- United States

- /

- Diversified Financial

- /

- NYSE:AGM

Federal Agricultural Mortgage (AGM): Examining Valuation After a 20% Drop in Share Price

Reviewed by Kshitija Bhandaru

Federal Agricultural Mortgage (AGM) stock has seen some movement lately, and many investors are wondering what’s driving sentiment. With shares down roughly 20% over the past month, it is worth looking deeper at what is happening behind the scenes.

See our latest analysis for Federal Agricultural Mortgage.

Stepping back, the 20% drop over the last month has cooled Federal Agricultural Mortgage's momentum following a period of steady gains. Its share price now stands at $164.53. Over the past year, total shareholder returns have been slightly negative. Meanwhile, the long-term five-year total return remains comfortably positive, which suggests underlying resilience despite near-term volatility and shifting market sentiment around valuation and growth potential.

If this recent volatility has you considering fresh opportunities, now could be a great chance to broaden your perspective and discover fast growing stocks with high insider ownership

With shares trading well below analyst price targets and solid growth in revenue and net income, the big question is whether Federal Agricultural Mortgage is currently undervalued, or if the market has already factored in its future prospects. Could there still be a buying opportunity, or is everything priced in?

Most Popular Narrative: 27% Undervalued

Federal Agricultural Mortgage’s most widely followed narrative places its fair value at $226, notably above the last close of $164.53. This sets a bold expectation and is driven by major shifts in the company’s addressable markets and structural tailwinds, preparing the ground for a pivotal quote.

Expansion into renewable energy, broadband, and infrastructure finance is driving significant new business volume and higher spreads. This positions Farmer Mac to benefit from increasing demand for financing related to sustainability and rural connectivity initiatives, which should support revenue and earnings growth going forward.

Ever wondered what’s fueling expectations for a double-digit move from here? The secret is a powerful combination of rising revenues, shifting profit margins, and a projected earnings path usually reserved for market leaders. This narrative hinges on gutsy financial forecasts. Find out which assumptions create the biggest upside.

Result: Fair Value of $226 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent regulatory uncertainty and rising credit losses in new segments could quickly challenge the upbeat growth narrative for Federal Agricultural Mortgage.

Find out about the key risks to this Federal Agricultural Mortgage narrative.

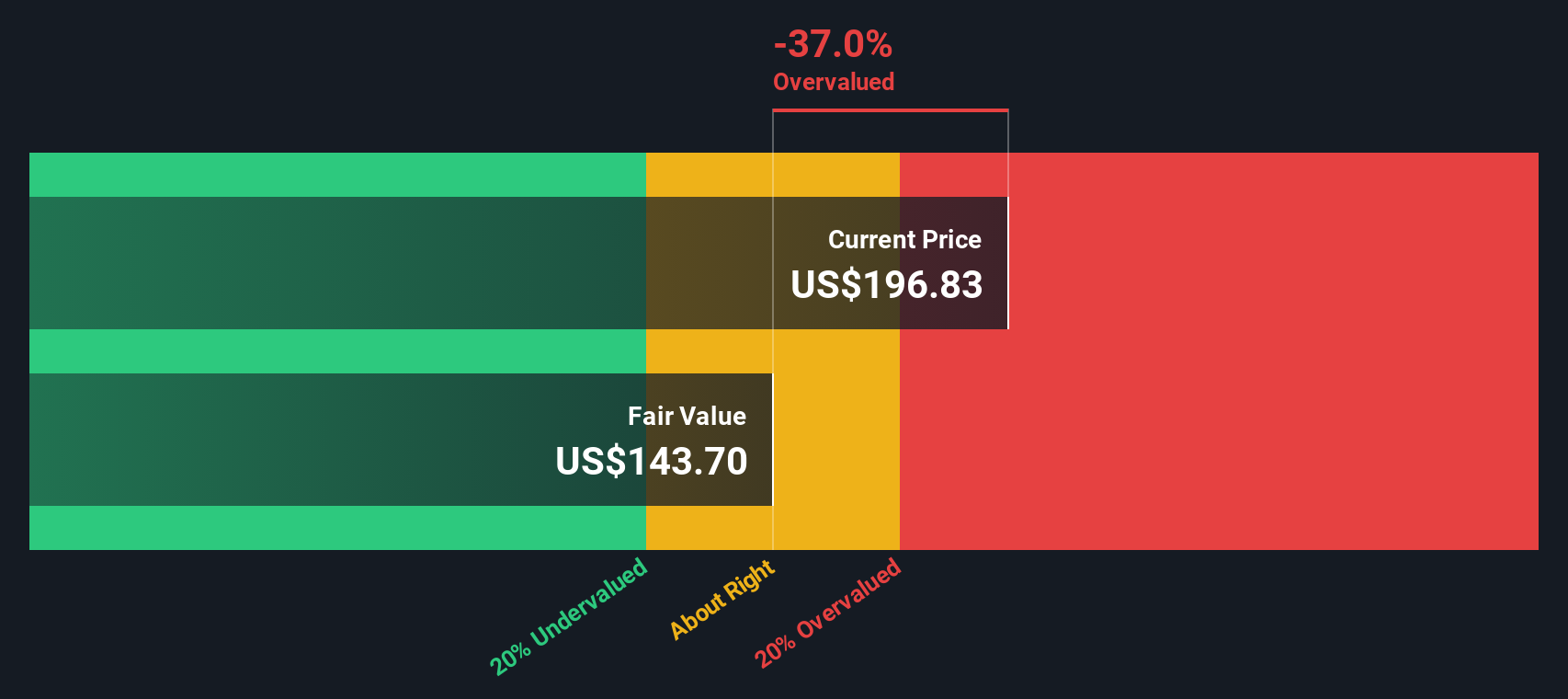

Another View: Our DCF Model Offers a Reality Check

While analysts believe Federal Agricultural Mortgage is undervalued, the Simply Wall St DCF model estimates fair value closer to $144, which is below the current share price of $164.53. This suggests the stock may actually be trading at a premium. Is the analyst optimism justified, or is caution warranted?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Federal Agricultural Mortgage for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Federal Agricultural Mortgage Narrative

If you see things differently or want a hands-on look at the data, you can shape your own narrative in just a few minutes. Do it your way

A great starting point for your Federal Agricultural Mortgage research is our analysis highlighting 6 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

There are countless opportunities just waiting for you to uncover. Give your portfolio an edge and stay ahead of the crowd with these handpicked stock ideas from the Simply Wall St Screener:

- Capture fresh momentum by reviewing these 3563 penny stocks with strong financials with strong financials and the potential for explosive growth that others may be missing.

- Boost your income stream when you scan these 19 dividend stocks with yields > 3% offering yields above 3 percent, a choice for anyone seeking reliable returns.

- Ride the AI wave and target tomorrow’s biggest winners by checking out these 24 AI penny stocks poised to transform multiple industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AGM

Federal Agricultural Mortgage

Provides a secondary market for various loans made to borrowers in the United States.

Established dividend payer and good value.

Market Insights

Community Narratives