- United States

- /

- Mortgage REITs

- /

- NYSE:ABR

Arbor Realty Trust (ABR): Profit Margin Falls, Raising Questions on Dividend Stability

Reviewed by Simply Wall St

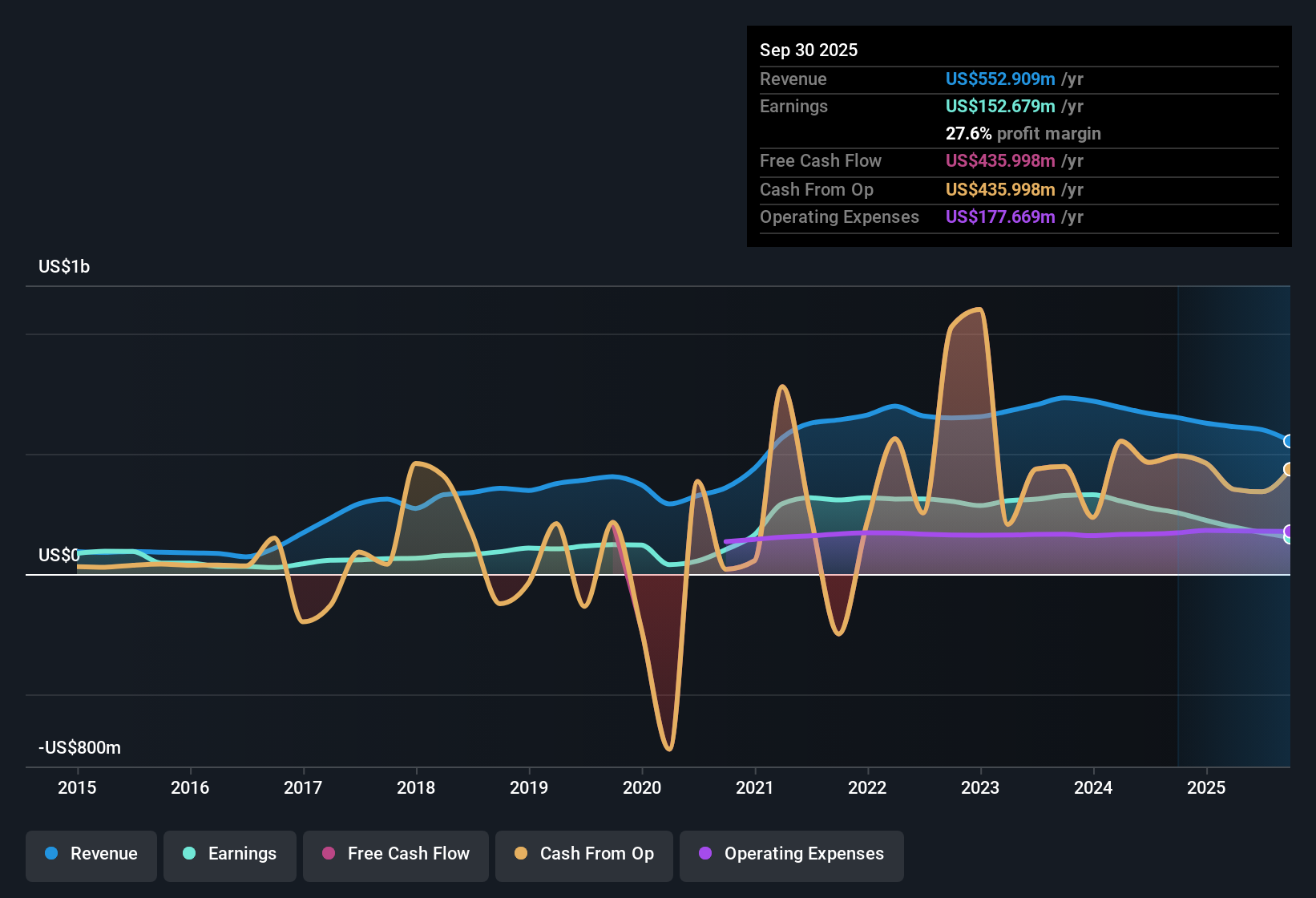

Arbor Realty Trust (NYSE:ABR) reported a net profit margin of 28.7%, down from 42.5% the previous year. Earnings have declined slightly by 0.2% per year over the past five years. While the company’s earnings are forecast to grow at an impressive 20% per year, outpacing the US market’s 15.9% projected annual growth, revenue is expected to rise at 7% per year, falling short of the national average. Investors will weigh these growth projections against a recent trend of negative earnings growth and concerns about the sustainability of the dividend.

See our full analysis for Arbor Realty Trust.Next, we will dive into how these headline numbers match up with the most-followed narratives from the Simply Wall St community. Sometimes the data backs up the story, other times it tells a more nuanced picture.

See what the community is saying about Arbor Realty Trust

Profit Margin Slips but Long-Term Outlook Holds

- Arbor Realty Trust’s net profit margin narrowed to 28.7% versus 42.5% the previous year, indicating earnings are under pressure even as the business faces a tougher environment with reduced agency production and persistently high interest rates.

- According to the analysts’ consensus view, the company’s diversified revenue streams and strategic loan modifications are seen as ways to preserve shareholder confidence and maintain a competitive edge despite margin compression.

- The consensus narrative highlights that management has improved collateral values by repositioning a large part of the loan book. This supports resilience even as core profit drivers have slowed.

- However, consensus also notes anticipated agency production could decrease by 10% to 20% in 2025. This may challenge further margin recovery.

Valuation Discount Compared to Peers

- The current price-to-earnings (P/E) ratio of 11.3x stands below both peer (12.1x) and industry (12.7x) averages. The shares trade at $10.09, which is beneath the $11.63 analyst price target.

- In the analysts’ consensus view, Arbor’s lower valuation is interpreted as fair, supported by the company’s consistent dividend payouts in a challenging sector but reflecting market concerns about earnings sustainability and slower top-line growth.

- The consensus narrative underscores that maintaining the dividend, while sector peers have cut theirs, lends some support to the valuation despite a soft revenue trajectory.

- However, the modest 5.9% premium of the analyst price target over the current share price suggests the market already prices in both strengths and risks, with little room for surprises.

Profit Outlook Hinges on Margin Expansion

- Analysts forecast net profit margins will climb from 35.6% today to 96.5% over the next three years. This represents an unusually sharp rise considering annual revenues are expected to fall by 28.7% over the same period.

- Based on the consensus narrative, this margin expansion is anticipated to come from Arbor’s repositioning of REO assets and diversified lending. However, the risks include if headwinds in agency origination and lower earnings guidance drive a strategic reset of the dividend.

- Consensus analysts highlight that while profit margin expansion looks promising, flattening earnings ($223.3 million now compared to $219.3 million in 2028) offsets upside from margin gains.

- They caution that for Arbor to justify a higher, 15.1x P/E on 2028 earnings, substantial execution will be required despite declining revenues.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Arbor Realty Trust on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think the data points lead to another story? Share your take and craft a narrative in just a few minutes. Do it your way

A great starting point for your Arbor Realty Trust research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Arbor Realty Trust’s inconsistent earnings, narrowing profit margins, and uncertain revenue trajectory raise concerns about the stability of its long-term growth.

If stability matters more to you, check out stable growth stocks screener (2103 results) to discover companies that consistently deliver steady growth in both revenue and profit across market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ABR

Arbor Realty Trust

Invests in a diversified portfolio of structured finance assets in the multifamily, single-family rental, and commercial real estate markets in the United States.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives