- United States

- /

- Capital Markets

- /

- NYSE:ARES

Assessing Ares Management (ARES) Valuation After Launching Global Logistics Platform Marq Logistics

Reviewed by Simply Wall St

Ares Management (ARES) just pulled its far flung logistics warehouses and development projects into one unified platform called Marq Logistics, a 600 million square foot footprint that could subtly reshape how investors think about this stock.

See our latest analysis for Ares Management.

All of this comes against a backdrop where the latest $165.46 share price sits alongside a 1 month share price return of almost 8% after a softer 90 day patch. At the same time, the 3 year total shareholder return above 160% shows the longer term momentum story is still very much intact.

If the Marq Logistics move has you thinking about where else capital might compound, it is a good moment to explore fast growing stocks with high insider ownership as fresh ideas for your watchlist.

Yet with earnings growing double digits, a fresh $350 million growth investment and the shares still trading below analyst targets, is Ares quietly undervalued or are markets already baking in years of future expansion?

Most Popular Narrative: 9.9% Undervalued

With Ares Management closing at $165.46 against a narrative fair value of $183.60, the valuation story hinges on ambitious growth and margin assumptions.

The significant ramp in perpetual capital (now nearly 50% of fee-paying AUM), combined with consistent investment performance and low client redemptions, is expected to drive higher recurring fee revenues, greater profitability, and improved earnings visibility.

Curious how recurring fees, expanding margins and a richer earnings mix are modeled to support this higher value? The narrative leans on bold compounding assumptions, aggressive profitability targets and a premium future multiple more often seen in market darlings. Want to see exactly how those moving pieces fit together?

Result: Fair Value of $183.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying private credit competition and fee pressure, alongside regulatory and retail flow risks, could quickly undermine those optimistic margin and growth assumptions.

Find out about the key risks to this Ares Management narrative.

Another Angle on Valuation

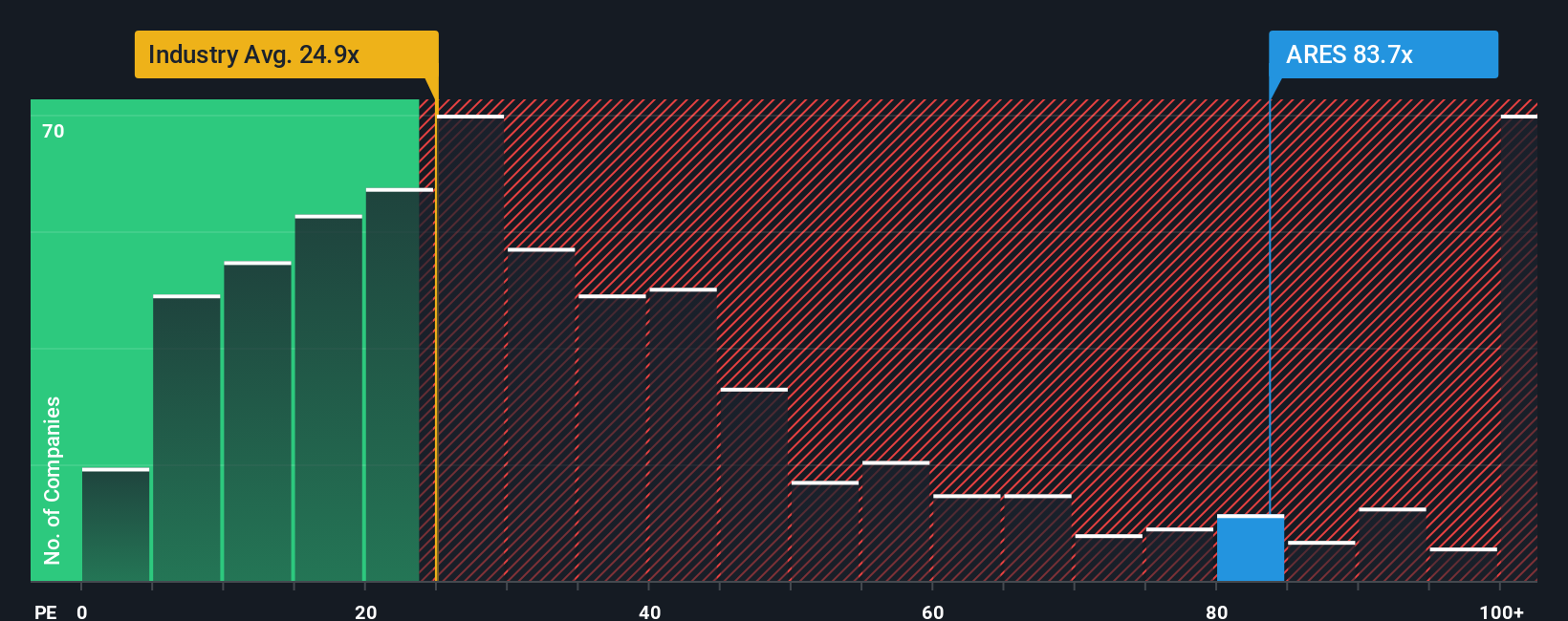

While the narrative fair value points to upside, our ratio based view tells a different story. Ares trades on a 71.2x price to earnings ratio versus a fair ratio of 22.7x, and far above both the US Capital Markets industry at 24x and peers at 13.9x. That kind of gap suggests meaningful valuation risk if sentiment or growth expectations cool, rather than a clear bargain.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ares Management Narrative

If this perspective does not quite align with your own, or you would rather dig into the numbers yourself, you can build a complete narrative in minutes: Do it your way.

A great starting point for your Ares Management research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before markets move on without you, use the Simply Wall St Screener to line up your next opportunities and stay one smart step ahead of the crowd.

- Capture potential mispricings by scanning these 908 undervalued stocks based on cash flows that strong cash flow analysis suggests may still be flying under the radar.

- Ride powerful secular trends by focusing on these 26 AI penny stocks positioned at the heart of the artificial intelligence shift.

- Lock in reliable income possibilities by reviewing these 15 dividend stocks with yields > 3% that can strengthen your portfolio’s cash yield.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ARES

Ares Management

Operates as an alternative asset manager in the United States, Europe, and Asia.

High growth potential with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026