- United States

- /

- Capital Markets

- /

- NYSE:BEN

Franklin Resources (BEN): Evaluating Valuation After Launching the Franklin Solana ETF in the Digital Asset Space

Reviewed by Simply Wall St

Franklin Resources (BEN) is back in the crypto spotlight after Franklin Templeton rolled out its new Franklin Solana ETF, giving traditional investors an easier way to tap Solana’s high speed blockchain ecosystem.

See our latest analysis for Franklin Resources.

The Solana ETF launch follows a run of crypto focused products and comes as Franklin Resources’ share price sits at $23.4, with a solid year to date share price return of 16.2% but a more modest 5 year total shareholder return of 22.1%. This suggests that momentum is improving recently while still rebuilding after a softer stretch.

If this kind of innovation has your attention, it could be a good moment to explore other fast growing stocks with high insider ownership that might be quietly setting up their next leg higher.

Yet with BEN trading just above cautious analyst targets, modest top line growth but stronger earnings, and insider buying ticking up, is this an overlooked entry point, or is the market already baking in the next growth phase?

Most Popular Narrative Narrative: 5.4% Undervalued

With Franklin Resources last closing at $23.4 against a narrative fair value of $24.73, the story implies modest upside if its roadmap plays out.

The company is actively expanding its presence in non U.S. and emerging markets, now with $500 billion of AUM outside the US and new mandates in countries like Uzbekistan and Saudi Arabia, positioning Franklin Resources to benefit from the rising global wealth and the increasing allocation of institutional capital worldwide. This is likely to support future AUM growth and top line revenue expansion.

Curious how slow headline revenue growth can still support this upside case? The narrative leans on margin expansion, earnings acceleration, and a future multiple reset. Want to see how those pieces fit together numerically? Read on to uncover the assumptions driving that fair value.

Result: Fair Value of $24.73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent client outflows and ongoing fee pressure could blunt the impact of Franklin’s expansion plans and delay the margin and earnings reset implied here.

Find out about the key risks to this Franklin Resources narrative.

Another Angle on Valuation

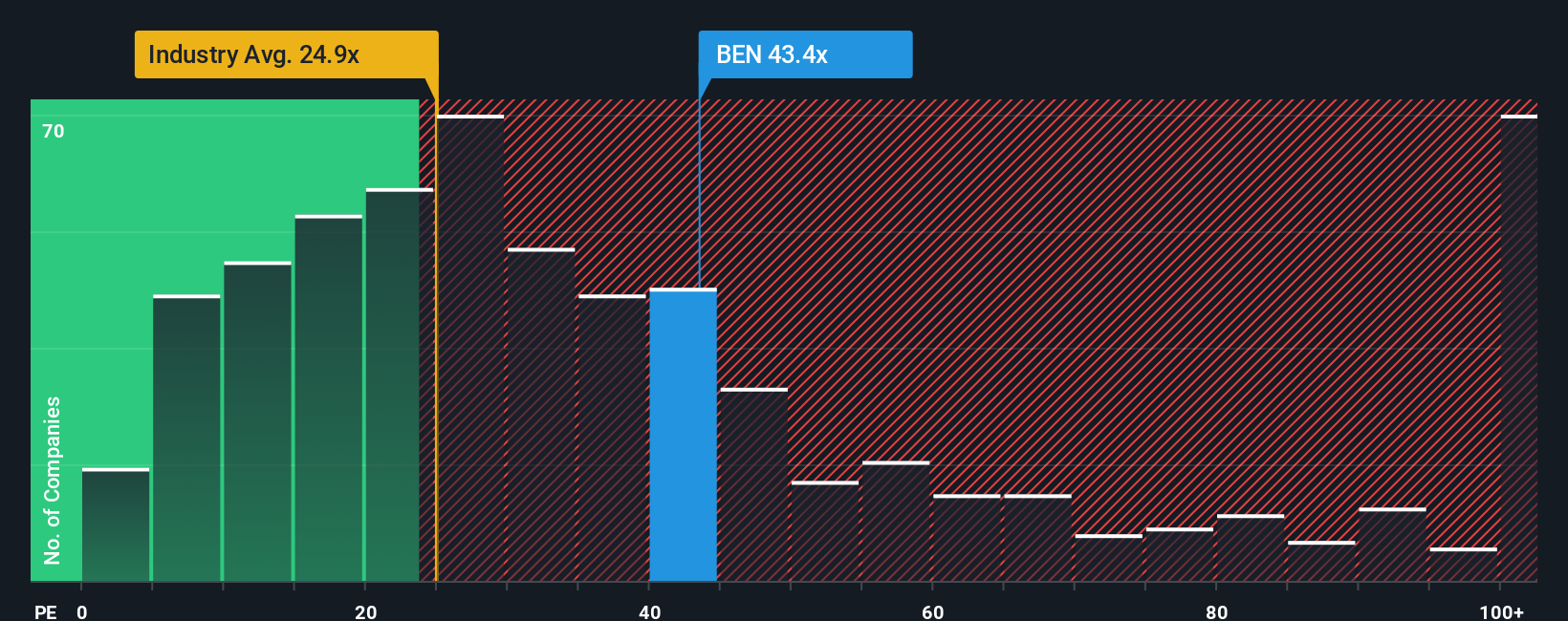

Step away from the narrative fair value and BEN suddenly looks less forgiving. On a price to earnings ratio of 25.8x versus a fair ratio of 17.4x, the stock also trades richer than the US Capital Markets industry at 24x and peers at 18.6x, which hints at downside if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Franklin Resources Narrative

If this perspective does not quite match your view, or you prefer digging into the numbers yourself, you can craft a tailored take in just minutes: Do it your way.

A great starting point for your Franklin Resources research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before you move on, lock in your next opportunities by using the Simply Wall Street Screener to uncover stocks that match your strategy with precision and speed.

- Target capital growth by scanning these 3574 penny stocks with strong financials that pair smaller market caps with solid balance sheets and the potential to surprise on the upside.

- Position your portfolio for the next tech wave by reviewing these 26 AI penny stocks powering advances in automation, data intelligence, and real world AI adoption.

- Secure income and stability by focusing on these 15 dividend stocks with yields > 3% that can potentially boost your yield while keeping quality front and center.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BEN

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026