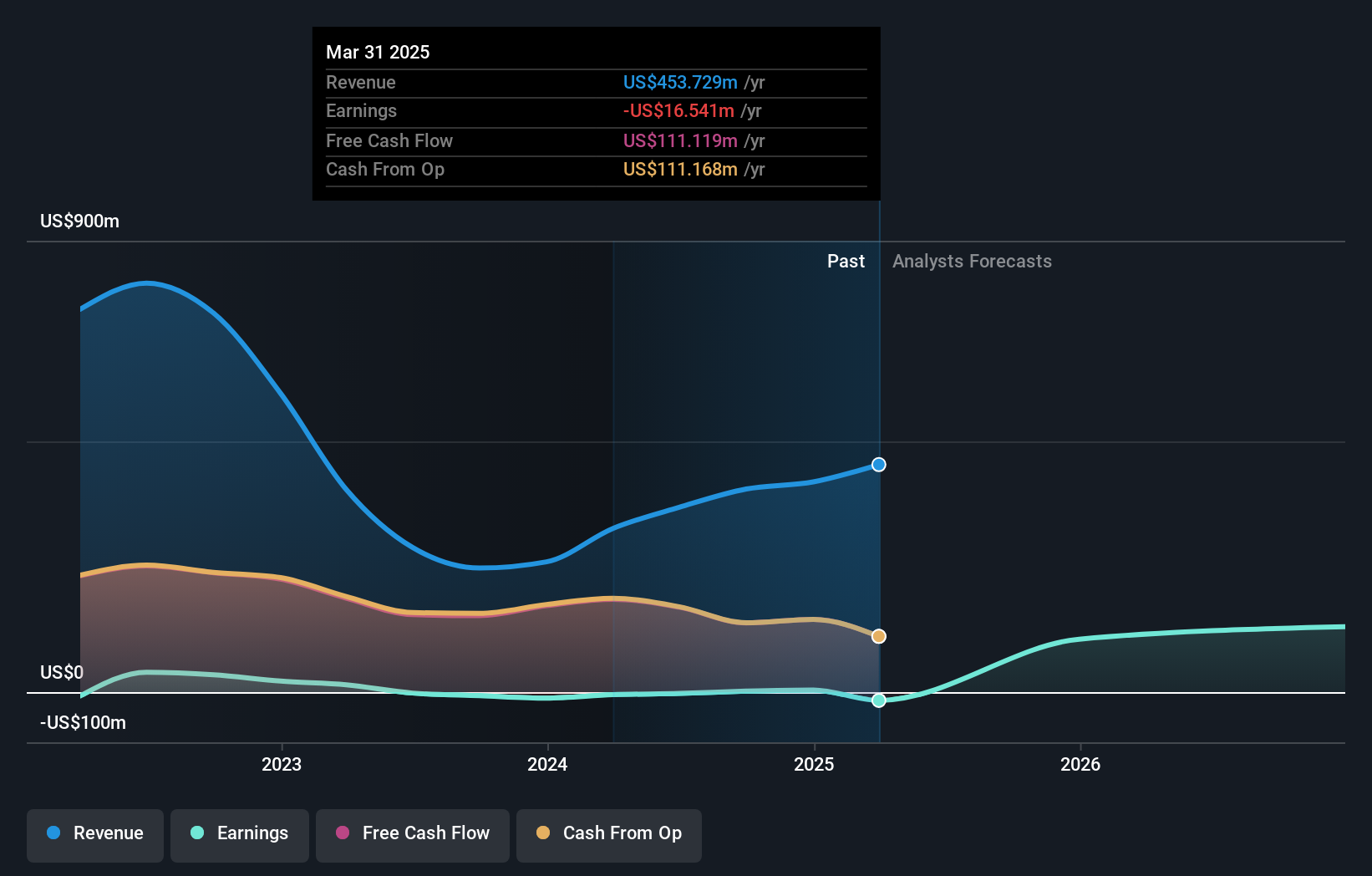

Waterdrop Inc. demonstrates strong growth potential with earnings forecasted to grow 26.7% annually, outpacing the US market's 15.1%. Recent Q1 2024 results show a rise in net income to CNY 80.63 million from CNY 49.73 million a year ago, driven by increased sales of CNY 704.7 million. The company reaffirmed its double-digit revenue growth guidance for 2024 and introduced an innovative Skin Care Face Washer, highlighting its commitment to expanding product offerings and enhancing market presence.

- Click here and access our complete growth analysis report to understand the dynamics of Waterdrop.

- Insights from our recent valuation report point to the potential undervaluation of Waterdrop shares in the market.

Key Takeaways

- Explore the 176 names from our Fast Growing US Companies With High Insider Ownership screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Waterdrop might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WDH

Waterdrop

Through its subsidiaries, provides online insurance brokerage services to match and connect users with related insurance products underwritten by insurance companies in the People’s Republic of China.

Flawless balance sheet and good value.