- United States

- /

- Consumer Finance

- /

- NYSE:ALLY

Ally Financial (ALLY): Rethinking Valuation After Q3 Results Highlight Growth in Dealer Finance and Capital Strength

Reviewed by Simply Wall St

Ally Financial (ALLY) has attracted attention following its third-quarter 2025 earnings report, which pointed to rising capital strength and growing dealer finance activity. These results are prompting investors to revisit the stock’s strategy and outlook.

See our latest analysis for Ally Financial.

Momentum has been building for Ally Financial, with a 1-month share price return of 6.4% and a 12.7% gain year-to-date, reflecting renewed confidence after strategic shifts and board appointments. Looking at the bigger picture, Ally’s 1-year total shareholder return of 13.8% adds to an impressive 3-year TSR of nearly 66%, which suggests that recent initiatives are resonating with investors over both the short and long term.

If you’re interested in finding companies with strong growth and engaged leadership, now is a great moment to broaden your search and discover fast growing stocks with high insider ownership

With shares trading at a notable discount to analyst price targets and strong growth in key business lines, the question for investors is clear: is Ally Financial currently undervalued, or are markets already pricing in its next phase of growth?

Most Popular Narrative: 16.2% Undervalued

Ally Financial’s current fair value is estimated at $48.06 per share, a notable premium to the latest closing price of $40.29. This gap has sparked fresh debate about whether investors are missing something in the company’s future projections and capital allocation.

“Digital-first strategy and disciplined cost management are driving customer growth, improved efficiency, and long-term margin expansion across core and diversified business lines. Strategic shifts into high-quality auto lending, insurance, and fee-based services are supporting stronger credit quality, revenue diversification, and resilient net interest margins.”

What’s fueling this rapid climb in value? Hint, it is not just one thing. Multiple ambitious growth targets and a tight focus on margins are at the heart of the narrative. Curious which financial triggers underpin such an optimistic outlook? See for yourself. These projections will surprise even seasoned market watchers.

Result: Fair Value of $48.06 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifting consumer preferences toward electric vehicles and heightened competition from fintechs could limit Ally's loan growth and put pressure on future profit margins.

Find out about the key risks to this Ally Financial narrative.

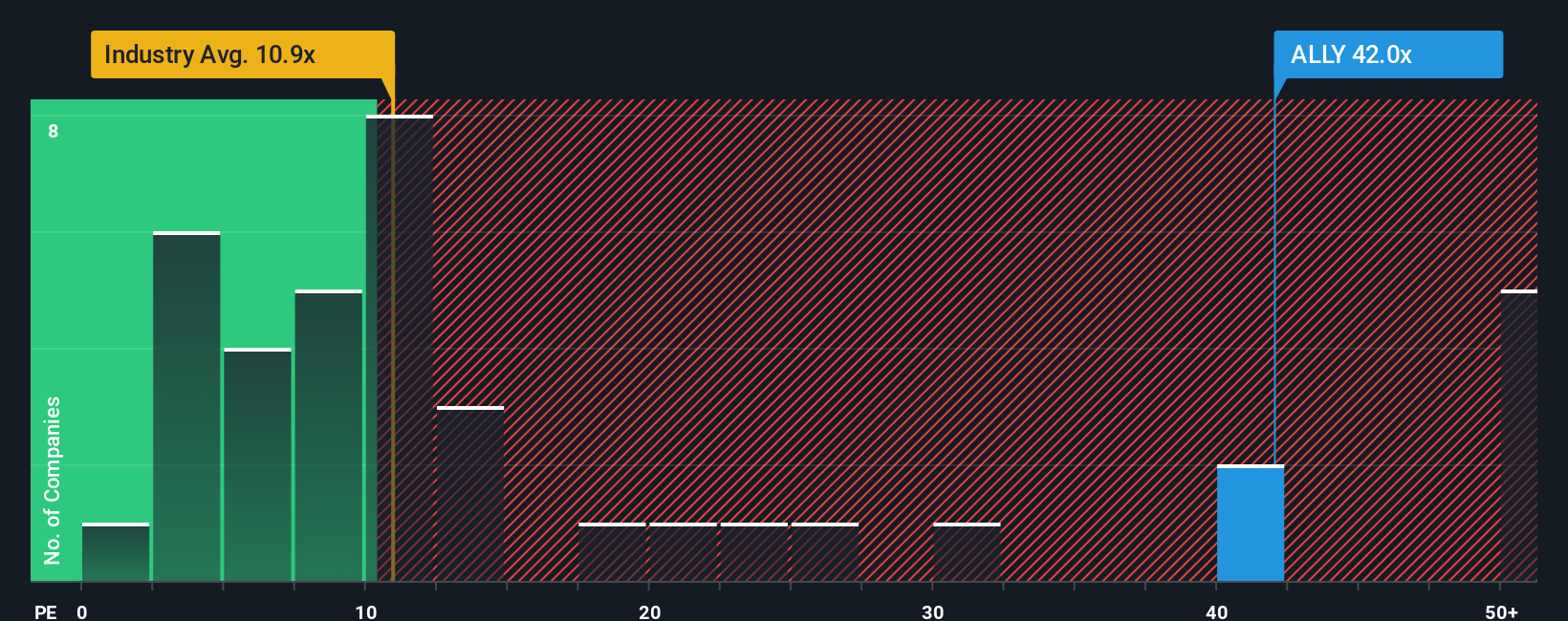

Another View: Multiples Raise the Bar

Looking from a different angle, the current price-to-earnings ratio stands at 23.7 times, which is higher than both the Consumer Finance industry average of 10.4x and the calculated fair ratio of 21.5x. This suggests the market is already pricing in a strong recovery and gives less margin for error if results disappoint. Is the optimism fully deserved, or could there be more risk than meets the eye?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ally Financial Narrative

If you see the story differently or just want to investigate the numbers for yourself, it only takes a few minutes to craft your own perspective. Do it your way

A great starting point for your Ally Financial research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Sharpen your investment strategy and stay ahead of changing trends. Don’t miss your chance to uncover hidden gems and future leaders in exciting market sectors.

- Capture sustainable income opportunities as you review these 14 dividend stocks with yields > 3%, which deliver above-average yields and strong fundamentals.

- Fuel your watchlist with innovation by exploring these 25 AI penny stocks, companies transforming industries through artificial intelligence and automation.

- Seize the potential for rapid growth by finding these 3575 penny stocks with strong financials, which are primed for a breakout year and backed by solid financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALLY

Ally Financial

A digital financial-services company, provides various digital financial products and services in the United States, Canada, and Bermuda.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives