- United States

- /

- Capital Markets

- /

- NYSE:AMP

Ameriprise Financial (AMP): Margin Dip Tests Bullish Narratives Despite Low Valuation

Reviewed by Simply Wall St

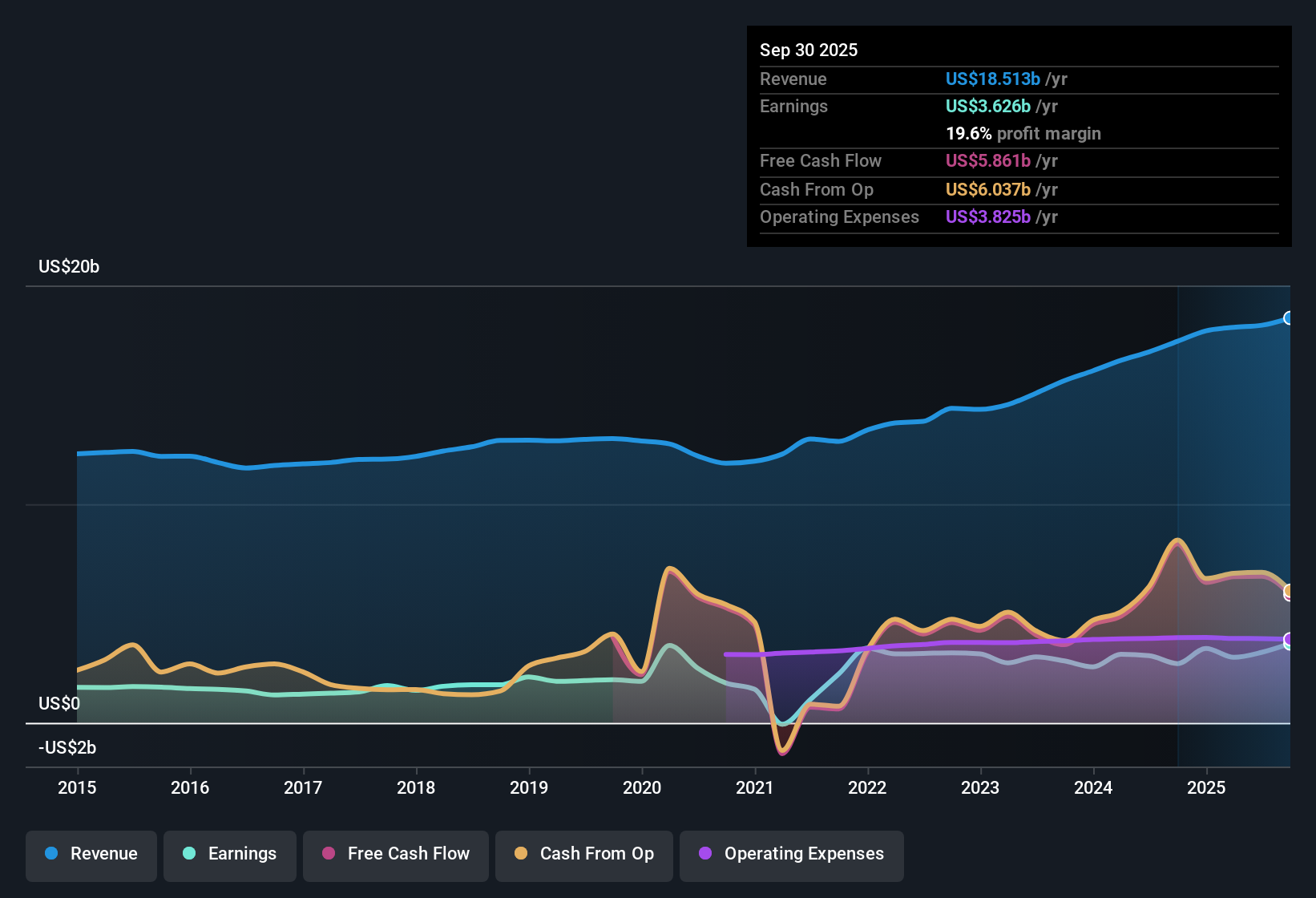

Ameriprise Financial (AMP) reported that earnings have grown by 14.3% per year over the past five years, though earnings growth in the most recent year slowed to 5.1%. Net profit margins ticked down to 17.7% from 18.1% last year, while revenue and earnings forecasts call for slower growth than the broader US market. With the stock trading at $454.11, well below both certain fair value estimates ($785.11) and analyst price targets, investors are weighing Ameriprise’s strong historical profit growth and quality earnings against moderating momentum and a more modest outlook.

See our full analysis for Ameriprise Financial.Next up, we’ll see how these results measure up against the most widely discussed narratives and expectations. Some views may get stronger, while others could be put to the test.

See what the community is saying about Ameriprise Financial

Profit Margins Signal Efficiency Pressure

- Even though net profit margins remain a healthy 17.7%, they've slipped from last year's 18.1%. This suggests operating pressures are starting to affect efficiency.

- Analysts' consensus view highlights that Ameriprise’s platform investments and new tech (like Signature Wealth UMA and PracticeTech) aim to boost adviser productivity. However, margin pressure indicates that rising costs and competitive recruiting may be weighing more heavily than anticipated.

- The consensus narrative notes adviser platform investments are intended to expand client satisfaction and future efficiency. A margin dip so soon after rollout raises questions about how quickly these enhancements will actually offset cost pressures.

- Analysts expect profit margins to climb to 19.4% within three years, but the current downtrend means execution risk is clearly part of the consensus picture.

- Bulls and bears both pay close attention to margin trends. See all sides of the story in the latest consensus narrative. 📊 Read the full Ameriprise Financial Consensus Narrative.

Growth Forecast Trails US Market

- Future growth projections have moderated: revenue is forecast to rise just 5.8% a year, and earnings only 2.5% per year, trailing well behind typical US market expectations.

- Analysts' consensus view flags that although adviser recruitment and new banking product launches are positioned as major tailwinds for revenue, persistent market volatility and client outflows cloud the outlook. While new business efforts are promising, they are not expected to vault Ameriprise onto a higher growth path.

- The expansion into banking and robust adviser retention are key initiatives cited. Yet consensus signals that adverse market moves or asset outflows could easily swamp these incremental gains.

- Earnings are expected to reach $4.0 billion by 2028 (from $3.2 billion today), but analyst dispersion is sizable, with less optimistic forecasts as low as $3.4 billion.

Valuation Strongly Favors Ameriprise

- Ameriprise’s price-to-earnings ratio sits at 13.3x, sharply below the 25.2x US Capital Markets industry average and peer average of 32.2x. This positions the stock as a significant value play relative to competitors.

- Analysts' consensus view suggests that at $454.11, Ameriprise trades not only below its DCF fair value of $785.11 but also lags the consensus analyst target price of $550.27. This gives investors a substantial implied upside if even modest growth and margin recovery targets are reached.

- The consensus forecast requires Ameriprise to reach a future PE of 15.2x on anticipated 2028 earnings, still below broader peer multiples.

- With a planned $4.5 billion share buyback and expected annual share count shrinkage of 2.83%, return potential is further bolstered by capital allocation policy.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Ameriprise Financial on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Notice a story in the numbers that others might not? Share your take in just a few minutes and shape the conversation. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Ameriprise Financial.

See What Else Is Out There

Ameriprise’s slowing earnings growth and recent margin pressures highlight challenges in sustaining consistent performance compared to stronger US market peers.

If steady, reliable results matter most to you, focus on companies with a proven track record of consistent expansion by using our stable growth stocks screener (2112 results) tool.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMP

Ameriprise Financial

Operates as a diversified financial services company in the United States and internationally.

Very undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives