- United States

- /

- Capital Markets

- /

- NYSE:ARES

Should Ares’ Unified Marq Logistics Platform Reshape the Core Real Estate Narrative for Ares (ARES)?

Reviewed by Sasha Jovanovic

- Ares Management has recently consolidated its global logistics real estate operations under a single brand, Marq Logistics, unifying platforms that now manage more than 600 million square feet of facilities across the Americas, Europe and Asia Pacific following the acquisition of GLP Capital Partners’ international business.

- This move creates one of the world’s largest integrated logistics property platforms, highlighting how Ares is reshaping its real estate franchise around scale, global reach and consistent service for tenants under a unified identity.

- We’ll now examine how the creation of the unified Marq Logistics platform could influence Ares Management’s investment narrative and growth profile.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Ares Management Investment Narrative Recap

To own Ares Management, you need to believe in the long term growth of alternative assets and Ares’ ability to keep scaling fee paying AUM without sacrificing profitability. The launch of Marq Logistics strengthens the case that logistics real estate is becoming a core pillar, but it does not fundamentally change the near term focus on integrating acquisitions while managing ongoing fee and margin pressure in a highly competitive alternatives market.

Among recent developments, the acquisition of GLP Capital Partners’ international business in March 2025 is most relevant here, because Marq Logistics effectively formalizes and brands the expanded global logistics footprint that deal created. For investors, it ties directly into the existing catalyst of Ares broadening its real estate and infrastructure platforms to support fee growth, while also adding another layer of execution risk as the firm absorbs and standardizes a very large, complex property portfolio.

Yet this push for scale also heightens a risk investors should be aware of if integration costs rise faster than…

Read the full narrative on Ares Management (it's free!)

Ares Management's narrative projects $7.1 billion revenue and $2.2 billion earnings by 2028.

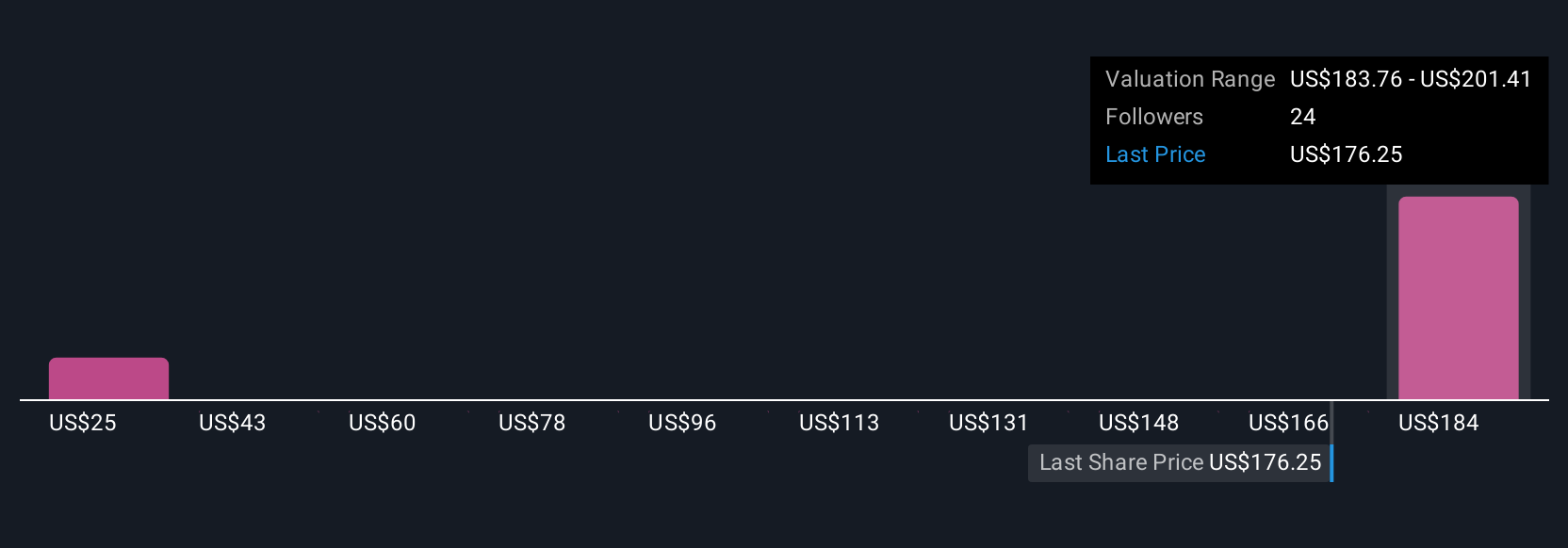

Uncover how Ares Management's forecasts yield a $183.60 fair value, a 15% upside to its current price.

Exploring Other Perspectives

Three fair value estimates from the Simply Wall St Community span a wide range from US$31.35 to US$201.41, underlining how far apart views on Ares can be. Against that backdrop, the Marq Logistics rollout and broader platform expansion keep the spotlight on whether Ares can convert its growing global footprint into resilient fee revenues despite fee competition and integration risk, so it pays to compare several perspectives before forming a view.

Explore 3 other fair value estimates on Ares Management - why the stock might be worth less than half the current price!

Build Your Own Ares Management Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ares Management research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Ares Management research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ares Management's overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ARES

Ares Management

Operates as an alternative asset manager in the United States, Europe, and Asia.

High growth potential with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026