- United States

- /

- Capital Markets

- /

- NYSE:AAMI

A Closer Look at Acadian Asset Management (NYSE:AAMI) Valuation After Recent Share Price Volatility

Reviewed by Simply Wall St

See our latest analysis for Acadian Asset Management.

While Acadian Asset Management’s share price has dipped 8.8% over the past month, the broader picture reveals robust momentum. Its year-to-date share price return stands at an impressive 70%, and the one-year total shareholder return is up 42%. This suggests recent volatility comes after a sustained period of strong gains, which could signal a period of consolidation or shifting investor sentiment around its growth outlook.

If you’re watching how leadership changes and evolving strategies fuel returns, it might be the right moment to broaden your search and discover fast growing stocks with high insider ownership

With shares still trading about 12% below analyst price targets and having rallied sharply over the past year, the key question is whether Acadian Asset Management is now undervalued or if the market has already priced in future growth.

Price-to-Earnings of 17.8x: Is it justified?

Acadian Asset Management currently trades at a price-to-earnings (P/E) ratio of 17.8x, just under the US market average of 18.7x and notably above its peer group, which sits at 12.5x. This indicates that the stock is relatively more expensive than similar companies, yet is slightly cheaper compared to the broader market.

The price-to-earnings multiple shows what investors are willing to pay for every dollar of the company’s earnings. For an asset manager like Acadian, this metric puts its profitability and market expectations into sharp focus, especially compared to both the sector and the US market as a whole.

Despite the above-average P/E versus peers, Acadian’s earnings have rebounded sharply in the past year. The market seems to be baking in expectations for future growth or sustained profitability. However, that premium may not be fully justified given the five-year track record of earnings decline, which signals caution unless this year’s momentum continues.

Relative to the broader industry, Acadian trades below the sector P/E average of 23.8x but is expensive compared to its peers at 12.5x. This mixed positioning suggests the stock is priced for optimism beyond what most competitors enjoy, while not standing out as an extreme outlier in the US market landscape.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 17.8x (ABOUT RIGHT)

However, slowing short-term performance and ongoing revenue volatility could challenge investors’ confidence if momentum does not result in consistent, longer-term growth.

Find out about the key risks to this Acadian Asset Management narrative.

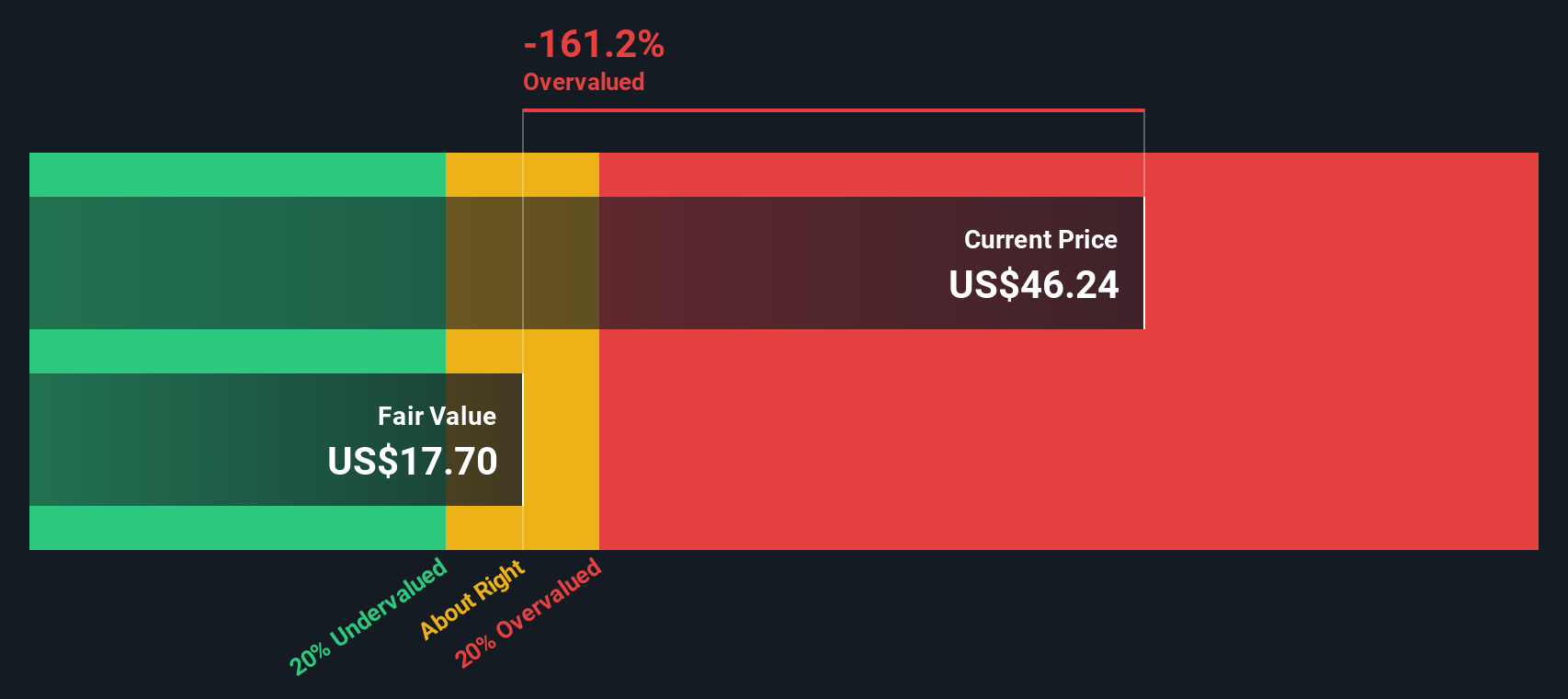

Another View: Discounted Cash Flow Challenges

While the price-to-earnings lens suggests Acadian Asset Management trades at about the right price, our SWS DCF model presents a different perspective. According to this model, Acadian shares are trading well above their estimated fair value, raising the possibility that the market is being too optimistic about the company's future cash flows. This may be an opportunity to closely examine whether expectations are outpacing reality.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Acadian Asset Management for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 923 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Acadian Asset Management Narrative

If you have a different take on the numbers or want to dive deeper into your own analysis, you can quickly craft your own narrative in just a few minutes. Do it your way

A great starting point for your Acadian Asset Management research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Expand your investing potential and seize opportunities others might miss, using insights from stocks that are gaining an edge in today’s market.

- Capture growth as artificial intelligence transforms industries when you back winners among these 25 AI penny stocks making breakthroughs in automation and data innovation.

- Pave your path to steady income by tapping into these 14 dividend stocks with yields > 3% with reliable yields above 3%, which may be ideal if regular returns fit your strategy.

- Position yourself on the frontier by targeting these 28 quantum computing stocks that are set to change the game with advances in secure computing and next-level tech.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AAMI

Acadian Asset Management

BrightSphere Investment Group Inc. is a publically owned asset management holding company.

Acceptable track record with low risk.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026