- United States

- /

- Capital Markets

- /

- NYSE:BLK

How BlackRock’s (BLK) Workflow Tech Push and Middle East Expansion Could Shape Its Innovation Edge

Reviewed by Sasha Jovanovic

- Earlier this month, BlackRock and AccessFintech announced a partnership to integrate AccessFintech’s Synergy Network with BlackRock’s Aladdin platform, aiming to deliver real-time, post-trade connectivity, advanced analytics, and improved workflow efficiency for a broad network of capital markets participants.

- This collaboration, along with BlackRock’s intention to significantly increase its investment in Saudi Arabia and the broader Middle East, highlights an effort to enhance technological capabilities while broadening its international presence in sectors such as artificial intelligence, transportation, and infrastructure.

- We’ll explore how BlackRock’s investment in workflow technology through AccessFintech could strengthen its growth and innovation outlook.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

BlackRock Investment Narrative Recap

To be a shareholder in BlackRock, you need to have confidence in the company's continued leadership in portfolio management, technology platforms, and global expansion. The recent BlackRock and AccessFintech partnership, which integrates workflow technology into Aladdin, supports margin resilience and client retention, key drivers for the business, but does not materially impact the short-term catalyst, which remains BlackRock's push into private markets and international growth. The main immediate risk still centers on persistent industry-wide fee compression, especially within ETFs and passive products.

Among the recent announcements, the integration of Aladdin Wealth with Luma Financial Technologies directly complements the latest AccessFintech news by showing BlackRock’s focus on broadening data and analytics capabilities for clients. This expanded connectivity aims to enhance decision-making and meet demand for greater transparency, further supporting BlackRock’s technology-led approach as a competitive catalyst.

But investors should also bear in mind, by contrast, the impact of margin pressure from ongoing fee compression…

Read the full narrative on BlackRock (it's free!)

BlackRock's outlook projects $28.7 billion in revenue and $8.9 billion in earnings by 2028. This scenario assumes a 9.9% annual revenue growth rate and a $2.5 billion increase in earnings from the current $6.4 billion level.

Uncover how BlackRock's forecasts yield a $1329 fair value, a 27% upside to its current price.

Exploring Other Perspectives

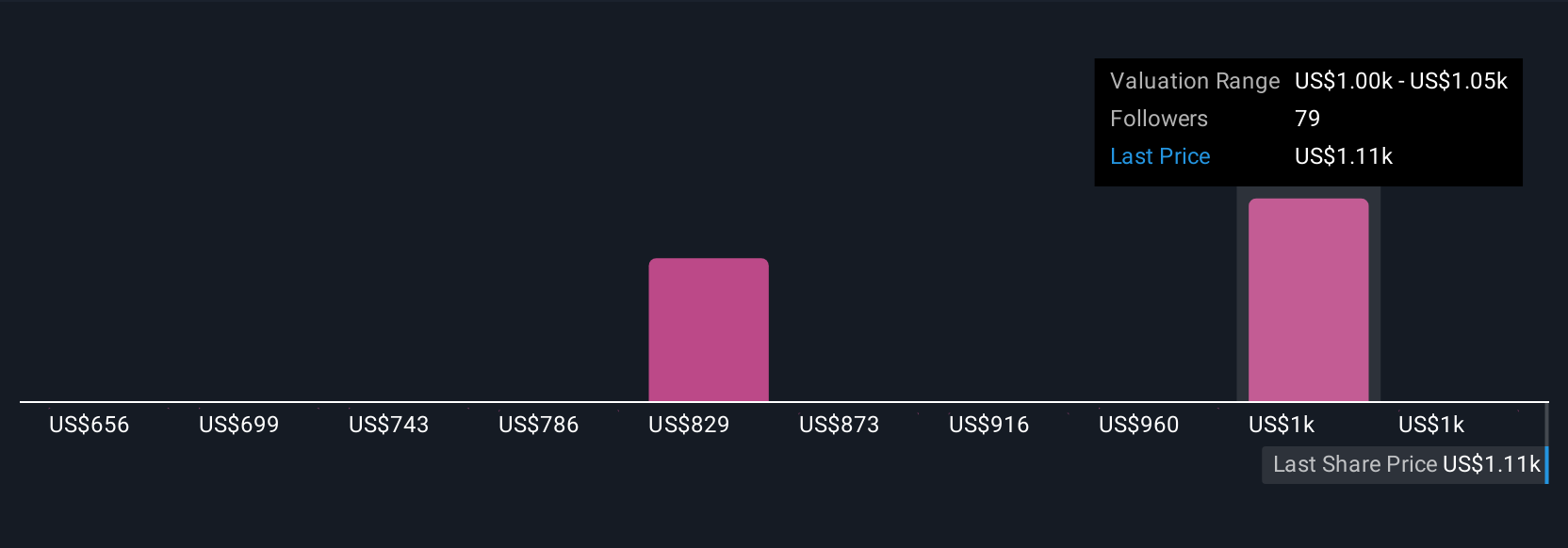

Seventeen members of the Simply Wall St Community have estimated BlackRock’s fair value between US$724 and US$1,391 per share. Against this wide range, ongoing fee compression remains a risk that could affect both near-term revenue and long-term profitability, so be sure to weigh multiple viewpoints.

Explore 17 other fair value estimates on BlackRock - why the stock might be worth as much as 33% more than the current price!

Build Your Own BlackRock Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BlackRock research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free BlackRock research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BlackRock's overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BlackRock might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BLK

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026