- United States

- /

- Capital Markets

- /

- NYSE:BLK

What BlackRock (BLK)'s New Options-Based Income ETF Push Means For Shareholders

Reviewed by Sasha Jovanovic

- Earlier this month, BlackRock expanded its outcome ETF suite by launching the iShares Nasdaq Premium Income Active ETF (BALQ), which combines Nasdaq 100 equity exposure with an options overlay to target current income for investors.

- This move underscores BlackRock’s push to grow outcome-oriented, income-focused ETFs by using its large systematic investing platform and options-writing expertise to address evolving portfolio needs.

- We’ll now explore how BlackRock’s push into premium income, options-based ETFs may influence the existing investment narrative around technology and fee growth.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

BlackRock Investment Narrative Recap

To own BlackRock, you generally need to believe in the long term growth of global assets, the durability of its ETF and technology franchises, and its ability to offset fee compression with higher value products. The BALQ launch reinforces BlackRock’s focus on outcome ETFs and income solutions, but it does not materially change the near term picture where fee pressure and integration risk in private markets remain key watchpoints.

The recent partnership between BlackRock and AccessFintech, integrating with Aladdin, is particularly relevant here because it shows how the firm is trying to deepen its technology edge and operational efficiency while expanding product innovation like BALQ. Together, these efforts speak to a central catalyst for the stock: using data, scale, and technology to support higher margin services that can help counter industry wide fee compression.

Yet, beneath this growth story, investors still need to be aware of the ongoing risk that persistent fee compression could...

Read the full narrative on BlackRock (it's free!)

BlackRock's narrative projects $28.7 billion revenue and $8.9 billion earnings by 2028. This requires 9.9% yearly revenue growth and about a $2.5 billion earnings increase from $6.4 billion today.

Uncover how BlackRock's forecasts yield a $1329 fair value, a 24% upside to its current price.

Exploring Other Perspectives

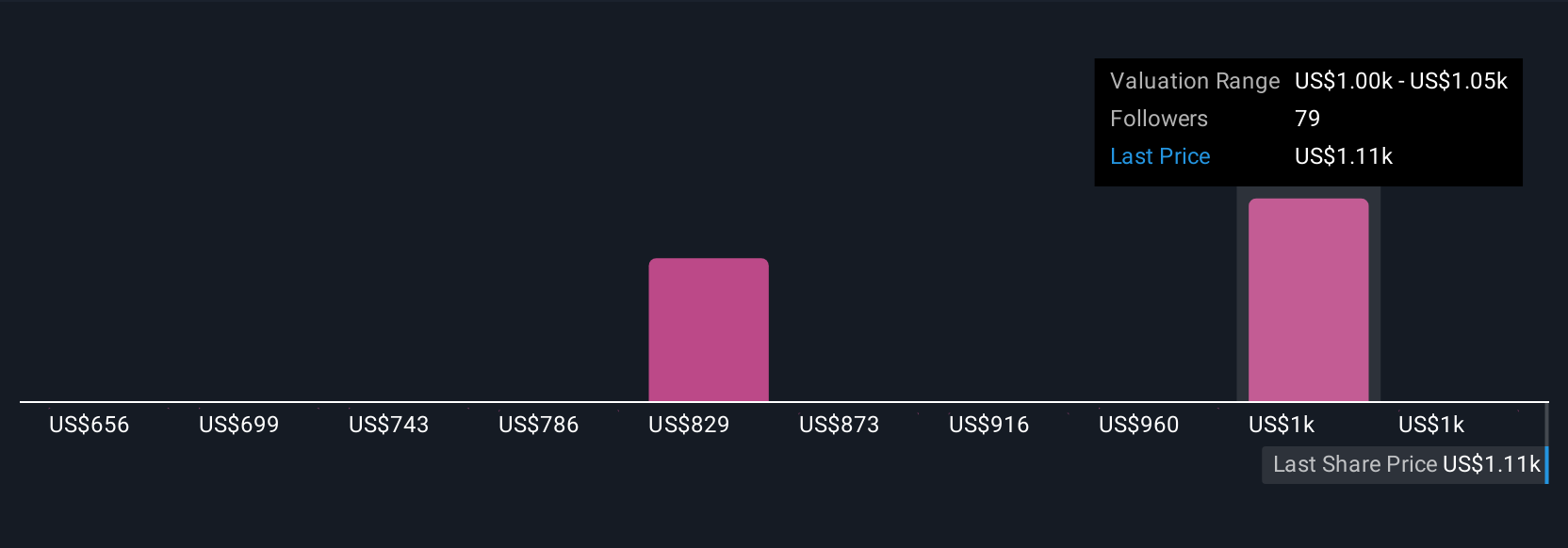

Seventeen members of the Simply Wall St Community place BlackRock’s fair value between US$724 and US$1,392, reflecting a wide spread of individual views. Against that backdrop, BlackRock’s push into higher value outcome ETFs and technology platforms like Aladdin may be critical for how its margins and earnings power evolve over time, so you may want to compare several of these perspectives before forming your own view.

Explore 17 other fair value estimates on BlackRock - why the stock might be worth 32% less than the current price!

Build Your Own BlackRock Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BlackRock research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free BlackRock research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BlackRock's overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BlackRock might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BLK

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026