- United States

- /

- Capital Markets

- /

- NYSE:AB

Assessing AllianceBernstein (AB) Valuation After Its 26% One-Year Shareholder Return

Reviewed by Simply Wall St

AllianceBernstein Holding (AB) has quietly outperformed the market over the past year, with the stock up about 26% and nearly doubling over five years. This performance is prompting a closer look at what still drives upside.

See our latest analysis for AllianceBernstein Holding.

With the share price at $41.88, AB has added a solid 7.0% 1 month share price return, and its 1 year total shareholder return near 26% hints that momentum is still tilting in shareholders' favor rather than fading.

If AB's steady climb has you rethinking your watchlist, this could be a good moment to broaden your search and discover fast growing stocks with high insider ownership.

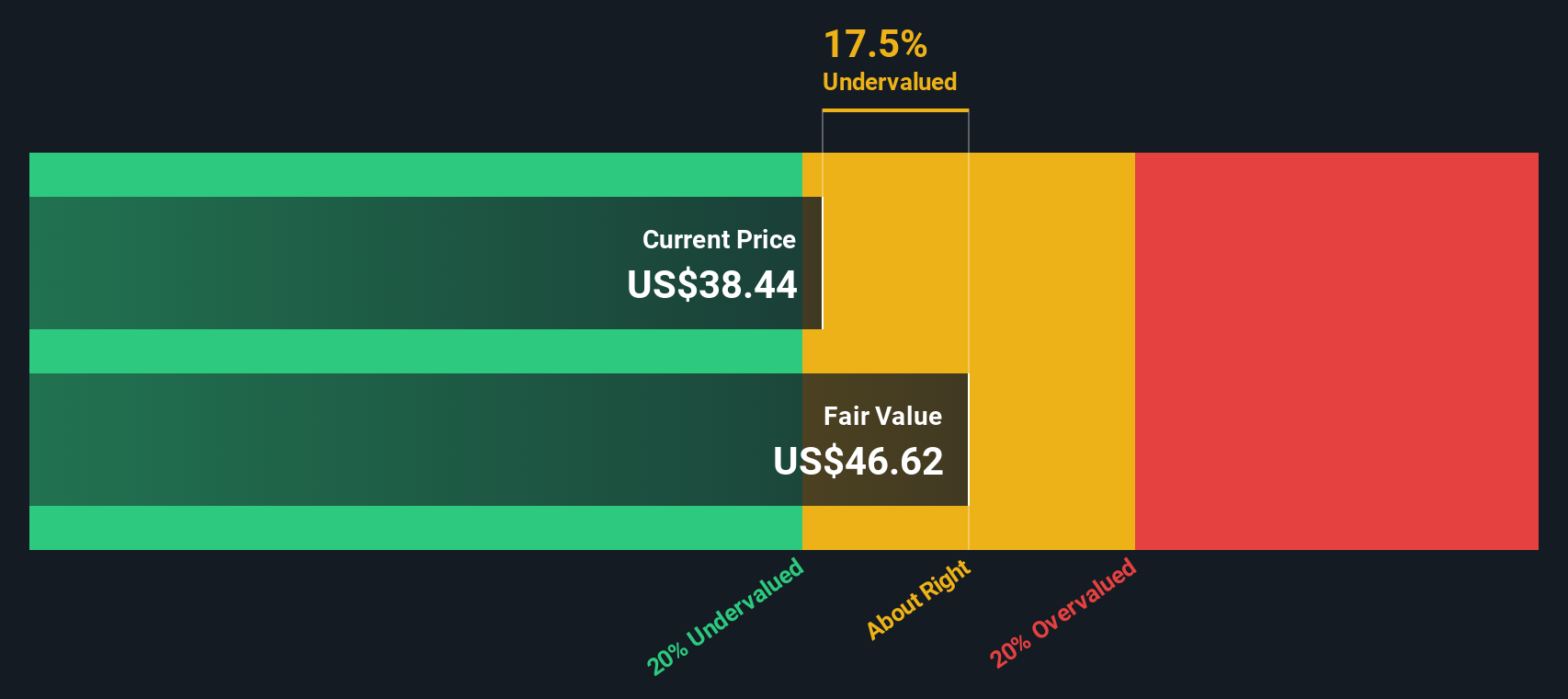

Yet with AllianceBernstein now trading slightly above its analyst target but still showing a modest intrinsic discount, investors must ask: is this a genuine value opportunity, or is the market already pricing in future growth?

Price-to-Earnings of 11.8x: Is it justified?

AllianceBernstein Holding looks inexpensive on earnings, with its 11.8x price to earnings multiple sitting well below both peers and the wider capital markets industry, even after the recent run up in the share price to $41.88.

The price to earnings ratio compares what investors pay today with the company’s current earnings. This makes it a common yardstick for established, profitable financial firms like AB. A lower multiple can imply the market is skeptical about the durability of earnings or is underappreciating the company’s future growth and cash generation profile.

Relative to the US Capital Markets industry average of 25x and a peer group closer to 43.8x, AB’s 11.8x multiple represents a steep valuation discount. This suggests investors are pricing in more muted prospects than our models indicate. Our analysis also points to an estimated fair price to earnings ratio of 12.5x, a level the market could reasonably move toward if sentiment and fundamentals stay aligned with current forecasts.

Explore the SWS fair ratio for AllianceBernstein Holding

Result: Price-to-Earnings of 11.8x (UNDERVALUED)

However, slower net income growth and recent share price strength could limit further upside if markets reassess the sustainability of asset management fees and flows.

Find out about the key risks to this AllianceBernstein Holding narrative.

Another View: Our DCF Fair Value Check

Our DCF model also points to AB being undervalued, with a fair value estimate of about $46.86 versus the current $41.88 share price. That 10.6% gap still looks like a cushion for buyers, but it raises the question of how much of it reflects real long term potential rather than modeling optimism.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out AllianceBernstein Holding for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 902 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own AllianceBernstein Holding Narrative

If you see the numbers differently or want to test your own thesis, you can quickly build a personalized view in minutes using Do it your way.

A great starting point for your AllianceBernstein Holding research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before markets shift again, consider using the Simply Wall Street Screener to identify opportunities beyond AB that align with your strategy.

- Explore potential mispricing with these 902 undervalued stocks based on cash flows, which screens for companies trading below their estimated intrinsic value based on future cash flows.

- Focus on the next wave of innovation with these 27 AI penny stocks, centered on businesses developing revenue-generating artificial intelligence solutions.

- Review these 15 dividend stocks with yields > 3% to find dividend-paying companies with yields above 3%, while also considering balance sheet quality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AB

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Estimated Share Price is $79.54 using the Buffett Value Calculation

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026