- United States

- /

- Capital Markets

- /

- NYSE:ARES

Ares Management (ARES): Examining Valuation After Recent Share Price Decline

Reviewed by Simply Wall St

See our latest analysis for Ares Management.

While Ares Management’s share price has slipped nearly 8% in the last month, this follows years of impressive overall returns for investors. The one-year total shareholder return is down 8.6%, reflecting some cooling momentum compared to the robust 114% total return seen over three years and a remarkable 303% gain over five years. With the stock recently trading at $150.52, investors are watching to see whether growth expectations or risk concerns will shape its next move.

If you’re curious about where to look next, now is the perfect chance to broaden your perspective and discover fast growing stocks with high insider ownership

With shares still trading nearly 20% below analyst targets, but recent gains cooling, investors face a key question: is this the moment to buy Ares Management at a relative bargain, or has the market already priced in its future growth?

Most Popular Narrative: 16.5% Undervalued

With shares having ended at $150.52 and the widely followed narrative suggesting a significantly higher fair value, investor expectations and market reality appear misaligned. The following perspective uncovers a growth story that explains why this valuation gap exists.

Robust international fundraising, particularly in Europe and Asia-Pacific, and ongoing success in deepening distribution partnerships are broadening Ares' addressable markets, increasing global deal flow, and positioning the company for sustained earnings growth.

Want to know what underpins this bullish view? The main ingredients include aggressive international expansion, new asset classes, and bold profitability assumptions. Discover the narrative’s projections for outstanding future earnings and its take on Ares' unique fee-growth engine.

Result: Fair Value of $180.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition or regulatory changes affecting retail investor flows could quickly undermine Ares Management's anticipated fee growth and profit expansion.

Find out about the key risks to this Ares Management narrative.

Another View: Market Ratios Tell a Different Story

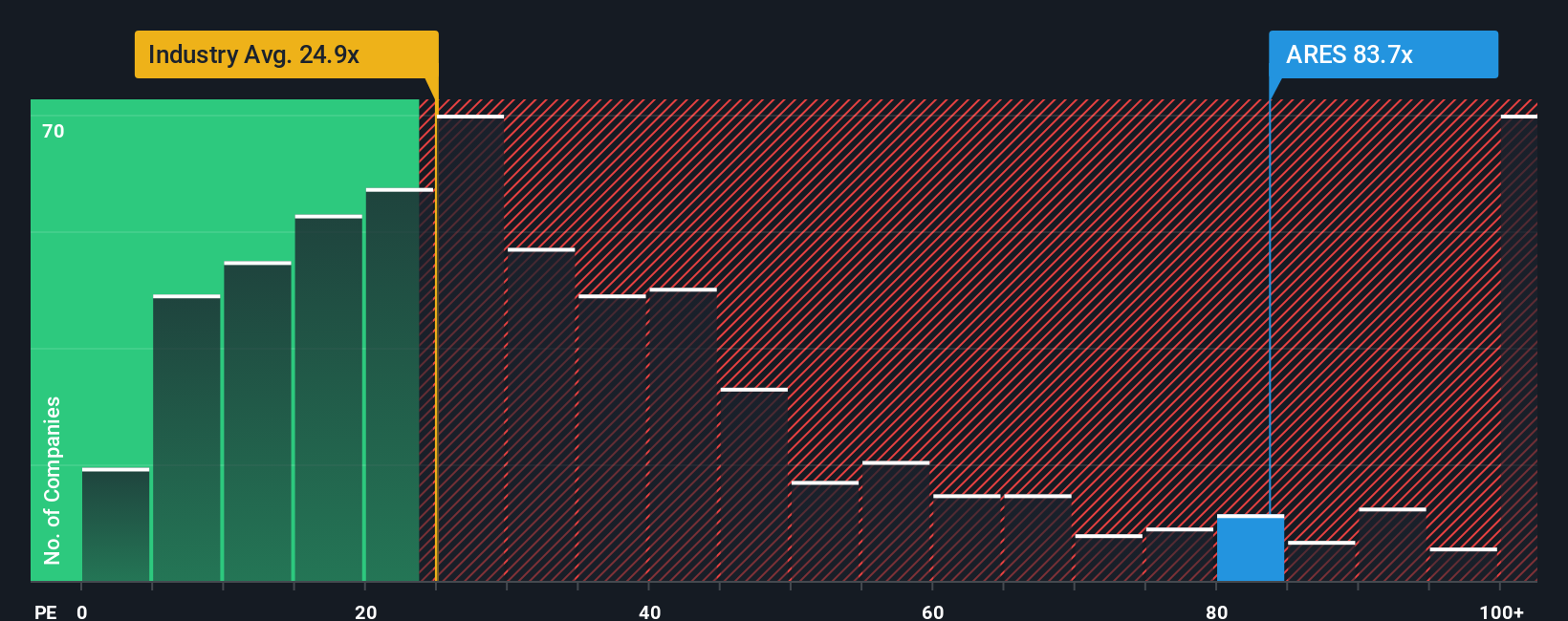

Looking at Ares Management through the lens of market price-to-earnings ratios, the picture shifts. The company trades at 89.4 times earnings, which is significantly above both the US Capital Markets industry average of 26.7 times and the peer average of just 13.8 times earnings. Even the fair ratio estimate sits at 26.8, far lower than Ares' current level. This wide gap may suggest heightened valuation risk and raises questions about whether the market is too optimistic about future growth or simply pricing in its unique business model. Should investors be wary of paying a premium, or does Ares truly deserve its lofty multiple?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ares Management Narrative

If you have a different perspective or want to dig into the numbers on your own, you can put together a personalized view with just a few clicks. Do it your way.

A great starting point for your Ares Management research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't let great opportunities pass you by. Use Simply Wall Street's free screeners to uncover standout investments across high-potential sectors. These are opportunities savvy investors are already watching.

- Capitalize on game-changing artificial intelligence by checking out these 26 AI penny stocks that are pushing boundaries in automation, natural language processing, and smart technologies.

- Boost your portfolio with reliable cash flow by finding these 21 dividend stocks with yields > 3% offering attractive yields and a track record of rewarding shareholders.

- Get ahead of the pack with these 849 undervalued stocks based on cash flows identified by our cash flow screens before the broader market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ARES

Ares Management

Operates as an alternative asset manager in the United States, Europe, and Asia.

High growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives